Growth Potential in the Transformer Market of Middle East-Africa

By Azhar Fayyaz, Research Analyst – at Power Technology Research

- Developments in the Middle East will be instigating the demand for distribution transformers in the MEA region.

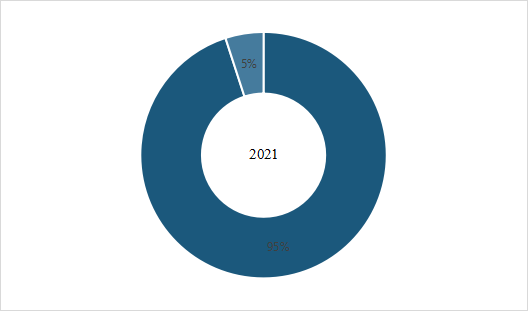

- The distribution transformer market of the Middle East and Africa accounts for 5% of the global distribution transformer market in terms of revenue.

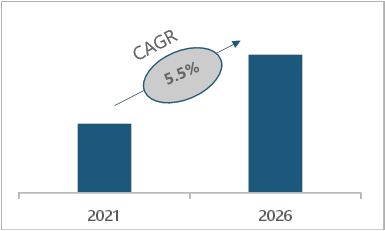

- The distribution transformer market of MEA is expected to grow with a CAGR of 5.5% from 2021-2026.

The world is currently undergoing an energy transition focused on curtailing global carbon emissions and the rise in temperatures. The Paris Agreement, a legally binding international treaty on climate change, has a significant role in this regard. It focuses on limiting global warming to well below 2°C, ideally 1.5°C, when compared to pre-industrial levels.

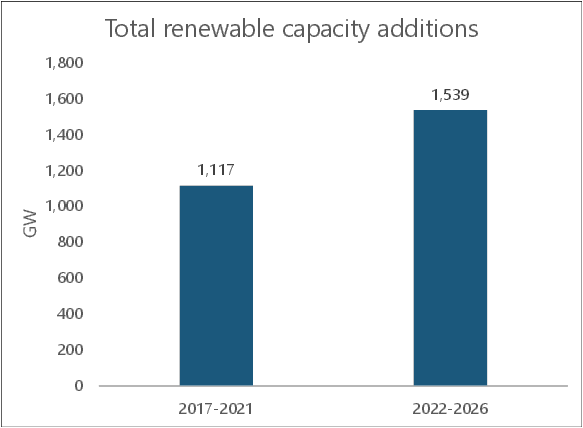

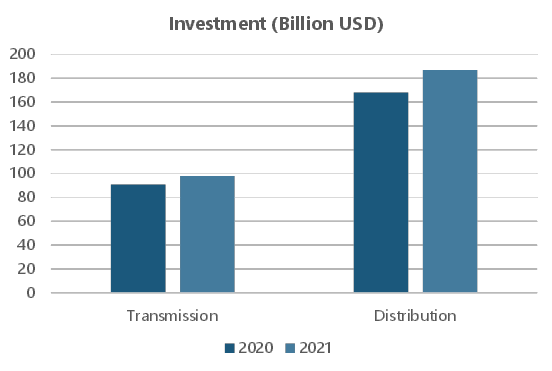

This has resulted in renewable capacity additions (solar and wind) and huge investments in the transmission and distribution infrastructure globally. The Middle East and Africa are also keeping pace with the global energy transition, especially when it comes to renewable capacity additions and investments in the transmission and distribution infrastructure. This, in turn, is driving the growth of distribution transformers in the region.

Figure 2: Investment in the T&D sector globally (2020-2021). Source: International Energy Agency

Figure 2: Investment in the T&D sector globally (2020-2021). Source: International Energy Agency

Market Drivers

In the Middle East and Africa, network expansions and renewable capacity additions followed by infrastructure development projects will be driving the growth of distribution transformers.

Network expansions

Distribution transformer demand in the region is significantly driven by network expansion plans in the Middle East than Africa to accommodate the increasing electricity demand and integration of renewables with the grid. Around 430,000 MVAs of transmission capacity is expected to be installed in over 10 years, which will eventually translate to capacity additions in the distribution network as well. Major network expansion plans in the region are given below:

- To cater to the ever-evolving grid dynamics, it is expected that Saudi Arabia will increase HV transmission substations capacity by 214,000 MVAs by 2030, which will result in the construction of almost 560 transmission substations.

- In the UAE, Dubai Electric and Water Authority has invested USD 2.31 Billion for the expansion of the electrical network, in order to meet the growing demand. On the other hand, Abu Dhabi’s transmission and dispatch company, TRANSCO, plans to install 4,680 MVA of transmission capacity by 2026.

- Qatar’s utility Kahramaa is expanding the transmission capacity in order to offset the increasing load. During 2020, a total of 856 new distribution stations began operations in the country.

- During the fiscal year 2020-2021, Egypt installed 16,893 MVAs of transmission capacity, which accounts for a significant 17.7% growth in the transmission capacity of the country year on year.

