中国电池制造商带来的成本压力、欧盟在电池成本可负担性上对可持续性的押注、磷酸铁锂电池成熟制造生态系统的缺失、政策框架的不明确性,这些核心威胁正削弱欧盟挑战大中华区在电池领域霸权的能力。

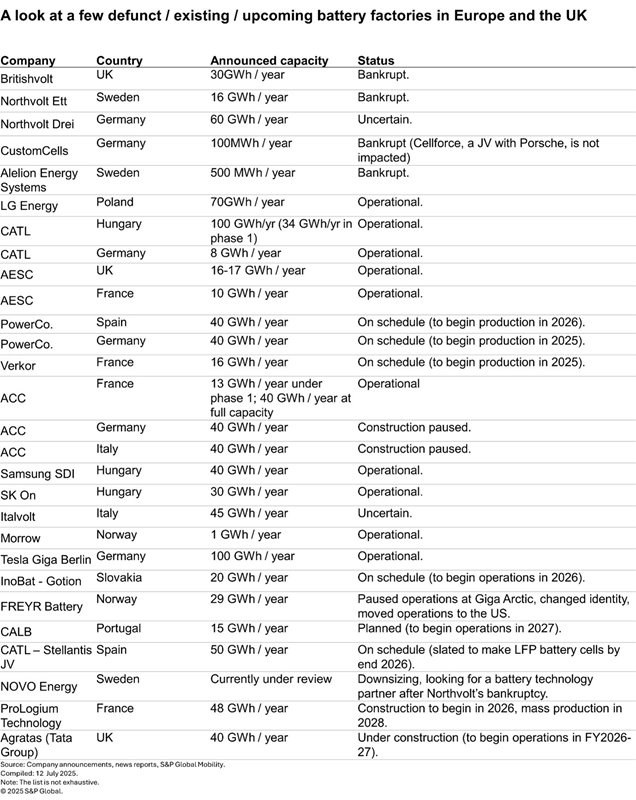

欧洲及英国地区近期接连出现多家知名电池企业突然申请破产,给当地电池产业的雄心壮志蒙上阴影。

英国颇具前景的电池初创企业Britishvolt曾获首相盛赞,却于2023年1月申请破产。 紧随其后的是瑞典电池企业Northvolt——这家代表欧洲对抗中国在全球电池供应链霸权的希望之星,于2024年11月在美国申请第11章破产保护。

尽管当时Northvolt管理层预期能获得新融资——包括1.45亿美元现金抵押及斯堪尼亚1亿美元的承诺资金——以维持其瑞典主工厂的运营连续性,但计划最终落空。 该公司最终于3月在瑞典申请破产。鉴于Northvolt维持流动性的困境及其对沃尔沃与Northvolt合资企业Novo Energy未来的影响,这家瑞典汽车制造商于1月决定全资收购该电池合资企业。与此同时,据路透社5月22日报道,Northvolt预计将在6月底前逐步关闭其斯凯莱夫特奥工厂剩余的电池电芯生产业务。

德国电池制造商CustomCells(弗劳恩霍夫协会分拆企业)于4月30日申请破产,其最大客户航空公司Lilium此前已宣告破产。

去年约同期,由梅赛德斯-奔驰、Stellantis集团与法国道达尔能源公司共同成立的高调电池合资企业ACC,暂停了其在德国和意大利各一座超级工厂的建设计划,旨在重新评估电池化学策略。 据悉,ACC的母公司正评估更经济实惠的替代方案,以取代其法国超级工厂已投产一年之久的镍钴锰(NCM)高镍电池。

挪威电池制造商FREYR Battery因现金流紧张及电动汽车需求放缓,于2024年缩减业务规模,放弃扩张计划,并暂停其位于莫伊拉纳的Giga Arctic超级工厂的电池芯生产。今年早些时候,该公司将名称从FREYR更名为T1 Energy,将总部从挪威迁至美国德克萨斯州奥斯汀市,以最大限度地享受美国税收优惠政策,并将业务重心转向太阳能应用领域。

欧盟的电池制造生态系统为何未能腾飞?

