Publicly accessible chargers worldwide approached 1.8 million in 2021, of which a third were fast chargers, with almost 500,000 chargers installed, according to the IEA.

By Ujyara Saleem, Research Analyst – at PTR Inc.

- Publicly accessible chargers worldwide approached 1.8 million in 2021, of which a third were fast chargers, with almost 500,000 chargers installed, according to the IEA.

- High-power DC chargers offer several advantages that can help accelerate the adoption of electric vehicles (EVs) and make them more practical for longer journeys, including faster charging times, reduced range anxiety, greater accessibility, and encouragement of further EV adoption.

- The challenges of high-power DC chargers include the high cost of installation and maintenance, grid integration, compatibility with different EV models and charging standards, regulatory and technical challenges, and significant investment in infrastructure.

I. Introduction

Publicly accessible chargers worldwide approached 1.8 Million charging points in 2021, of which a third were fast chargers. According to the IEA, nearly 500 000 chargers were installed in 2021, which is more than the total number of public chargers available in 2017. The number of publicly accessible chargers was up by 37% in 2021, which is lower than the growth rate in 2020 (45%) and pre-pandemic rollout rates. The average annual growth rate ranked almost 50% between 2015 and 2019. In 2021, fast charging increased slightly more than in 2020 (48% compared with 43%), and slow charging much slower (33% compared with 46%).

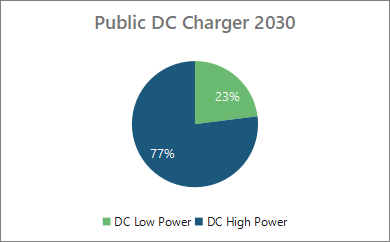

As per PTR Inc., DC high-power chargers are defined as chargers with greater than 60kW power. Public charging is moving towards high-power DC charging, with DC high-power CAGR for public charging at 24% and DC low-power at 9% for Europe. Additionally, the number of high-power DC public chargers in Europe are expected to reach approximately 470,000 by 2030. Europe has over 300,000 slow chargers and nearly 50,000 fast chargers, with Germany having the fastest chargers.

II. Advantages of High-Power DC Chargers for Public EV Charging

High-power DC chargers offer several advantages that can help accelerate the adoption of electric vehicles (EVs) and make them more practical for longer journeys.

Firstly, high-power DC chargers offer faster charging times compared to slower AC chargers. This means that EV drivers can quickly top up their battery and get back on the road in a shorter amount of time, while a slower AC charger may take several hours to provide the same amount of charge. Faster charging times can increase the convenience of EVs and reduce the time spent waiting at charging stations.

Secondly, high-power DC chargers can help alleviate range anxiety, which is a common concern among EV drivers. With longer charging ranges, drivers can travel further distances before needing to recharge. This can increase the accessibility of EVs and make them a more practical option for longer journeys.

Thirdly, the increasing availability of high-power DC chargers can make EVs more accessible to a wider range of drivers. As more charging stations are installed, EV drivers can have greater confidence that they will be able to find a charger when needed, reducing concerns about range limitations.

Finally, the adoption of high-power DC chargers can help encourage the further adoption of EVs. As more drivers switch to EVs, the demand for charging stations will increase, and more businesses and governments may invest in charging infrastructure, creating a positive feedback loop that can accelerate the transition to sustainable transportation. Altogether, high-power DC chargers improve the economics of public charging stations for operators.

III. Challenges in the Adoption of High-Power DC Chargers for Public EV Charging

Despite the numerous benefits of high-power DC chargers, they are not without their challenges. The most significant challenge is the high cost of installation and maintenance, which can be a deterrent to widespread adoption. This cost includes not only the charger equipment but also the necessary infrastructure to support the high-voltage power lines, transformers, and electrical grid. Regular maintenance is also essential to ensure that the chargers operate at optimal efficiency.

The integration of high-power DC chargers into the existing electrical grid can be challenging. This is because high-power DC chargers require a significant amount of power, which can cause a strain on the grid if not properly integrated. It is critical to ensure that the grid infrastructure can handle the increased load from high-power DC chargers, particularly during peak demand periods. The installation of high-power DC chargers requires significant investment in infrastructure, including upgrading the electrical grid, transformers, and high-voltage power lines. Additionally, it is important to consider the impact of high-power DC chargers on the local grid's stability and the potential for power outages.

