Wie der Wettlauf um schnelleres und intelligenteres Laden China in den Mittelpunkt des nächsten großen Sprungs nach vorne in der Welt der Elektrofahrzeuge rückt.

In [mainland] China's hypercompetitive market, any technological advancement achieved by one brand is quickly surpassed by rivals, a pace that Western global automakers find challenging to match.

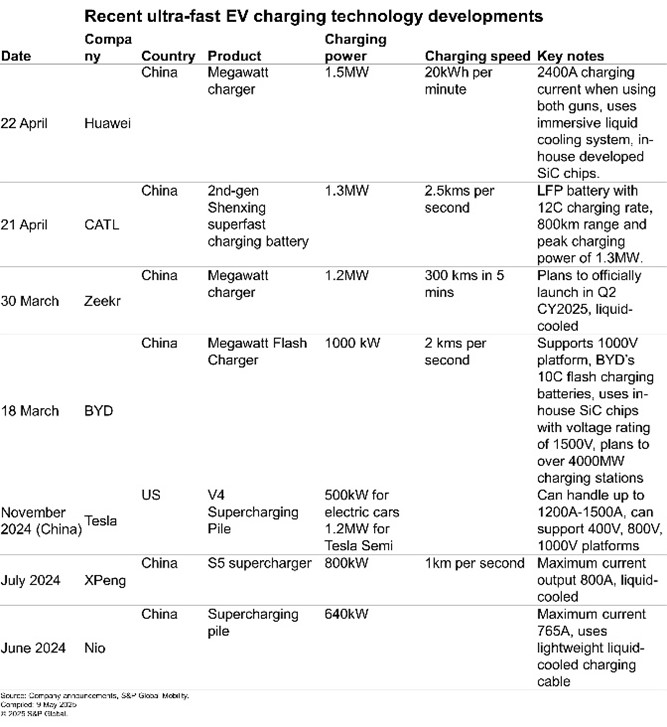

The race to develop ultrafast chargers for electric cars started around 2022, when at an event, Chinese electric carmaker XPeng launched its S4 ultrafast supercharging technology. At the event in Guangzhou, the company organized a ‘live’ demonstration of charging its electric SUV G9 with its S4 supercharger, which delivered a Chinese light-duty test cycle (CLTC) range of 210 kms in just 5 minutes of charging.

It was then Xpeng Chairman and CEO He Xiaopeng took the spotlight and compared the performance of its S4 supercharging pile with Tesla’s then available V3 Supercharger and Porsche’s Turbo Supercharging pile.

While XPeng’s S4 supercharger boasted of a maximum power of 480 kW and a maximum current flow rate of 670A, Tesla V3 Superchargers and Porsche’s Turbo Supercharging pile delivered a maximum power of 250 kW (maximum current flow rate of 631A) and 350 kW (maximum current flow rate of 500A) respectively. Both Tesla and Porsche’s fast chargers could deliver shorter driving range in 5 minutes of charging time when compared to XPeng’s S4 supercharger.

Almost three years later, more companies from [mainland] China are stepping up to unveil their superfast charging solutions, all thanks to continuous enhancement of charging technologies with an aim of reducing the charging time.

It is known that while lack of adequate EV charging infrastructure continues to be the key roadblock in the global mass adoption of EVs, long charging durations, which also cause unavailability of public EV charging spaces, is emerging to be a strategic deterrent for people buying EVs.

High-power ultrafast chargers or supercharging piles are not the sole answer to this problem. While fast-charging EVs is key to significantly cutting down the charging times, to appropriately handle the high flow of current from the grid to the vehicle’s batteries, automakers have been lately developing dedicated 800V architectures, as against the more popular and affordable 400V platforms, comprising several components such as high-voltage battery pack, electric motors, inverters, onboard chargers, DC-DC converters and efficient thermal management systems.

The development of 800V architectures was first seen in [mainland] China, and the technology has been picked up by western automakers as well.

However, technology innovations in [mainland] China continues to move at a breakneck pace.