在近期接受Battery Associates采访时,PowerCo首席执行官弗兰克·布洛姆直言不讳地指出:在电动汽车发展的早期阶段(21世纪初),当西方尚未看到电动出行领域的商业价值时,日本、韩国和中国已开始为笔记本电脑、手机、混合动力车及电动车大规模生产电池。

他表示 :"由此,他们实现了规模化生产并不断优化工艺流程。"

相比之下,欧盟委员会直至2017年才意识到建立本土电池产业链的必要性与紧迫性,随后成立欧洲电池联盟(EBA)。2018年又出台首份《欧盟电池战略行动计划》。这表明相较于中国大陆及东亚国家,欧盟本土电动汽车电池产业链仍处于发展初期。

布洛姆将电池生产称为"成本密集型"业务,称PowerCo高管每周例会中80%时间都在讨论成本问题。

此外,他还重点指出中国大陆政府为电池制造企业提供的多层次支持体系,包括直接与间接资金支持、快速投产审批流程(加速工厂建设)、能源补贴、税收返还、特定经济开发区免费提供厂房等多种优惠政策。

"欧洲或德国不存在类似运作体系。但我们必须尽快在此领域做得更好。"布洛姆表示。

尽管布洛姆阐述了欧洲构建具有竞争力的电动汽车电池价值链面临的若干关键挑战,但更需深入探究欧洲在电池领域持续难以与中国大陆抗衡的根本原因。

a) 成本压力与纯电动汽车普及乏力

中国电池制造商凭借规模与成本优势主导全球电池生态,加之纯电动汽车(BEV)普及速度低于预期,双重压力持续阻碍本土电池企业于欧盟地区建设超级工厂。

BEV市场疲软不仅将阻碍新超级工厂投资(导致投资者持谨慎态度),更将对现有电池企业的运营可行性构成重大压力。电池需求疲软已重创CustomCells、FREYR Battery和ACC——受BEV需求低于预期及成本压力影响,后两者已暂停在德国和意大利的超级工厂建设计划。

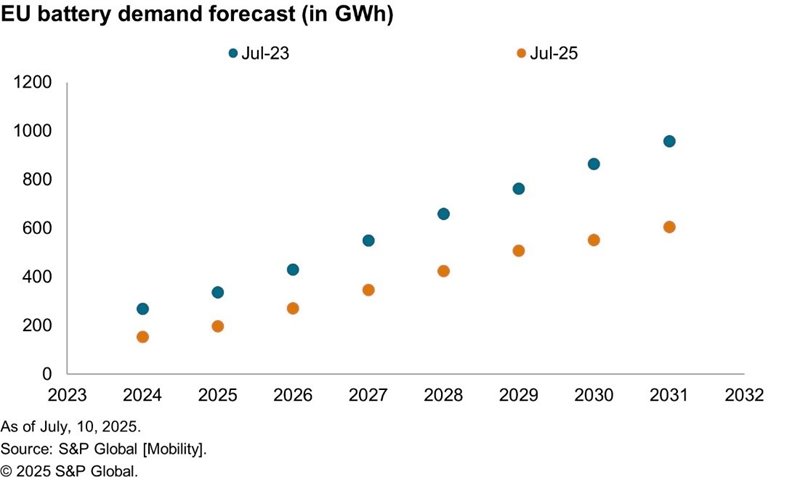

下图展示了标普全球移动公司对2024至2031年欧盟电池需求的修订预测。可见由于纯电动汽车普及速度低于预期,欧盟地区电动汽车电池需求预测已被下调。2025年修订后的欧盟电池需求量较此前预期下降逾40%。 同样地,2030年的修订需求量较先前预测值下降了36%以上。

暂且不论纯电动汽车的缓慢普及,若深入剖析成本压力的驱动因素,我们会发现若干人口结构与地缘政治因素——这些因素在常规商业环境下,对发达的西方国家而言都难以应对且错综复杂。例如,欧盟新兴的电池制造生态系统仍处于初级阶段,其生产流程既崭新又未优化,与大陆地区截然不同。 其劳动力与能源成本远高于中国大陆,还需承担将关键电池材料从数千公里外的产地运入欧盟的额外开支。

