Electric Commercial Vehicles: Opportunities and Challenges in Europe

by Abdullah Shakil, Analyst I, and Muhammad Saad Siddiqui, Junior Analyst – at PTR Inc.

- Europe has set an ambitious goal to ban ICE vehicles by 2035. This decision has received a mixed response as Germany and Italy oppose this ban while France supports it.

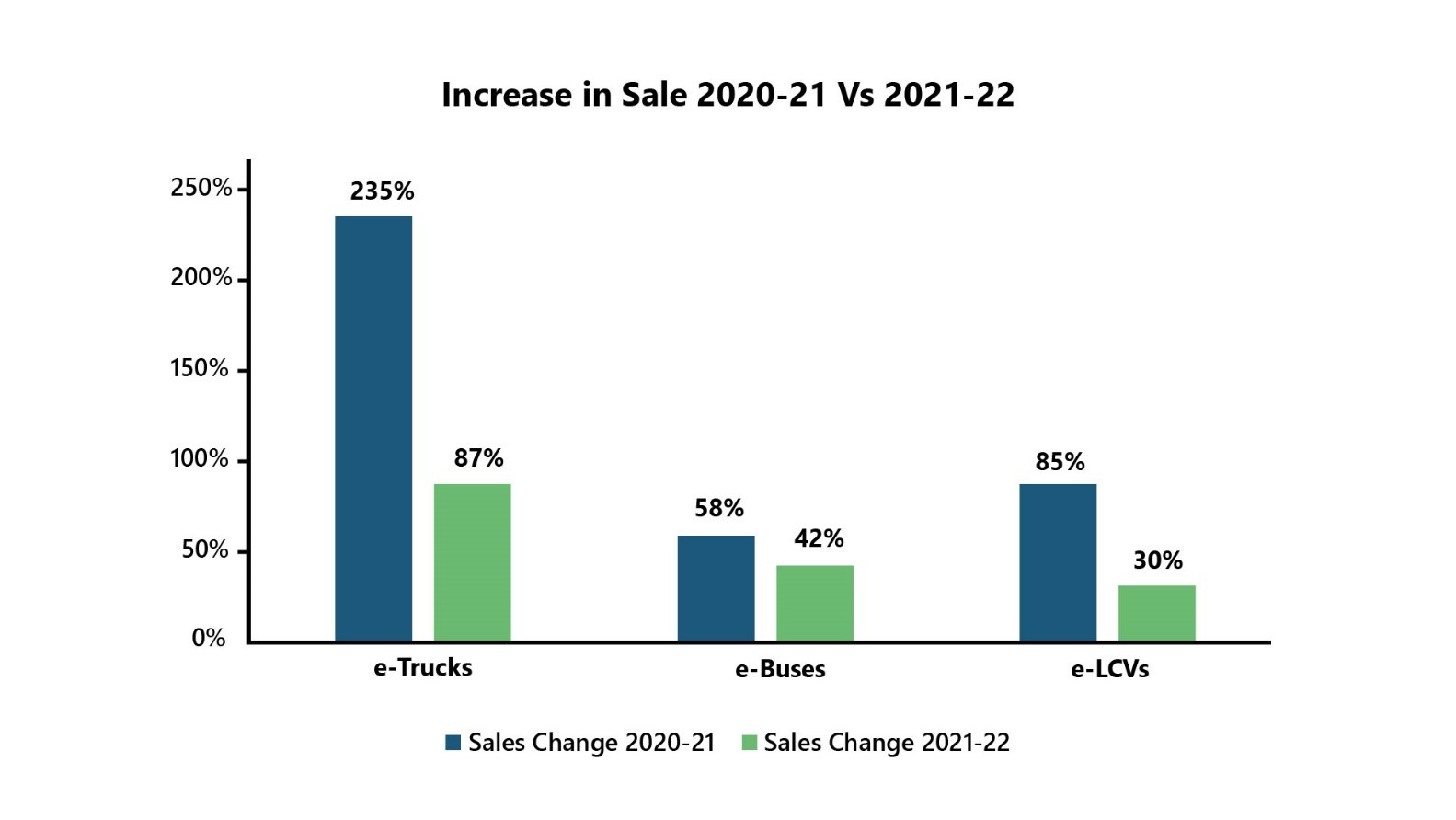

- From 2021 to 2022, the sales across all categories of commercial vehicles increased but at a much slower rate.

