Greenland is emerging as a potential pillar of critical mineral supply, but turning geological promise into industrial reality comes with major logistical, regulatory, and geopolitical trade-offs.

Greenland’s vast reserves of critical minerals and rare earth elements could significantly impact global supply chains, especially as industries look to diversify away from mainland China. While recent investments highlight rising international interest in Greenland’s resources for clean energy and technology, the island’s harsh climate, limited infrastructure and regulatory challenges remain significant obstacles to unlocking its full potential.

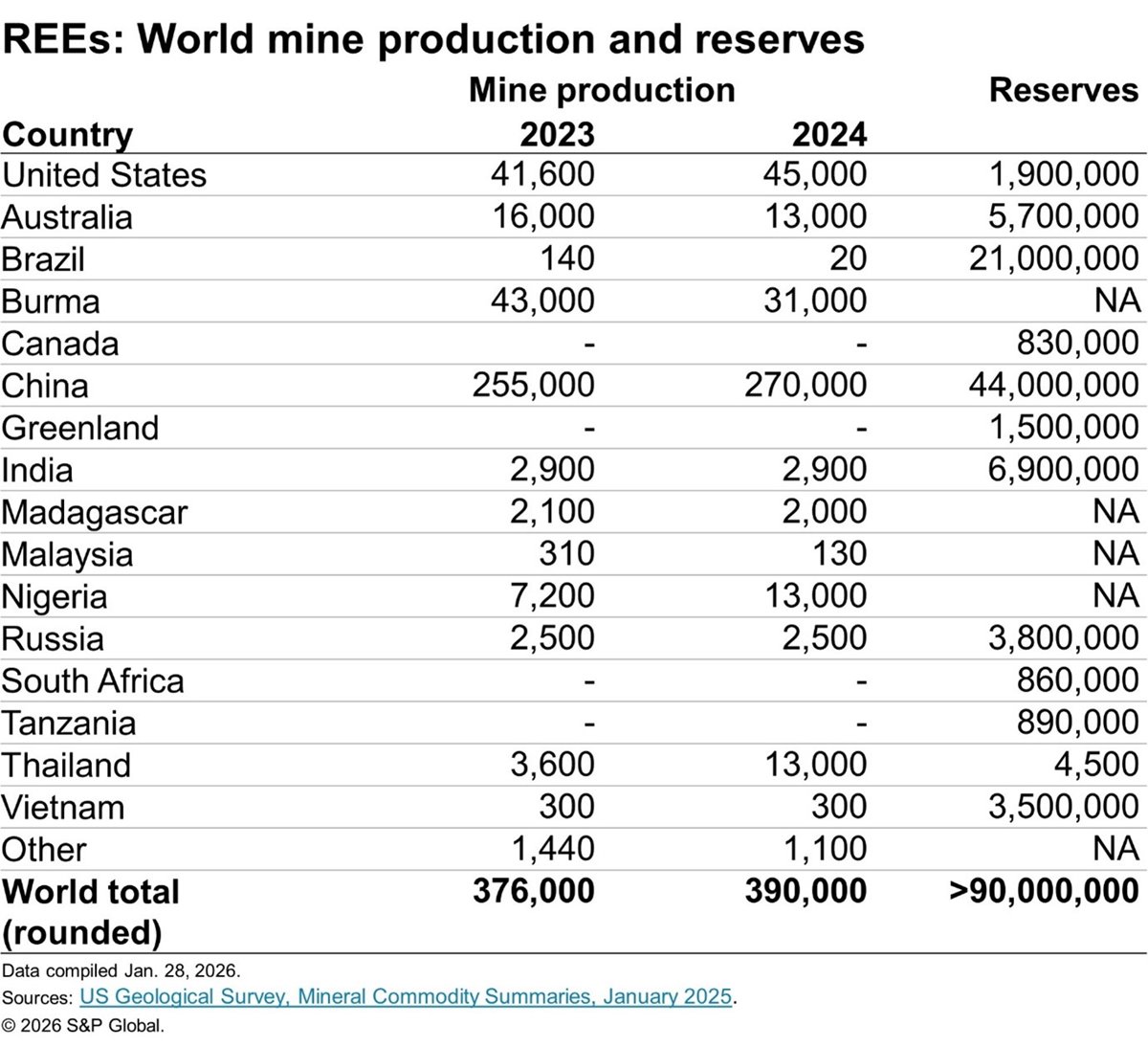

Greenland has emerged as a strategic area due to its extensive reserves of rare earth elements (REEs) and other critical minerals essential to industries such as automotive, defense, and clean energy. Its resource base includes REEs, graphite, copper, nickel, zinc, iron ore and tungsten, which are key inputs to clean energy technology. According to the National Geological Survey of Denmark and Greenland (GEUS), the island contains an estimated 36.1 million metric tons of REE resources, with the Kvanefjeld and Tanbreez deposits in southern Greenland representing the most significant concentrations. A GEUS report published in November 2023 also found that Greenland hosts deposits of 25 of the 34 critical raw materials identified by the European Commission, including lithium, copper, niobium, tantalum and titanium.

For more insights like this, join us in Berlin this May and start planning your visit.

Get your ticket todayNoticeable increase in investment for mining