反观中国大陆的宁德时代、比亚迪等顶尖电池企业,除享受免税政策及研发专项资金支持外,还获得了政府多形式扶持,包括直接补贴。

媒体报道显示,比亚迪在2018至2022年间获得约37亿美元直接补贴。宁德时代年报同样表明,该电池制造商的政府补贴金额从2018年的7670万美元攀升至2023年的8.092亿美元。 中国大陆另一家领先电池制造商宁德时代(EVE Energy)仅在2023年就获得约2.089亿美元政府补贴。

要理解中国大陆(特别是省级层面)的政府支持力度,关键在于评估 中国西北部甘肃省的地方当局如何助力鲜为人知的电池制造商甘肃金鸿翔新能源有限公司,在短短半年内实现日产25万块电池的产能突破。

甘肃省当局为超级工厂项目提供"全生命周期服务",涵盖从快速投产到项目进展监控的全流程。金红翔新能源工厂所在的金昌经济开发区免费提供"即租即用"的标准化厂房,为企业节省了生产成本和时间。 此外,政府还组建了跨部门专项管理团队,集结发展改革、环保、安全监管等部门代表,仅用30天就完成15项政府审批。

除上述支持措施外,地方政府还提供设备折旧补贴等激励政策。

政府优惠政策使企业能专注产品研发的同时,甘肃省还拥有丰富的关键原材料本地供应资源,进一步降低了物流成本。文章指出,这些因素使甘肃生产的电池单体制造成本较中国沿海地区工厂降低约12%。

电池制造中优化工艺如何带来显著效益,可从超级工厂的废品率数据中窥见一斑。该指标反映生产过程中浪费的材料数量——尤其是锂、镍、钴等高成本原材料。废品率过高将导致生产成本上升,并降低物料处理效率。

中国大陆现有厂商已实现低于10%的超高效率工艺。然而全球其他地区的电池初创企业因缺乏专业技术,在产能爬坡阶段面临严峻质量问题,报废率常高达30%-40%。北伏特(Northvolt)在瑞典斯凯夫特奥工厂扩大产能时,其高报废率问题曾引发业界广泛关注。

标普全球移动业务部电池研究经理阿里·阿迪姆指出,对现金流本已为负的电池初创企业而言,解决报废率问题关乎生死存亡。

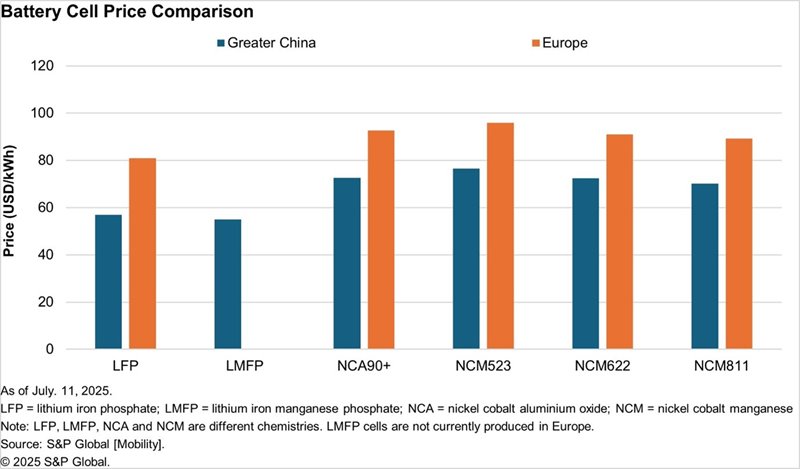

下图基于标普全球移动业务部电池电芯价格数据,对比了大中华区与欧洲主流化学体系电芯的价格。 该图表不仅凸显了磷酸铁锂电池相较于欧美主流NCM组合的成本优势,更揭示了即便西方电池厂开始采用磷酸铁锂技术,中国大陆仍占据显著优势。这一成就主要归功于中国电池制造商:其供应链运转高效、工艺成熟优化,并获得政府强力支持。

此外,必须指出的是,尽管LFP电池单价低于60美元/千瓦时,但在大中华区,LMFP电池的价格更为实惠,约为55美元/千瓦时。这不仅使LMFP电池成为值得关注的关键化学体系,而且目前该电池仅在大中华区生产,欧盟尚未实现量产,这为北京方面提供了另一项巨大优势。