- The challenges to adopting electric commercial vehicles include supply chain constraints and non-availability of local raw materials for battery production.

The electrification of commercial vehicle fleets is a significant step towards a sustainable future. Electric commercial vehicles do not release harmful emissions like traditional internal combustion engine (ICE) vehicles, mitigating the global carbon footprint. Apart from their environmentally friendly attributes, electric commercial vehicles are viable economically in the long term, with significant reductions in operational costs compared to their fossil-fuel counterparts.

Multiple countries are diverting hefty subsidies towards electric vehicles to achieve carbon neutrality. Europe has set an ambitious goal to ban ICE vehicles by 2035. This ban is facing backlash from major countries, including Germany and Italy, as these countries believe that it is being implemented without proper research, leading to decreased sales of buses, trucks, and light commercial vehicles. On the other hand, countries like France support the ban, saying that the world should follow EU policies and try to achieve carbon neutrality soon.

Current Outlook

From 2020 to 2021, the per-unit sales of electric trucks, buses, and light commercial vehicles increased by 235%, 58%, and 85%, respectively. From 2021 to 2022, the sales across all categories of commercial vehicles increased but at a much slower rate. From 2021 to 2022, the increase in the sale of electric trucks, buses, and light commercial vehicles was 87%, 42%, and 30%, respectively. Figure 1 below illustrates the increase in sales of trucks, buses, and LCVs in the two years.

Figure 1: Percentage Increase in Sales of Electric Commercial Vehicles (2021 vs. 2022). Source: PTR Inc.

The decrease in sales was primarily observed due to the decreased share of sales in countries opposing the ICE vehicle ban. Germany led this campaign and allied with six other countries, including Italy, Poland, Czech Republic, Slovakia, Romania, and Hungary, against this ban affecting the European electric market sentiments. Germany, considered a market leader of electrification in Europe, saw a decrease in its market share for electric buses, trucks, and LCVs from 17%, 61%, and 24% in 2021 to 14%, 27%, and 22% in 2022, respectively. Moreover, the sales of electric buses and LCVs in Germany increased by a meager 10% and 8%, while the sales of electric trucks saw a decline of 16% in 2022.

