Come la corsa verso una ricarica più veloce e intelligente sta posizionando la Cina al centro del prossimo grande balzo in avanti nel mondo dei veicoli elettrici.

In [mainland] China's hypercompetitive market, any technological advancement achieved by one brand is quickly surpassed by rivals, a pace that Western global automakers find challenging to match.

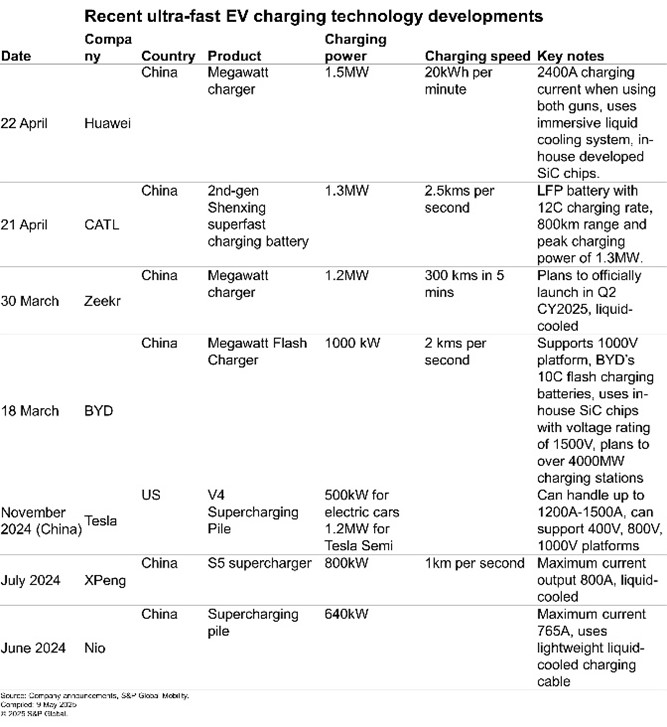

The race to develop ultrafast chargers for electric cars started around 2022, when at an event, Chinese electric carmaker XPeng launched its S4 ultrafast supercharging technology. At the event in Guangzhou, the company organized a ‘live’ demonstration of charging its electric SUV G9 with its S4 supercharger, which delivered a Chinese light-duty test cycle (CLTC) range of 210 kms in just 5 minutes of charging.

It was then Xpeng Chairman and CEO He Xiaopeng took the spotlight and compared the performance of its S4 supercharging pile with Tesla’s then available V3 Supercharger and Porsche’s Turbo Supercharging pile.

While XPeng’s S4 supercharger boasted of a maximum power of 480 kW and a maximum current flow rate of 670A, Tesla V3 Superchargers and Porsche’s Turbo Supercharging pile delivered a maximum power of 250 kW (maximum current flow rate of 631A) and 350 kW (maximum current flow rate of 500A) respectively. Both Tesla and Porsche’s fast chargers could deliver shorter driving range in 5 minutes of charging time when compared to XPeng’s S4 supercharger.

Almost three years later, more companies from [mainland] China are stepping up to unveil their superfast charging solutions, all thanks to continuous enhancement of charging technologies with an aim of reducing the charging time.

It is known that while lack of adequate EV charging infrastructure continues to be the key roadblock in the global mass adoption of EVs, long charging durations, which also cause unavailability of public EV charging spaces, is emerging to be a strategic deterrent for people buying EVs.

High-power ultrafast chargers or supercharging piles are not the sole answer to this problem. While fast-charging EVs is key to significantly cutting down the charging times, to appropriately handle the high flow of current from the grid to the vehicle’s batteries, automakers have been lately developing dedicated 800V architectures, as against the more popular and affordable 400V platforms, comprising several components such as high-voltage battery pack, electric motors, inverters, onboard chargers, DC-DC converters and efficient thermal management systems.

The development of 800V architectures was first seen in [mainland] China, and the technology has been picked up by western automakers as well.

However, technology innovations in [mainland] China continues to move at a breakneck pace.