值得注意的是,LMFP电池通过在正极添加锰元素实现了比LFP电池更高的能量密度。但LMFP化学体系在系统级大规模制造中仍面临挑战。

与此同时,布洛姆在近期采访中承认优化电池制造流程的益处,并表示PowerCo目前正在学习标准化流程。今年萨尔茨吉特工厂投产后,该公司将在西班牙建设第二座更现代化、更优化的超级工厂,随后在加拿大建设第三座超级工厂。

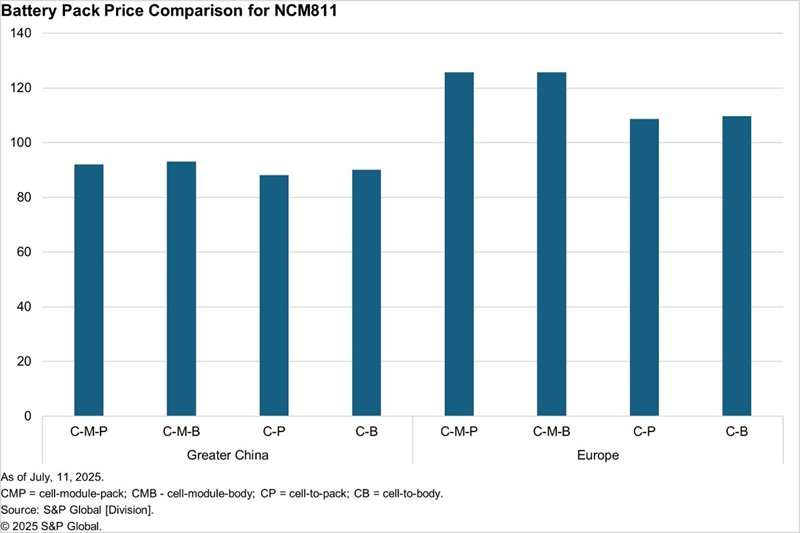

根据标普全球移动能源电池价格数据,大中华区NCM811电池组总价(含电芯、模块及电池包价格)约为每千瓦时92美元,而欧洲市场价格约为每千瓦时126美元。 下图展示了电池制造商在多种组合模式下NCM811电池组价格的差异,包括电芯-模块-电池包(CMP)、电芯-模块-车身(CMB)、电芯直装电池包(CP)以及电芯直装车身(CB)等模式。

对于采用电池直装式结构的磷酸铁锂电池组,标普全球移动数据表明,大中华区电池总价约为每千瓦时75美元,而欧洲约为每千瓦时102美元。此处比较价格针对的是采用棱柱形结构的磷酸铁锂电池组。

b) 欧盟押注可持续性而非可负担性

全球资金最雄厚的电池初创企业之一Northvolt,在早期便遭遇财务危机,其案例深刻揭示了欧洲过度追求可持续性的困境。曾任特斯拉供应链主管的Northvolt联合创始人兼首席执行官彼得·卡尔松,选择在瑞典建立超级工厂,旨在利用该地区丰富廉价的清洁能源,将碳足迹降至最低。

在斯凯莱夫特奥市建设电池电芯超级工厂Northvolt Ett的同时,公司管理层还致力于整合上游业务,构建闭环循环系统。该系统不仅能追溯电池原材料来源,更计划到2030年实现50%的电池生产原料来自回收利用。 为实现这一目标,这家资金雄厚的企业在Northvolt Ett工厂旁投资建设了全功能回收设施Revolt Ett。

这家电池初创企业还在斯凯莱夫特奥市投资建立了Upstream 1正极活性材料(CAM)生产基地。但投资并未止步于此。 该公司还投资建设了硫酸钠回收基础设施——这种盐类是阴极活性材料(CAM)生产过程中的副产品。值得注意的是,每生产一吨CAM,最多可产生两吨硫酸钠。Northvolt坦言,行业标准做法是将硫酸钠作为废料排入河流海洋,这在法律允许范围内。 但该公司不惜投入巨资改变行业惯例,通过净化盐类副产品将其升级为商业产品。如此庞大的基础设施建设成本,唯有在实现规模化运营时才能获得回报。然而北伏特未能如期扩大核心业务规模,无法按承诺及时向客户交付电池电芯。