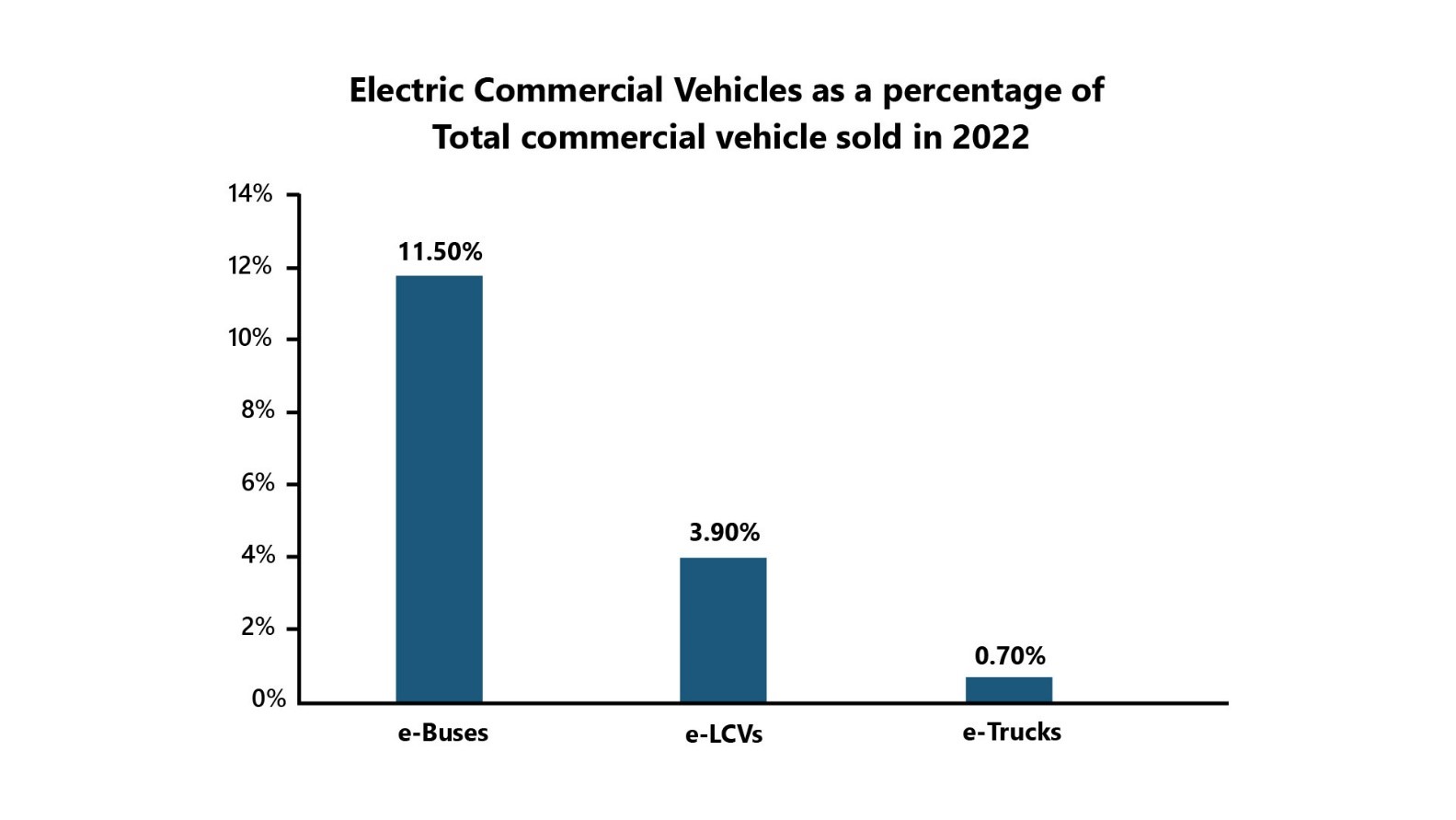

Despite the overall growth observed in 2021 and 2022, electric buses, trucks, and LCVs comprised 11.5%, 0.7%, and 3.9% of the overall sales in Europe's buses, trucks, and LCVs segment in 2022, as shown below in Figure 2.

Figure 2: Electric Commercial Vehicles Sold as a Percentage of Total Commercial Vehicles Sold for the Year 2022. Source: PTR Inc.

Looking further into the electric commercial vehicle sales across Europe in terms of the electric buses sold as a percentage of all buses in 2022, Finland was leading the market with a 68% share of e-buses, followed by Romania with 63% and Denmark with 61%. In the case of electric trucks, Norway had the highest electric-to-total sales ratio in 2022 at around 6%, followed by Switzerland (5.2%) and Sweden (3%). Moreover, in the case of the electric LCVs to total LCVs sales ratio, Norway was the market leader in 2022, with 20% of the sales being electric, followed by Sweden (12%) and Switzerland (8%).

Challenges in the Way of Electrification

There are a few challenges in the widespread adoption of electric commercial vehicles. As the demand for electric vehicles rose, the global supply chain got strained. In 2022, major OEMs, such as Volvo and Scania, hesitated to book new truck orders due to supply chain issues. The supply chain issues will likely worsen with no end to the Russia-Ukraine conflict in sight.

Europe is dependent on other countries for raw materials used in battery production. Lack of localized mining also contributes to lower adoption of electric commercial vehicles. Almost two-thirds of the world's cobalt is sourced from the Democratic Republic of Congo, and 40% of the lithium is derived from China. Europe depends on China for refined lithium, as China is responsible for 76% of global battery production. Although lithium extraction is in the planning phase, it will take too long till the extraction and production are actually realized. Portugal, which holds the bloc's largest lithium reserve, does not expect production until 2026. Overcoming raw material supply challenges is a major challenge for Europe to increase the adoption of electric commercial vehicles.

Volta Trucks, a European manufacturer, was dependent on an American firm for its battery and had to halt operations due to its supplier, Proterra, declaring bankruptcy. This event sheds light on how the European players in the electric commercial vehicles segment depend on other countries for battery production.

