更快、更智能的充电技术竞赛如何将中国置于全球电动汽车下一轮重大飞跃的核心位置。

In [mainland] China's hypercompetitive market, any technological advancement achieved by one brand is quickly surpassed by rivals, a pace that Western global automakers find challenging to match.

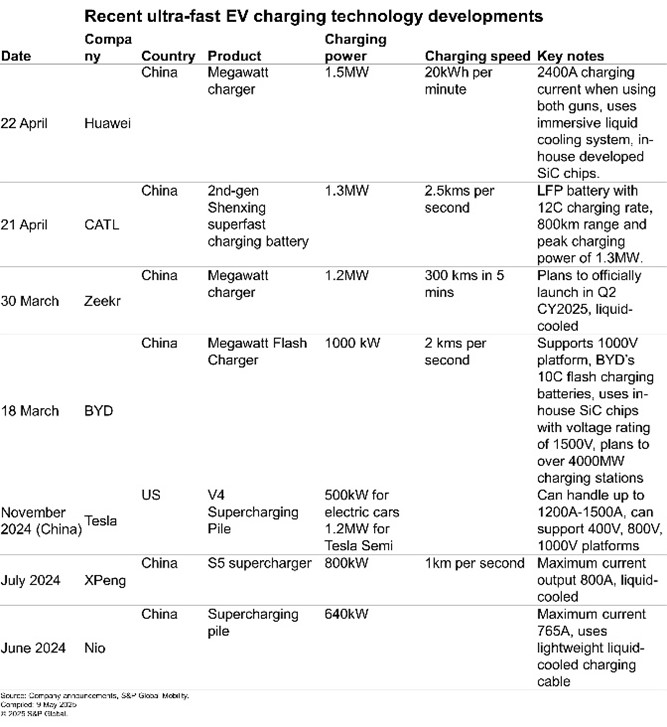

The race to develop ultrafast chargers for electric cars started around 2022, when at an event, Chinese electric carmaker XPeng launched its S4 ultrafast supercharging technology. At the event in Guangzhou, the company organized a ‘live’ demonstration of charging its electric SUV G9 with its S4 supercharger, which delivered a Chinese light-duty test cycle (CLTC) range of 210 kms in just 5 minutes of charging.

It was then Xpeng Chairman and CEO He Xiaopeng took the spotlight and compared the performance of its S4 supercharging pile with Tesla’s then available V3 Supercharger and Porsche’s Turbo Supercharging pile.

While XPeng’s S4 supercharger boasted of a maximum power of 480 kW and a maximum current flow rate of 670A, Tesla V3 Superchargers and Porsche’s Turbo Supercharging pile delivered a maximum power of 250 kW (maximum current flow rate of 631A) and 350 kW (maximum current flow rate of 500A) respectively. Both Tesla and Porsche’s fast chargers could deliver shorter driving range in 5 minutes of charging time when compared to XPeng’s S4 supercharger.

Almost three years later, more companies from [mainland] China are stepping up to unveil their superfast charging solutions, all thanks to continuous enhancement of charging technologies with an aim of reducing the charging time.

It is known that while lack of adequate EV charging infrastructure continues to be the key roadblock in the global mass adoption of EVs, long charging durations, which also cause unavailability of public EV charging spaces, is emerging to be a strategic deterrent for people buying EVs.

High-power ultrafast chargers or supercharging piles are not the sole answer to this problem. While fast-charging EVs is key to significantly cutting down the charging times, to appropriately handle the high flow of current from the grid to the vehicle’s batteries, automakers have been lately developing dedicated 800V architectures, as against the more popular and affordable 400V platforms, comprising several components such as high-voltage battery pack, electric motors, inverters, onboard chargers, DC-DC converters and efficient thermal management systems.

The development of 800V architectures was first seen in [mainland] China, and the technology has been picked up by western automakers as well.

However, technology innovations in [mainland] China continues to move at a breakneck pace.

On March 17, China’s largest EV maker, BYD, launched an all-new Super e-Platform, which features flash-charging batteries, a 30,000 rpm electric motor, a new in-house designed silicon carbide (SiC) power chip, among other parts, to upgrade the core components in an EV to achieve a charging power of 1 megawatt (1000 kW) and a peak charging speed of 2 kms per second. The company said that its newly developed platform can deliver up to 400 kms of driving range within 5 minutes of charging time — the fastest charging mechanism available in mass produced vehicles. According to the company, the BYD Super e-Platform is the world’s first mass-produced 1000V high-voltage architecture for passenger vehicles.

This has come at a time when almost every other global automaker from the US, Europe, Japan, South Korea and other markets is still taking time to settle the 800V architectures in their respective portfolios. For example, Tesla mainly uses 400V architecture that supports charging EVs at up to 250 kW. That said, the newly launched Cybertruck (pickup) and Semi (electric truck) are developed on 800V and 1000V electrical platforms, respectively.

To achieve a faster flow of current inside the battery pack, BYD has reduced the internal resistance by 50% in its flash charging battery, achieving charging current of 1000A and charging rate of 10C. Notably, the C-rate is a measure of the speed at which a battery can be fully charged or discharged relative to its maximum capacity. While 1C would mean that a battery could be fully charged in 1 hour, 10C would mean that the battery can be fully charged in just 1/10th of an hour, which would be roughly 6 minutes. Therefore, the higher the C-rate, the faster a battery can be charged — a parameter equally important as a fast-charging pile.