Northvolt Ett工厂首期规划年产能16GWh,但2023年实际仅安装1GWh产能。更甚者,这1GWh产能利用率近乎为零——除微不足道的试产量外,公司几乎未生产任何电池电芯。在电芯交付延误两年后,宝马于2024年取消了价值20亿欧元的电池电芯订单。

该公司无疑对生产"绿色"电池芯抱有坚定承诺,但其核心目标早早被稀释——尤其当它本应专注于完成500亿美元订单以实现规模化生产时。若能避免在回收等周边业务上的投资,本可节省宝贵现金流,用于解决斯凯莱夫特奥工厂电池芯生产延误问题,从而确保企业生存。

欧洲在《绿色协议》中承诺的可持续发展目标——包括2050年实现气候中和、交通排放量削减90%——正给依赖资本密集型硬件的新兴清洁技术企业带来巨大压力。这种局面形成两难困境:欧盟的最佳选择是生产碳足迹低于中国大陆制造的"绿色"电池。

此外,欧洲电池初创企业生态系统一直押注原始设备制造商将因其对可持续性的关注而为其产品支付溢价。但阿里指出,中国电池制造商并非只是旁观欧盟地区同行,而是通过实现电池价值链多层面的脱碳,提供了比欧洲企业更低的碳足迹。

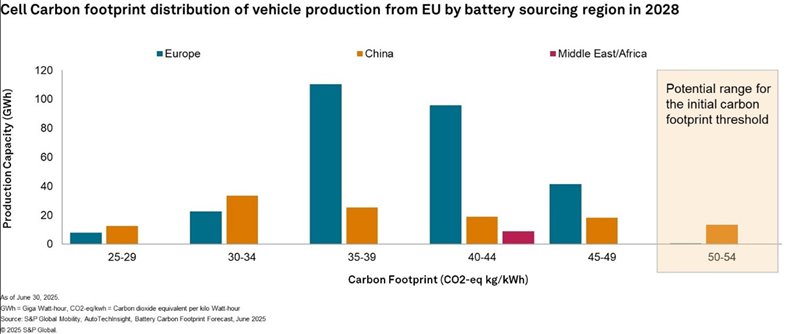

下图对比了大中华区与欧洲生产的电池电芯碳足迹。尽管产能规模庞大,但得益于碳排放管控措施,大中华区电池电芯生产的平均碳足迹低于欧洲。

c) Lack of an Established LFP Manufacturing Ecosystem in Europe

While the choice of battery chemistry significantly influences the cost structure of a BEV or a plug-in hybrid electric vehicle (PHEV), it is known that the lithium iron phosphate (LFP) batteries offer a cost advantage as compared to the more widely used lithium nickel cobalt manganese oxide (NMC) batteries. Notably, the LFP batteries are understood to be about 30% less expensive per kilowatt-hour compared to the NMC batteries, which continue to be the predominant chemistry used by the automakers in the US and Europe.

In contrast, the LFP batteries are more widely used in mainland China, the world’s largest EV market, giving the Chinese battery makers a significant advantage on the cost parameter. This also stemmed from the licensing agreements that the Chinese battery makers had with the patent holders — mainly universities in the US and Canada — over the years. This helped the Chinese companies in integrating the technology in their manufacturing processes while continuing to enhance it in their respective R&D labs.

Meanwhile, Korean and Japanese battery makers focused more on high-density, nickel-rich battery chemistries such as NCM and NCA, giving very limited attention to the applicability of affordable LFP battery cells.

That said, key patents of LFP battery technology began expiring by 2022, giving wider access to global battery companies. This shift coincided with global automakers’ ongoing pursuit to reduce the development and manufacturing cost of EVs to achieve wider adoption.

In 2020, Tesla adopted LFP batteries, moving away from NCA cells. The move was aimed at avoiding nickel, a supply chain-constrained metal, and cobalt, which came from the infamous mines of the Democratic Republic of Congo. Tesla’s battery competency and cost structures sparked interest among rivals such as Ford Motor Company, General Motors and Volkswagen, who followed suit.