On the other hand, Fuel Cell Electric Vehicles (FCEVs) might affect conventional EV adoption in the heavy-duty segment due to longer travel range, ability to perform efficiently even in cold weather, and little to no refueling time (if compared with EVs). Although FCEVs are currently in the nascent stages, as the technology matures, they can potentially challenge the market for electric vehicles, especially in the heavy-duty segment.

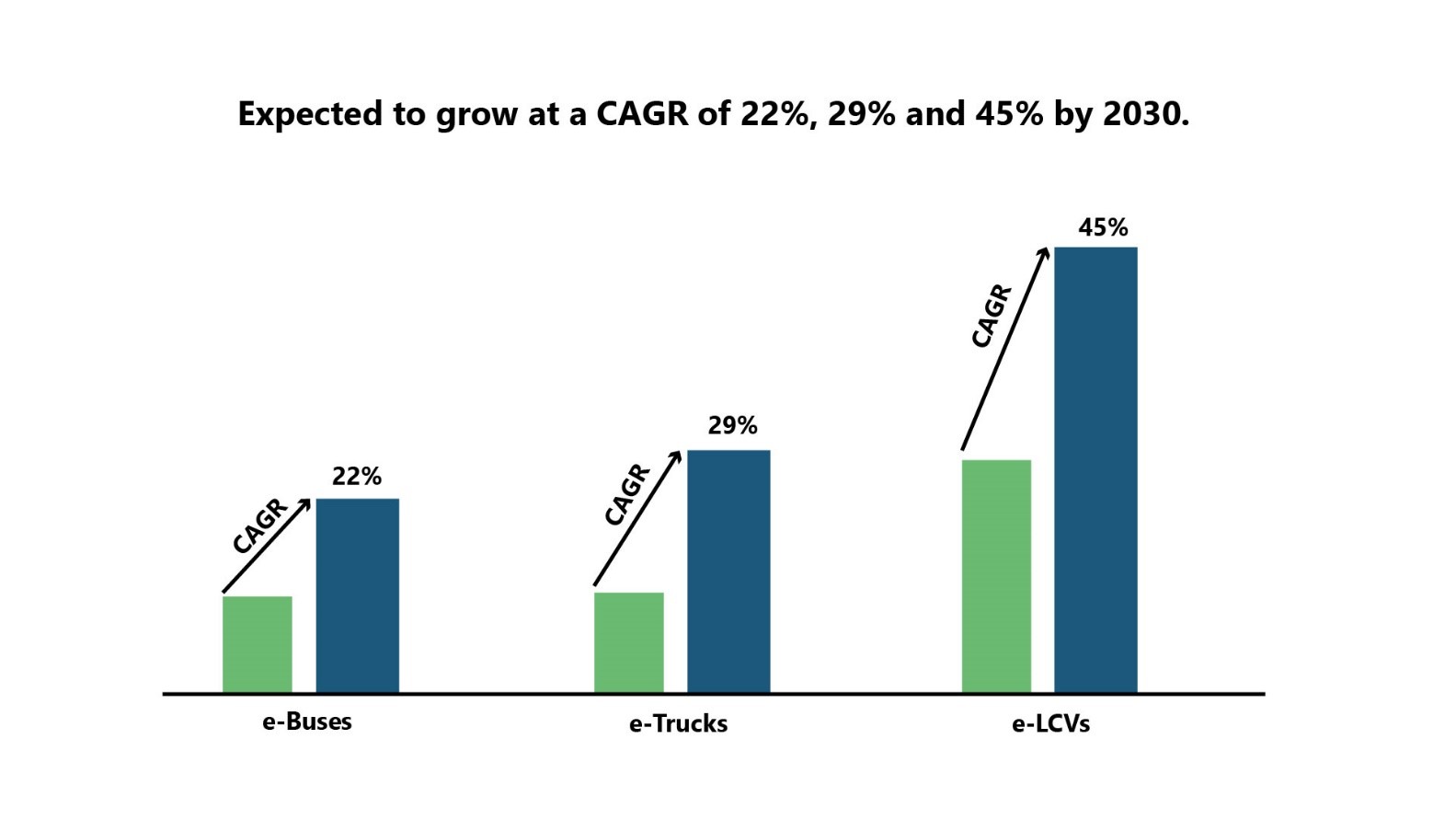

Figure 3: Expected CAGR of e-bus, e-trucks and e-LCVs till 2030. Source: PTR Inc.