According to BYD Chairman Wang Chuanfu, the development of the Super e-Platform is aimed at making the EV charging process as quick and as convenient as refueling a gasoline car.

At the China EV10 Forum 2025, which was organized in Beijing between March 28-30, Zeekr, Geely’s premium electric car unit, unveiled its plans to launch a fully liquid-cooled ultrafast charging pile that could deliver a peak power of 1.2MW per charging gun. The charging pile was later showcased at Auto Shanghai 2025 in April.

The 1.2MW ultrafast charger from Zeekr is the result of continuous advancement by its in-house team of engineers, upgrading the first-generation 360 kW fast charger to 600 kW and subsequently to 800 kW. That said, it remains unclear if Zeekr has developed EVs that could be compatible with its 1.2MW ultrafast charger, which is scheduled for an official launch in [mainland] China in second quarter 2025.

CATL organized its Super Tech Day on April 21, where it launched multiple advanced battery technologies, including the second generation of its Shenxing battery. The company said that it is the world’s first LFP battery, which features an 800 km range as well as a 12C peak charging rate — a significant advancement over the first generation 4C Shenxing battery launched in 2023.

The advanced version is also able to provide a peak charging power of 1.3 MW and achieves a range of 2.5 kms per second of charging.

A day later, on April 22, Huawei launched its megawatt fast-charging system that could deliver a peak power output of 1.5MW. Reportedly, Huawei’s MW charger, which was unveiled on the sidelines of 2025 Huawei DriveONE & Smart Charging Network Launch Conference in Shanghai, boasts of releasing a charging current of up to 2400A when using both the guns at the same time. At that rate, Huawei claims, its MW charger can charge a 300-kWh battery in about 15 minutes.

Reports suggest that while Huawei’s megawatt charger is aimed at heavy-duty electric trucks, Zeekr’s MW charger is developed for fast charging passenger EVs. That said, BYD is the only company that has officially used its 1MW charger to charge its passenger cars — Han L and Tang L models, which are developed on 1000V high-voltage architecture and use BYD’s 10C flash charging batteries.

Meanwhile, Huawei has conducted a pilot project deploying its megawatt charger at Shenzhen’s Yantian Port, where electric heavy-duty trucks have successfully implemented a “charge 15 minutes, operate 4 hours” work cycle. According to media reports, the project led to a 35% reduction in operating costs as compared to the traditional diesel engine powered trucks.

华为的兆瓦级充电桩采用自主研发的碳化硅(SiC)芯片——与比亚迪的兆瓦级充电桩相同——并部署了沉浸式液冷系统,以高效控制热量。

为何中国企业正在开发快速电动汽车充电技术

随着全球电动汽车渗透率的持续提升,电网到车辆(G2V)与车辆到电网(V2G)技术领域将不断涌现创新成果。作为全球最大的电动汽车市场,中国有望引领所有发达国家的发展进程。 中国大陆正持续扩建电动汽车充电基础设施,全国充电桩数量已突破1100万个,现正全力推进建设兆瓦级充电桩网络的下一阶段目标。

为此,比亚迪已在全国布局4000座兆瓦级充电站,旨在大幅缩短充电时长。 在部署超级充电桩和兆瓦级充电桩的同时,蔚来、宁德时代、中石化、吉利等企业正同步构建庞大的电池换电网络,以实现充电设施的高效周转。其终极目标是验证:消费者在公共充电站为电动车充电的体验,已与加油站为燃油车加油的体验持平。

在中国大陆这个竞争白热化的市场,任何品牌的技术突破都会被竞争对手迅速超越,这种速度令西方全球汽车制造商难以匹敌。因此,当面对新型兆瓦级充电器的公告时,特斯拉V4超级充电器的数据显得相形见绌。

中国企业之所以能实现这些创新,得益于其在高压纯电动架构领域的长期实践、碳化硅技术的娴熟掌握、政府补贴支持以及高度适配的生态系统。

然而,要在全国范围大规模部署兆瓦级充电桩仍面临多重挑战。例如,多台超级充电桩与兆瓦级充电桩同时运行可能给电网带来巨大负荷。 此外,升级电网及现有充电网络将极度消耗资本。由于缺乏兆瓦级充电桩大规模部署及其电网影响的实证数据,实施难度显得更为严峻。

不过,华为等企业已启动试点项目,其兆瓦级充电桩可动态调节输出功率以减轻电网负荷。 据悉,华为已与国家电网合作开发智能调度系统,通过动态管理充电功率,可将电网峰值负荷降低40%。

鉴于此类合作在中国大陆已积极推进,相关企业极可能很快公布下一阶段部署计划。

展望未来

若您认为本文颇具启发性,2026年柏林国际线圈绕组与电气制造展览会(CWIEME Berlin 2026)现已开放注册。加入全球规模最大的线圈绕组与电气制造行业盛会,探索电动汽车充电技术如何重塑电动出行格局,并与同行、供应商及技术领袖深入探讨这些前沿议题。