Although NMC batteries continue to provide higher energy density when compared to the LFP cells, the gap has narrowed in recent years, thanks to the significant technology advancements made by Chinese battery makers.

Reports suggest that the energy density of LFP battery packs is about one-fifth lower by mass (Wh/kg) and about one-third lower by volume (Wh/L) than that of NMC packs. This performance deficit, however, is compensated by a superior thermal stability, safety and a longer life cycle as compared to the NMC battery packs.

That said, the EU has an upcoming LFP battery cell manufacturing ecosystem. According to official announcements, it is expected that CATL will likely lead the efforts to localize the production of LFP battery cells in the region. The company, which already has two plants operational in the EU region, signed two key strategic partnerships in 2024. It signed a deal with Renault to provide the French carmaker with LFP battery cells from its Hungary plant, as well as entered into an equal joint venture with Stellantis to set up LFP battery cell gigafactory in Spain.

In addition, LG Energy, which produces NCM battery cells at its Poland-based facility, plans to add LFP cells at Renault's site.

VW’s PowerCo, which has fast charging LFP cells on its test benches at Salzgitter, is on track to commence production at the site later this year.

d) Too Many, Indistinct Policy Interventions

The European Commission launched its first-ever dedicated ‘strategic action plan’ for batteries in 2018. The action plan was aimed at securing access to battery-critical raw materials, especially the materials that are not available in Europe, from resource-rich countries, supporting battery R&D, promoting sustainable battery cell manufacturing and recycling, developing a highly skilled workforce to contribute to the battery value chain, among other areas. The action plan included a funding of €360 million to promote battery R&D and €270 million to similar projects dedicated to smart grid and battery storage under Horizon 2020. That said, there was no explicitly mentioned funding available for companies putting factories to produce batteries in the EU region at that time. For context, SK On had just begun the construction of its battery plant in Hungary in early 2018, and LG Energy Solution had already established its first battery plant in Europe in Poland in 2016.

Over the years, the European Commission has rolled out several regulations aimed at promoting the local battery ecosystem, such as the Critical Raw Materials Act, Circular Economy Action Plan, Net Zero Industry Act, New Batteries Regulation 2023, which included the battery passport mandate, and the latest Industrial Action Plan for the automotive sector, which was released in March.

To boost battery manufacturing in Europe, the latest industrial action plan launched a “battery boost” package, which makes funding of €1.8 billion available over 2025-27 to support companies manufacturing batteries in the EU. This is in addition to the €3 billion that the commission has already announced earlier.

However, policymakers are still exploring the possibility of providing direct production support to companies producing batteries in the EU. The commission is also exploring if specific state aid can be provided to such companies and is working to prepare a new Clean Industrial State Aid Framework to simplify state aid rules. In addition, policymakers are also exploring the possibility of introducing specific European content requirements on battery cells and components in EVs sold in the EU region. The paper also mentioned that the commission is assessing whether interventions on standardizing battery designs could be beneficial for battery startups in the critical scale-up phase.

Although the traditional EU approach is tilted toward preparing several frameworks, rolling out new regulations and targets, making funds available via dedicated units such as the European Investment Bank (EIB), it lacks a clear pathway for companies towards achieving the EU’s ambitious goals. For example, if we compare EU’s policy approach with that of the US and focus on the latter’s execution via the roll out of the Inflation Reduction Act (IRA), it can be concluded that the US IRA addressed multiple aspects of boosting demand creation as well as advancing local manufacturing by providing tax credits for domestic production and incentives for sourcing critical materials, in addition to clearly defining the eligibility requirements for companies to qualify for those tax credits.

The result was encouraging for the US. The IRA fetched billions of dollars in fresh investments into the country to strengthen the domestic supply chain while continuing to offload foreign dependency every subsequent year.

It is also noteworthy to mention that in a few instances, European policies have been self-contradictory, often making it difficult for companies to take clear decisions. For example, EU’s move to impose countervailing duties on the import of made-in-China BEVs only encouraged Chinese carmakers to ship hybrid vehicles, which attracted no additional import duty. With demand slowdown for BEVs and an increasing uptake of hybrid vehicles, it remains questionable how EU’s policy in this regard is not self-defeating.