Future Outlook and Opportunities

Although there are certain challenges with the adoption of electric commercial vehicles, the e-bus, e-trucks, and e-LCVs market is expected to grow (in terms of per unit sales) with a CAGR of 22%, 29%, and 45% by 2030, as shown in Figure 3.

The EU voted that only electric heavy-duty vehicles will be classified as zero-emissions vehicles. There was discussion about classifying alternative fuel-based ICE vehicles as zero-emissions vehicles. However, this debate has been put to rest until 2027, when the EU shall review the role of a carbon correction factor (CCF) in the transition towards zero-emission mobility in the heavy-duty vehicle sector. This development benefits the electric heavy-duty segments because the ICE vehicles powered by alternative fuels will not be able to compete (as zero-emission vehicles) with electric vehicles till 2027.

The EU has introduced a 100% zero-emission target for urban buses by 2035 while setting an intermediate target of achieving 85% for this category by 2030. The Council has agreed to exempt inter-urban buses from this target due to the challenges faced in the inter-urban bus segment, such as range anxiety and lack of charging infrastructure throughout highways.

EU issued the Clean Vehicle Directive to ensure widespread clean mobility and set targets for procuring clean (low- and zero-emission) vehicles. According to the directive, most EU countries should make sure that 45% of buses and 10% of trucks are clean vehicles from 2 August 2021 to 31 December 2025. The target increases to 65% for buses and 15% for trucks from 1 January 2026 to 31 December 2030. Furthermore, half of the bus targets should be met by procuring purely zero-emission buses. Clean Vehicle Directive will help accelerate the adoption of clean vehicles in the near future.

Although countries opposing the ICE vehicle ban are affecting the pace towards electrification, the commitment to achieving net zero persists as the same countries are allocating hefty subsidies to realizing their respective goals. The pushback by countries on the ICE ban is not because of their unwillingness to achieve these goals but because the goals are proving to be practically difficult to achieve. The willingness of these countries can be gauged as they are allocating funds to encourage the demand and supply of carbon-neutral vehicles. Over the years, Germany has pledged more than 3.2 billion dollars in grants and subsidies under its numerous programs for stimulating the e-bus, e-truck and e-LCV markets.

Other countries in the EU have followed suit by allocating billions of dollars to not only boost the demand for electric trucks, buses, and LCVs but also allow for tax cuts for suppliers of such vehicles and charging infrastructures. These initiatives show that the countries opposing or supporting the ICE ban are committed to promoting clean vehicles in Europe.

Looking Ahead

The electrification of commercial vehicle fleets in Europe represents a crucial step towards a sustainable and eco-friendly future, offering both environmental and economic benefits. While the transition is encountering challenges, such as supply chain issues and dependence on foreign battery production, the future outlook remains promising because of the region's strong intent in the shape of supportive policies in reaching its carbon neutrality goals as well as ample resources that it can leverage towards achieving them. Notably, from 2022-2030, per-unit sales of e-buses, e-trucks, and e-LCVs are expected to grow with a CAGR of 22%, 29%, and 45%, respectively.

Furthermore, it is considered that FCEVs (as the technology matures) may affect conventional EV adoption in the heavy-duty segment. FCEV technology can provide a longer range and the ability to work in cold temperatures with insignificant refueling time (compared to conventional EVs).

About the Authors

Abdullah Shakil currently serves as a key member of the Commercial and Off-Highway (COHV) team at PTR Inc. Before working for PTR Inc., he has had the experience of serving in the capital market of Pakistan. But after his master’s in Economics, Abdullah's focus has shifted towards market research in topics related to New Energy Vehicle markets and companies.

Saad Siddique, an Analyst at PTR Inc., conducts comprehensive research on the market development of Commercial Vehicles. His responsibilities include analyzing technical advancements, historical trends, and economic feasibility that impact the industry. Furthermore, he assesses the standings of Original Equipment Manufacturers (OEMs) in the new energy sector, monitoring their financial performance to provide valuable insights into the competitive landscape. Saad did his bachelor’s in Economics and Mathematics, with a minor in Computer Sciences from Lahore University of Management Sciences (LUMS). This interdisciplinary foundation equips him with a unique skill set, blending quantitative analysis with a solid understanding of economic principles.

For more details, please contact [email protected]