On March 17, China’s largest EV maker, BYD, launched an all-new Super e-Platform, which features flash-charging batteries, a 30,000 rpm electric motor, a new in-house designed silicon carbide (SiC) power chip, among other parts, to upgrade the core components in an EV to achieve a charging power of 1 megawatt (1000 kW) and a peak charging speed of 2 kms per second. The company said that its newly developed platform can deliver up to 400 kms of driving range within 5 minutes of charging time — the fastest charging mechanism available in mass produced vehicles. According to the company, the BYD Super e-Platform is the world’s first mass-produced 1000V high-voltage architecture for passenger vehicles.

This has come at a time when almost every other global automaker from the US, Europe, Japan, South Korea and other markets is still taking time to settle the 800V architectures in their respective portfolios. For example, Tesla mainly uses 400V architecture that supports charging EVs at up to 250 kW. That said, the newly launched Cybertruck (pickup) and Semi (electric truck) are developed on 800V and 1000V electrical platforms, respectively.

To achieve a faster flow of current inside the battery pack, BYD has reduced the internal resistance by 50% in its flash charging battery, achieving charging current of 1000A and charging rate of 10C. Notably, the C-rate is a measure of the speed at which a battery can be fully charged or discharged relative to its maximum capacity. While 1C would mean that a battery could be fully charged in 1 hour, 10C would mean that the battery can be fully charged in just 1/10th of an hour, which would be roughly 6 minutes. Therefore, the higher the C-rate, the faster a battery can be charged — a parameter equally important as a fast-charging pile.

According to BYD Chairman Wang Chuanfu, the development of the Super e-Platform is aimed at making the EV charging process as quick and as convenient as refueling a gasoline car.

At the China EV10 Forum 2025, which was organized in Beijing between March 28-30, Zeekr, Geely’s premium electric car unit, unveiled its plans to launch a fully liquid-cooled ultrafast charging pile that could deliver a peak power of 1.2MW per charging gun. The charging pile was later showcased at Auto Shanghai 2025 in April.

The 1.2MW ultrafast charger from Zeekr is the result of continuous advancement by its in-house team of engineers, upgrading the first-generation 360 kW fast charger to 600 kW and subsequently to 800 kW. That said, it remains unclear if Zeekr has developed EVs that could be compatible with its 1.2MW ultrafast charger, which is scheduled for an official launch in [mainland] China in second quarter 2025.

CATL organized its Super Tech Day on April 21, where it launched multiple advanced battery technologies, including the second generation of its Shenxing battery. The company said that it is the world’s first LFP battery, which features an 800 km range as well as a 12C peak charging rate — a significant advancement over the first generation 4C Shenxing battery launched in 2023.

The advanced version is also able to provide a peak charging power of 1.3 MW and achieves a range of 2.5 kms per second of charging.

A day later, on April 22, Huawei launched its megawatt fast-charging system that could deliver a peak power output of 1.5MW. Reportedly, Huawei’s MW charger, which was unveiled on the sidelines of 2025 Huawei DriveONE & Smart Charging Network Launch Conference in Shanghai, boasts of releasing a charging current of up to 2400A when using both the guns at the same time. At that rate, Huawei claims, its MW charger can charge a 300-kWh battery in about 15 minutes.

Reports suggest that while Huawei’s megawatt charger is aimed at heavy-duty electric trucks, Zeekr’s MW charger is developed for fast charging passenger EVs. That said, BYD is the only company that has officially used its 1MW charger to charge its passenger cars — Han L and Tang L models, which are developed on 1000V high-voltage architecture and use BYD’s 10C flash charging batteries.

Meanwhile, Huawei has conducted a pilot project deploying its megawatt charger at Shenzhen’s Yantian Port, where electric heavy-duty trucks have successfully implemented a “charge 15 minutes, operate 4 hours” work cycle. According to media reports, the project led to a 35% reduction in operating costs as compared to the traditional diesel engine powered trucks.