Similarly, while the EU aims to bolster local manufacturing of batteries, it imposes almost negligible import duty of as low as 1.3% on the import of battery cells into the region. Moreover, reports suggest there is zero tariff on the import of sodium-ion batteries into the EU region. In comparison, the US has raised the import duty on lithium-ion battery cells imported from mainland China to 25%, from the previous rate of 7.5%, under the Biden administration. This was further raised to 58% on lithium-ion batteries imported from Greater China under the Trump administration.

标普全球移动展望

尽管存在这些结构性风险,过去两年欧盟和英国仍宣布了多个新的电池制造项目。其中包括印度塔塔集团计划在英国萨默塞特郡建设的40GWh超级工厂。该项目已启动施工,但该设施预计将在2026-27财年正式投产。

政策层面,欧盟似乎正逐步认识到需要更积极地扶持本土新兴电池企业。近期欧盟委员会宣布将向该地区六个电池电芯制造项目提供总额8.52亿欧元的补助金,此举令人鼓舞。 受资助项目包括:法国的ACC与Verkor超级工厂项目、德国的Cellforce与Leclanche电池项目、瑞典沃尔沃支持的Novo Energy超级工厂,以及波兰的LG能源解决方案电池工厂。

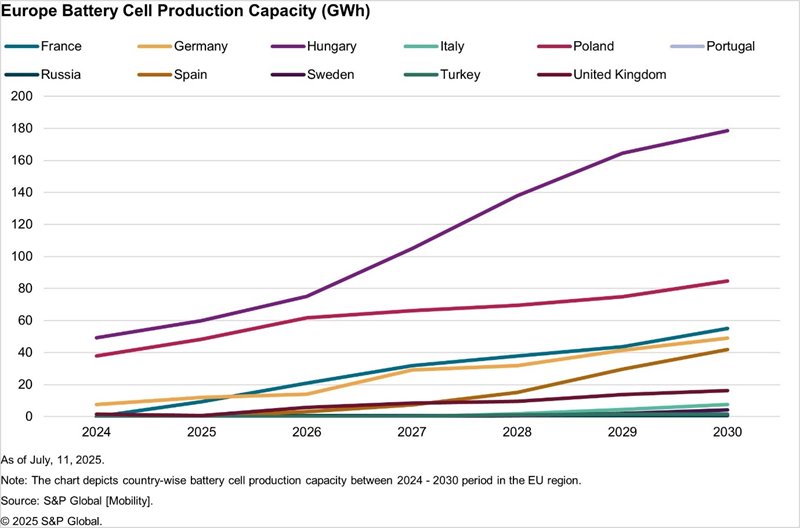

标普全球移动数据预测显示,到2030年匈牙利仍将保持欧洲电池电芯产能首位,波兰、法国和德国将分列二至四位。 匈牙利在欧盟电池电芯产能中的领先地位,主要得益于其地理位置居中,更接近亚洲和中东地区。此外,该国不仅拥有欧盟最低的电力成本,与西欧国家相比还具备低成本劳动力优势。

标普全球移动业务旗下电池研究机构的阿迪姆在谈及欧盟地区现有及即将投产的超级工厂时表示:"欧洲电池生产的本土化进程主要源于自主选择,同时受到整车制造商降低供应链风险的压力驱动。这意味着欧洲整车厂商愿意为采购本土电池支付溢价,以降低地缘政治、运输及供应链风险。"

"当前在缺乏原产地规则且进口关税极低的情况下,欧洲电池制造商正面临廉价中国电芯的冲击。欧洲可能采取保护主义措施应对,例如推行本土采购激励政策或提高进口电池电芯关税。"

他还指出,欧洲面临的主要挑战仍是缺失磷酸铁锂电池芯的生产能力。 "安赛乐米塔尔和PowerCo正根据客户对低价电池芯的需求重新审视其镍基战略,但目前绝大多数磷酸铁锂电池芯来自中国大陆及周边地区。尽管宁德时代等中国供应商计划启动本地化生产,但对中企的依赖很可能持续甚至加剧。"

阿米特·潘迪

高级研究分析师,标普全球移动出行

如需了解更多信息,请 点击此处