In December 2025, Greenland granted a 30-year exploitation license to GreenRoc Mining for the Amitsoq graphite deposit in southern Greenland. Backed by the European Raw Materials Alliance, the project targets high-grade flake graphite suitable for lithium-ion battery anodes. The Amitsoq mine, last active in 1922, is expected to produce around 80,000 metric tons of graphite concentrate annually from approximately 400,000 metric tons of ore. According to S&P Global Mobility, demand for graphite used in lithium-ion batteries for the light vehicle segment totaled 1.2 million metric tons in 2025. This demand is expected to grow at a compound annual growth rate of 13% to reach 2.5 million metric tons in 2031.

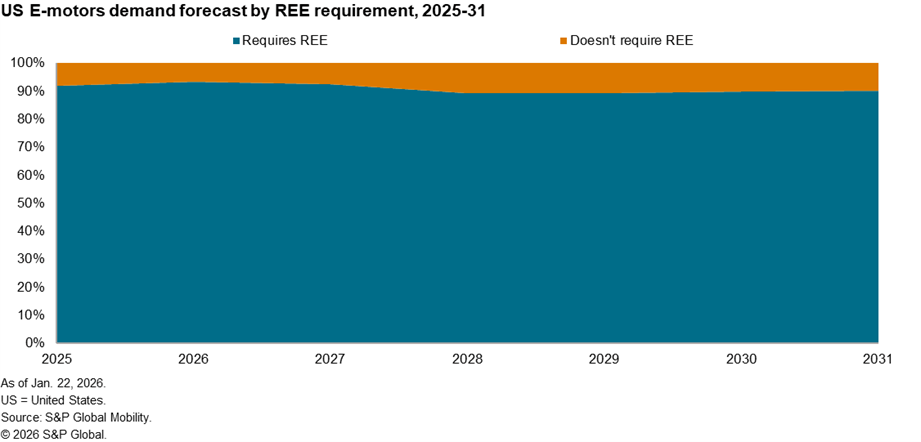

In June 2025, Critical Metals Corp received a letter of intent from the US Export-Import Bank for up to $120 million in non-dilutive financing to support development of the Tanbreez rare earth project in southern Greenland. According to the company, the $290 million project is expected to reach initial commercial production with an annual output capacity of up to 85,000 metric tons of rare earth materials. As per S&P Global Mobility forecast, as of 2025, almost 92% of total electric motor (e-motor) demand in the US had REE in it. This same trend is expected to continue in near future.

Similarly, in the same month, EIFO, Denmark’s Export and Investment Fund, invested 100 million Danish kroner (£11.3 million) to increase its stake in Amaroq Minerals Ltd., a Greenland-focused mining company engaged in the exploration and development of gold and strategic critical minerals, making EIFO one of its top three shareholders.

Again, in May 2025, the government of Greenland granted a 30-year exploitation license to Greenland Anorthosite Mining, a local mineral exploration company, for anorthosite mining, a material used in transport, construction and green energy applications.