On March 17, China’s largest EV maker, BYD, launched an all-new Super e-Platform, which features flash-charging batteries, a 30,000 rpm electric motor, a new in-house designed silicon carbide (SiC) power chip, among other parts, to upgrade the core components in an EV to achieve a charging power of 1 megawatt (1000 kW) and a peak charging speed of 2 kms per second. The company said that its newly developed platform can deliver up to 400 kms of driving range within 5 minutes of charging time — the fastest charging mechanism available in mass produced vehicles. According to the company, the BYD Super e-Platform is the world’s first mass-produced 1000V high-voltage architecture for passenger vehicles.

This has come at a time when almost every other global automaker from the US, Europe, Japan, South Korea and other markets is still taking time to settle the 800V architectures in their respective portfolios. For example, Tesla mainly uses 400V architecture that supports charging EVs at up to 250 kW. That said, the newly launched Cybertruck (pickup) and Semi (electric truck) are developed on 800V and 1000V electrical platforms, respectively.

To achieve a faster flow of current inside the battery pack, BYD has reduced the internal resistance by 50% in its flash charging battery, achieving charging current of 1000A and charging rate of 10C. Notably, the C-rate is a measure of the speed at which a battery can be fully charged or discharged relative to its maximum capacity. While 1C would mean that a battery could be fully charged in 1 hour, 10C would mean that the battery can be fully charged in just 1/10th of an hour, which would be roughly 6 minutes. Therefore, the higher the C-rate, the faster a battery can be charged — a parameter equally important as a fast-charging pile.

According to BYD Chairman Wang Chuanfu, the development of the Super e-Platform is aimed at making the EV charging process as quick and as convenient as refueling a gasoline car.

At the China EV10 Forum 2025, which was organized in Beijing between March 28-30, Zeekr, Geely’s premium electric car unit, unveiled its plans to launch a fully liquid-cooled ultrafast charging pile that could deliver a peak power of 1.2MW per charging gun. The charging pile was later showcased at Auto Shanghai 2025 in April.

The 1.2MW ultrafast charger from Zeekr is the result of continuous advancement by its in-house team of engineers, upgrading the first-generation 360 kW fast charger to 600 kW and subsequently to 800 kW. That said, it remains unclear if Zeekr has developed EVs that could be compatible with its 1.2MW ultrafast charger, which is scheduled for an official launch in [mainland] China in second quarter 2025.

CATL organized its Super Tech Day on April 21, where it launched multiple advanced battery technologies, including the second generation of its Shenxing battery. The company said that it is the world’s first LFP battery, which features an 800 km range as well as a 12C peak charging rate — a significant advancement over the first generation 4C Shenxing battery launched in 2023.

The advanced version is also able to provide a peak charging power of 1.3 MW and achieves a range of 2.5 kms per second of charging.

A day later, on April 22, Huawei launched its megawatt fast-charging system that could deliver a peak power output of 1.5MW. Reportedly, Huawei’s MW charger, which was unveiled on the sidelines of 2025 Huawei DriveONE & Smart Charging Network Launch Conference in Shanghai, boasts of releasing a charging current of up to 2400A when using both the guns at the same time. At that rate, Huawei claims, its MW charger can charge a 300-kWh battery in about 15 minutes.

Reports suggest that while Huawei’s megawatt charger is aimed at heavy-duty electric trucks, Zeekr’s MW charger is developed for fast charging passenger EVs. That said, BYD is the only company that has officially used its 1MW charger to charge its passenger cars — Han L and Tang L models, which are developed on 1000V high-voltage architecture and use BYD’s 10C flash charging batteries.

Meanwhile, Huawei has conducted a pilot project deploying its megawatt charger at Shenzhen’s Yantian Port, where electric heavy-duty trucks have successfully implemented a “charge 15 minutes, operate 4 hours” work cycle. According to media reports, the project led to a 35% reduction in operating costs as compared to the traditional diesel engine powered trucks.

Das MW-Ladegerät von Huawei wurde unter Verwendung der intern entwickelten Siliziumkarbid- oder SiC-Chips entwickelt – genau wie das MW-Ladegerät von BYD – und verfügt über ein immersives Flüssigkeitskühlsystem, um die Temperatur effizient unter Kontrolle zu halten.