Another challenge of high-power DC chargers is ensuring compatibility with different EV models and charging standards. Not all EVs are designed to accept high-power DC charging, and there are different charging standards used around the world. To ensure that high-power DC chargers are widely adopted, they must be designed to be compatible with multiple EV models and charging standards. This requires close coordination between EV manufacturers, charging station operators, and grid operators to ensure that the charging infrastructure is compatible with a wide range of EVs. Additionally, there are regulatory and technical challenges that need to be addressed to ensure that high-power DC chargers are interoperable and can communicate with each other and with the grid.

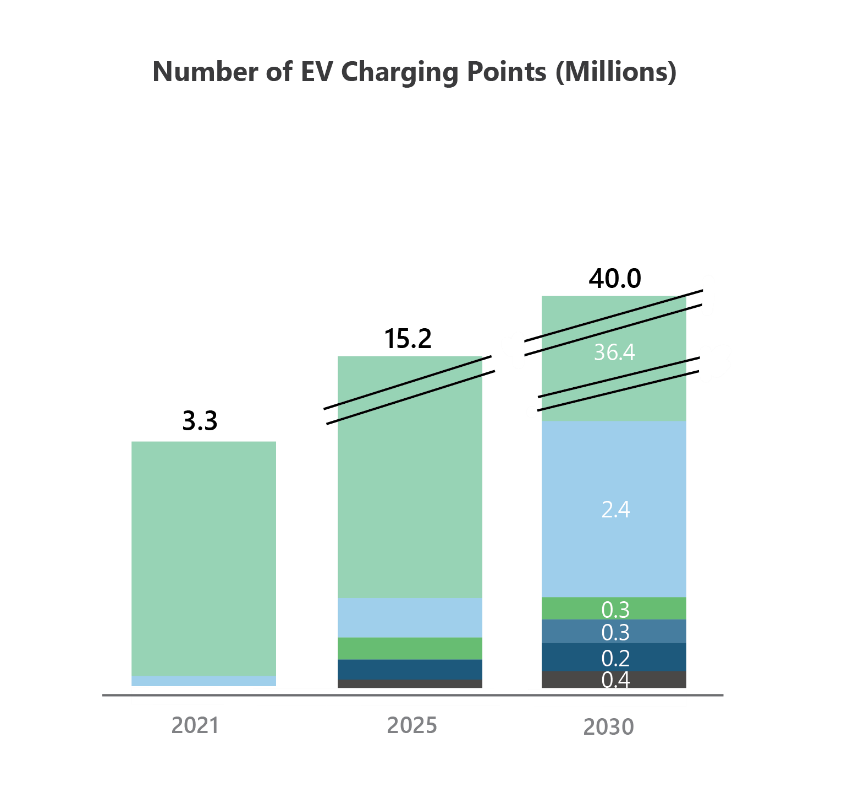

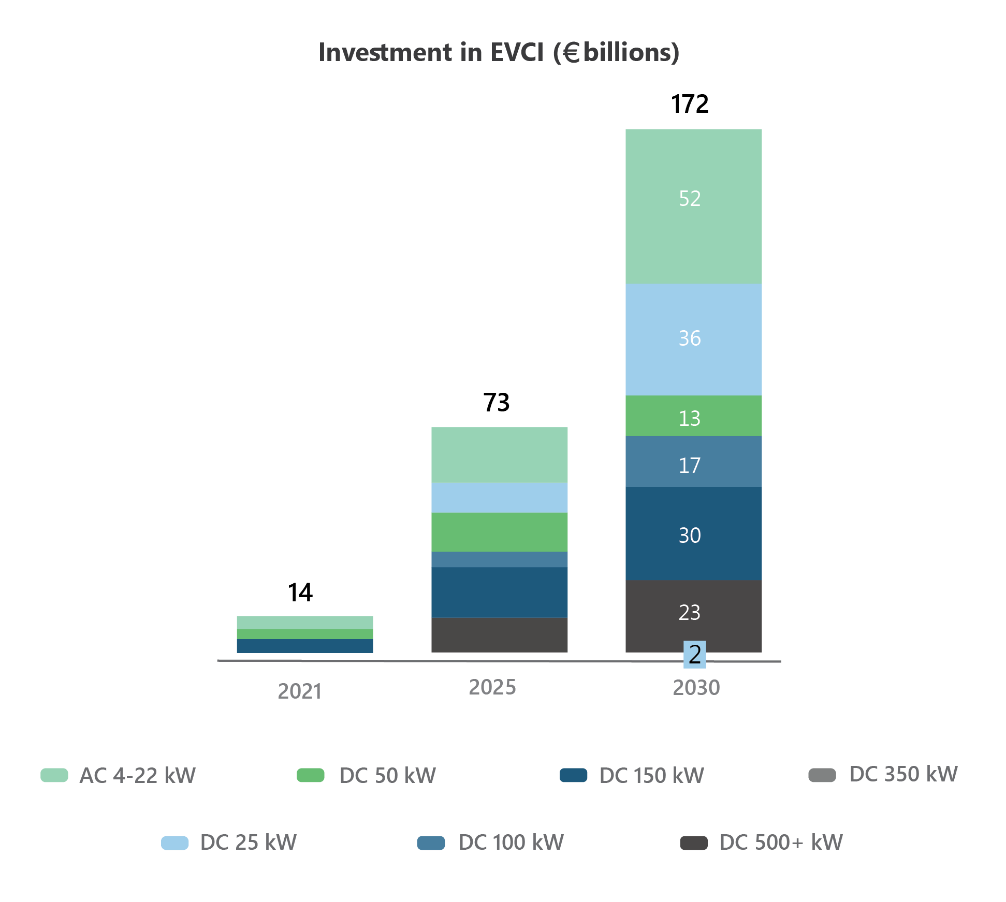

T&E estimates that in the demand-driving-oriented pathway, the investment in EVCI (Electric Vehicle Charging Infrastructure) for Passenger Cars (PCs) and Commercial Vehicles (CVs) will reach approximately USD 185 Billion. Out of this investment, around 60% (about USD 130 Billion) will be dedicated to DC fast charging points (as shown in Fig. 1). Although DC charging points are fewer in number compared to AC charging points, the cost of hardware and installation for DC charging points is significantly higher. For instance, the estimated investment per kW by 2030 ranges from around USD 135 for AC 11 kW to about USD 430 for DC 150 kW. The total investment cost for DC charging points is also considerably higher than that of AC charging points, with an estimated cost of approximately USD 1,000 per unit for an AC 11 kW charger, compared to about USD110,000 for a DC 500+ kW charger and up to USD 280,000 for a DC 1 MW charger.