Why the sudden interest in Greenland?

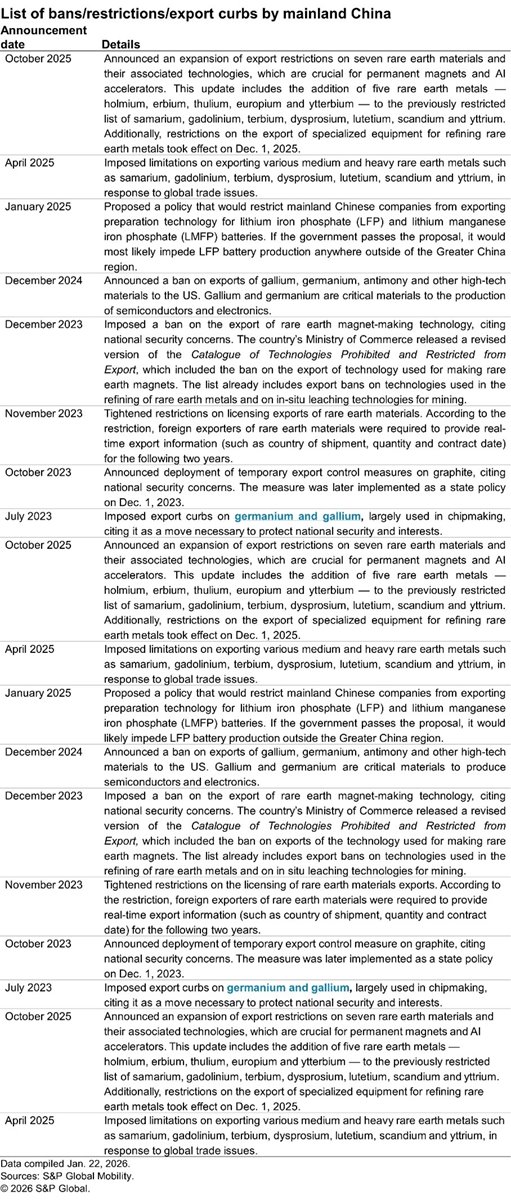

The relevance of Greenland as a potential source of REEs and other critical minerals has grown amid escalating geopolitical tensions and trade disputes. Mainland China’s dominant position in the mining and processing of REEs and several critical minerals, combined with recent export restrictions on these materials and related technologies, has disrupted global supply chains, particularly in the automotive sector, and underscores the risks of concentrated supply.

According to the US Geological Survey (January 2025), between 2020 and 2023, the US imported almost 70% of rare earth compounds and metals from mainland China. In response, governments and companies are increasingly seeking to diversify critical mineral supply chains and reduce dependence on mainland China, significantly elevating Greenland’s role as an alternative source.

Can Greenland help solve critical minerals supply chain issues?

Greenland holds some of the world’s most promising reserves of critical minerals, such as REEs, nickel, graphite and cobalt; however, it will be exceptionally challenging for any country or company to exploit these resources easily and turn them into a major source of critical minerals in the short term.

Its extreme arctic climate (80% of the island is covered in ice sheet), limited infrastructure, environmental sensitivities, regulatory framework and political considerations make large scale mining operations difficult and costly. Furthermore, its REE deposits are colocated with Uranium deposits, making it difficult, if not impossible, to obtain a mining license.

In December 2021, Greenland enacted legislation banning the exploration and mining of uranium, except where uranium is incidental and below an average concentration of 100 parts per million. As a result, the Kvanefjeld REE project, which has sought an exploitation license since 2019, has been unable to secure approval due to its uranium content. The ban has led to ongoing legal proceedings since 2022, with Energy Transition Minerals claiming the law amounts to expropriation and seeking $11.5 billion in compensation.

While the geological potential is significant, practical barriers prevent any country from easily leveraging or extracting these resources in the near term.

To hear more about current challenges and opportunities like the ones in Greenland, claim your free pass to CWIEME Berlin today and start planning your visit.

Register for your passAuthor

.jpg)

Priyanka Mohapatra

Senior Research Analyst, S&P Global Mobility

For more information, please click here