Download the report to find out:

Report developed in partnership with

-cropped.png)

Below is an excerpt from the section on the tariff wars between China-US and Europe

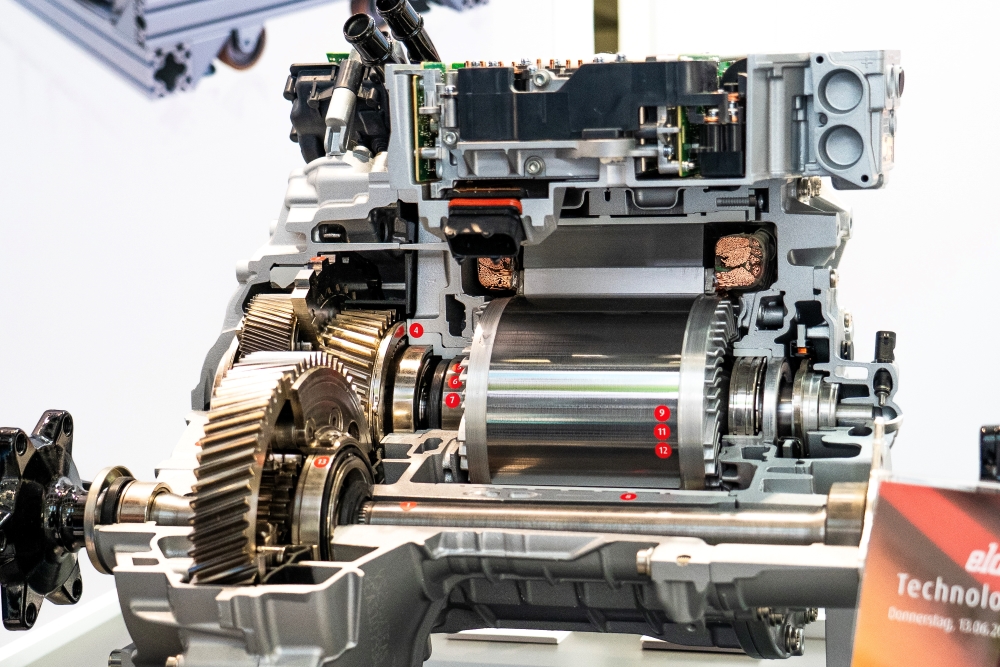

The performance of e-motors relies on materials like permanent magnets, windings, and motor-core laminations. Copper is commonly used for windings due to its conductivity and cost, while rare earth elements (REEs) such as neodymium, dysprosium, and terbium are crucial for permanent magnets in e-motors.

S&P Global Mobility forecasts, as of 2024, 83% of e-motors in BEVs are based on permanent magnets, highlighting the heavy reliance on REEs. Manufacturers prefer these motors for their efficiency and power density, which enhance performance and range. Demand for e-axle permanent magnet motors is expected to grow from 14.8 million units in 2024 to 45.8 million units by 2030, at a 21% CAGR.

The demand for permanent magnet e-motors in BEVs, FCEVs, and HEVs is set to rise from 41.4 million units in 2024 to 93.5 million in 2030, growing at 15%, with mainland China's demand expected to increase by 12% annually.

Mainland China dominates rare earth production, accounting for 60% of mining and 90% of refining. Many countries depend on mainland China's processed REEs for cost and availability, but this monopoly can be leveraged in trade disputes and geopolitical tensions.

Fill out the form below to get your copy of the report.