Roll-out of renewables

Renewable targets in the region, specifically in Middle Eastern countries, are also expected to drive the demand for distribution transformers in the MEA. Renewable generation is usually connected with the grid at the distribution voltage levels hence driving the demand of distribution transformers as opposed to conventional generation which is connected with the grid at the transmission voltage levels. Renewable expansion plans of some major economies in the region are given below:

- The Kingdom of Saudi Arabia is planning to expand its renewable generation capacity to 9 GW by 2030.

- UAE is aiming to increase the contribution of clean energy in the total energy mix from 25% to 50%, with a renewable energy target of 44 GW by 2050.

- Qatar is planning to expand solar generation capacity to 2-4 GW by 2030, along with 25% reduction in greenhouse gas emissions by 2030.

- Egypt is planning to increase the share of renewable generation in the overall generation mix by 20% by 2022 and 42% by 2035.

Infrastructure development projects

Huge investments in the infrastructure development projects in the region especially the projects in middle eastern countries will also be instigating the demand for distribution transformers in the region, for instance:

- Neom city, with a planned investment of USD 500 Billion, is expected to be completed by the end of 2029.

- King Abdullah Economic City, with a planned investment of USD 59 Billion, is expected to be completed by the end of 2034.

- Red Sea Tourism Project, with an investment of USD 9 Billion, is expected to be completed by the end of 2024.

- The Abu Dhabi International Airport expansion project, with a planned investment of USD 6.8 Billion.

- Mohammed Bin Rashid Real Estate Development Project, worth USD 28 Billion, is expected to be completed by the end of 2035.

- Al-Khiran Residential City Development Project in Kuwait, with an investment of USD 13 Billion, is expected to be completed till 2025.

- Lusail city project, with an investment of USD 8.2 Billion, expected to be completed by 2025.

- Egypt is building a new administrative capital near Cairo worth USD 40 Billion.

Market Snapshot of the Region

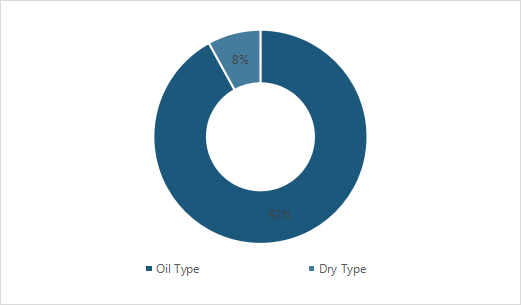

According to Power Technology Research, the distribution transformer market of the Middle East and Africa accounts for 5% of the global distribution transformer market in terms of revenue. From a technology perspective, within the MEA, 92% of the distribution transformers sold in 2021 were oil type distribution transformers, while only 8% fell in the dry type category.

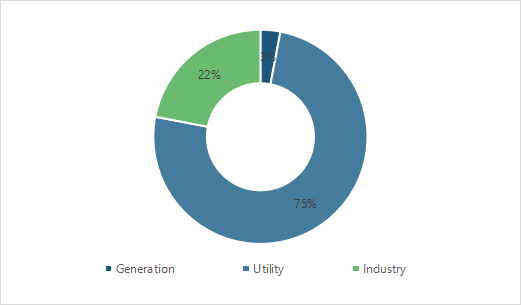

Application wise, the majority of the demand for distribution transformers in the region was generated by utilities, which accounted for 75% of the total demand in 2021. This was followed by the industry and generation sectors, which accounted for 22% and 3% of the total demand for distribution transformers in the region respectively.

Figure 3: Share of MEA in the global distribution transformer market. Source: Power Technology Research

Figure 4: Share of oil versus dry type transformers in the distribution transformer market of MEA. Source: Power Technology Research

Figure 5: Application vertical demand segregation of distribution transformers in MEA. Source: Power Technology Research

Looking Ahead

The distribution transformer market of the MEA in upcoming years will primarily be driven by developments in the Middle East, including the transmission network expansion plans. This will eventually lead to the expansion of the distribution network along with the increased roll-out of renewables and infrastructure development projects. As far as Africa is concerned, there is some movement in SMEs due to FDI from China and India, which may provide a push to the MEA’s distribution transformer market.

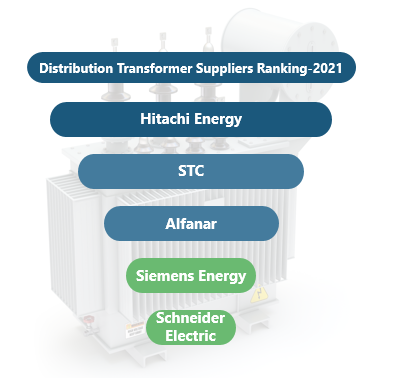

According to Power Technology Research, the distribution transformer market of MEA is expected to grow with a CAGR of 5.5% from 2021-2026. Hitachi Energy, STC, Alfanar, Siemens Energy, and Schneider Electric were the leading players, in terms of market share, in the distribution transformer market of the MEA in 2021. But the growth potential of the market in the upcoming years is expected to invite more players, especially from Asia, which will further increase the competition.

Figure 6: Leading distribution transformer suppliers in MEA (2021). Source: Power Technology Research

Figure 7: Growth potential in the distribution transformer market of MEA (2021-2026). Source: Power Technology Research