Il caricabatterie MW di Huawei è stato sviluppato utilizzando chip in carburo di silicio (SiC) sviluppati internamente, gli stessi utilizzati nel caricabatterie MW di BYD, e impiega un sistema di raffreddamento a liquido immersivo per mantenere efficiente il controllo termico.

Perché le aziende cinesi stanno sviluppando tecnologie di ricarica rapida per veicoli elettrici

La crescente diffusione globale dei veicoli elettrici continuerà a stimolare nuove innovazioni nelle tecnologie grid-to-vehicle (G2V) e vehicle-to-grid (V2G), con la Cina [continentale] - il più grande mercato mondiale di veicoli elettrici - che dovrebbe guidare tutti i paesi sviluppati. Continuando ad espandere la propria infrastruttura di ricarica per veicoli elettrici fino a oltre 11 milioni di caricatori in tutto il Paese, la Cina continentale si sta ora preparando a compiere il prossimo passo avanti con la costruzione di una vasta rete di caricatori da megawatt.

A tal fine, BYD sta già lavorando alla creazione di una vasta rete di 4000 stazioni di ricarica da 1 MW in tutta la Cina continentale, con l'obiettivo di ridurre drasticamente i tempi di ricarica in questi siti. Mentre l'installazione di pile di supercaricatori e caricatori megawatt costituisce un aspetto di questo approccio, aziende come Nio, CATL, Sinopec, Geely e altre stanno anche costruendo una vasta rete di sostituzione delle batterie per ottenere tempi di ricarica rapidi in queste strutture. L'obiettivo finale è dimostrare che l'esperienza dei consumatori che ricaricano i loro veicoli elettrici in una stazione di ricarica pubblica è ora pari a quella del rifornimento di un'auto a benzina.

Nel mercato ipercompetitivo della Cina [continentale], qualsiasi progresso tecnologico raggiunto da un marchio viene rapidamente superato dai rivali, un ritmo che le case automobilistiche occidentali globali trovano difficile da eguagliare. Di conseguenza, le statistiche del Supercharger V4 di Tesla sembrano modeste se confrontate con i nuovi annunci sui caricatori megawatt.

Le aziende cinesi sono anche in grado di realizzare queste innovazioni grazie a una maggiore esperienza nella lavorazione con architetture BEV ad alta tensione, alla competenza nella tecnologia SiC, ai sussidi governativi e a un ecosistema altamente favorevole.

Tuttavia, ci sono molteplici sfide per un'implementazione su larga scala dei caricatori MW in tutto il paese. Ad esempio, il funzionamento simultaneo di diversi supercharger e caricatori megawatt potrebbe creare un carico immenso sulla rete elettrica. Inoltre, l'aggiornamento della rete elettrica e della rete di ricarica esistente potrebbe essere un'operazione altamente dispendiosa in termini di capitale. La mancanza di dati reali sull'implementazione su larga scala dei caricatori MW e sul loro impatto sulla rete rende l'implementazione ancora più scoraggiante.

Detto questo, aziende come Huawei stanno già implementando progetti pilota con i propri caricatori MW che regolano dinamicamente la potenza di uscita per mitigare l'impatto sulle reti elettriche. Secondo quanto riferito, Huawei ha collaborato con la rete statale per sviluppare un sistema di programmazione intelligente che gestisce dinamicamente la potenza di ricarica e riduce il carico di picco della rete fino al 40%.

Con collaborazioni così attive già in corso nella Cina continentale, è altamente probabile che queste aziende aggiorneranno molto presto le prossime fasi di implementazione.

Guardando al futuro

Se avete trovato interessante questo articolo, sono aperte le iscrizioni al CWIEME Berlin 2026. Partecipate alla più grande fiera del settore dedicata all'avvolgimento di bobine e alla produzione elettrica per scoprire come i progressi nella tecnologia di ricarica dei veicoli elettrici stanno ridefinendo la mobilità elettrica e approfondire questi argomenti con colleghi, fornitori e leader tecnici.

Autore

Amit Panday

Analista di ricerca senior, S&P Global Mobility

Per ulteriori informazioni, cliccare qui.