Warum chinesische Unternehmen Technologien für das schnelle Laden von Elektrofahrzeugen entwickeln

Die weltweit zunehmende Verbreitung von Elektrofahrzeugen wird weiterhin neue Innovationen im Bereich der Grid-to-Vehicle- (G2V) und Vehicle-to-Grid- (V2G) Technologien vorantreiben, wobei China – der weltweit größte Markt für Elektrofahrzeuge – voraussichtlich alle Industrienationen anführen wird. China baut seine Ladeinfrastruktur für Elektrofahrzeuge auf über 11 Millionen Ladestationen im ganzen Land aus und bereitet sich nun auf den nächsten Schritt vor, nämlich den Aufbau eines großen Netzwerks von Megawatt-Ladestationen.

Zu diesem Zweck arbeitet BYD bereits daran, ein umfangreiches Netzwerk von 4000 1-MW-Ladestationen in ganz China aufzubauen, mit dem Ziel, die Ladezeiten an diesen Standorten drastisch zu verkürzen. Während die Installation von Supercharger-Säulen und Megawatt-Ladegeräten einen Teil dieses Ansatzes ausmacht, bauen Unternehmen wie Nio, CATL, Sinopec, Geely und andere auch ein umfangreiches Batteriewechselnetzwerk auf, um schnelle Durchlaufzeiten an diesen Batterieladeeinrichtungen zu erreichen. Das ultimative Ziel ist es, den Anwendungsfall zu beweisen, dass das Verbrauchererlebnis beim Laden ihrer Elektrofahrzeuge an einer öffentlichen Ladestation nun mit dem Tanken eines Benzinautos vergleichbar ist.

Auf dem hart umkämpften Markt in [Festland-]China wird jeder technologische Fortschritt einer Marke schnell von den Konkurrenten übertroffen, ein Tempo, mit dem westliche globale Autohersteller nur schwer mithalten können. Infolgedessen sehen die V4-Supercharger-Statistiken von Tesla im Vergleich zu den Ankündigungen neuer Megawatt-Ladegeräte eher bescheiden aus.

Chinesische Unternehmen sind auch aufgrund ihrer längeren Erfahrung mit Hochspannungs-BEV-Architekturen, ihrer Kompetenz in der SiC-Technologie, staatlicher Subventionen und eines äußerst förderlichen Ökosystems in der Lage, diese Innovationen zu realisieren.

Allerdings gibt es mehrere Herausforderungen für eine großflächige Einführung von MW-Ladegeräten im ganzen Land. Beispielsweise könnte der gleichzeitige Betrieb mehrerer Supercharger und Megawatt-Ladegeräte eine immense Belastung für das Stromnetz darstellen. Darüber hinaus könnte die Aufrüstung des Stromnetzes sowie des bestehenden Ladenetzes eine äußerst kapitalintensive Angelegenheit sein. Der Mangel an realen Daten über den großflächigen Einsatz von MW-Ladegeräten und deren Auswirkungen auf das Stromnetz lässt die Umsetzung noch schwieriger erscheinen.

Allerdings führen Unternehmen wie Huawei bereits Pilotprojekte mit ihren MW-Ladegeräten durch, die die Ausgangsleistung dynamisch anpassen, um die Auswirkungen auf die Stromnetze zu mildern. Berichten zufolge hat Huawei in Zusammenarbeit mit dem staatlichen Stromnetzbetreiber ein intelligentes Planungssystem entwickelt, mit dem die Ladeleistung dynamisch gesteuert und die Spitzenlast im Netz um bis zu 40 % reduziert werden kann.

Angesichts dieser bereits laufenden aktiven Kooperationen in [Festland-]China ist es sehr wahrscheinlich, dass diese Unternehmen sehr bald über die nächsten Schritte der Einführung berichten werden.

Ausblick

Wenn Sie diesen Artikel aufschlussreich fanden, können Sie sich jetzt für die CWIEME Berlin 2026 anmelden. Nehmen Sie an der größten Fachmesse der Branche für Spulenwickel- und Elektrofertigung teil, um zu erfahren, wie Fortschritte in der EV-Ladetechnologie die E-Mobilität verändern, und diskutieren Sie diese Themen mit Kollegen, Lieferanten und technischen Führungskräften.

Autor

Amit Panday

Senior Research Analyst, S&P Global Mobility

Weitere Informationen finden Sie hier.