Figure 1: Cumulative Charging Points for Passenger Cars and Commercial Vehicles under the T&E Master Plan's Demand-oriented Pathway

Source: T&E Master Plan

IV. Public Policies and Plans to Promote Fast-Charging EV.

European countries are demonstrating their resolve to shift towards high-power DC through a variety of policies and plans:

- By 2026, there should be at least one electric charging pool for cars every 60 kmalong main EU (European Union) roads, The chargers are expected to be high-power DC. The European Parliament has adopted a set of draft rules aimed at increasing the deployment of recharging and alternative refueling stations for vehicles and supporting the uptake of sustainable vehicles. MEPs want electric car charging stations every 60 km along main EU roads, hydrogen refueling stations every 100 km, and fewer emissions from ships. The rules are part of the "Fit for 55 in 2030 package," which aims to reduce greenhouse gas emissions by at least 55% by 2030 compared to 1990 levels. MEPs have also set national targets for the deployment of alternative fuels infrastructure, which will be mandatory.

- The EU Commission has given the German government permission to subsidize the construction of 8,500 fast charging points with a sum of 1.8 Billion euros. The measure envisages charging stations every 15 to 30 driving minutes. The Deutschlandnetz was first proposed by the German government in August 2021, and is to involve the installation of charging stations at approximately 900 locations in Germany. The focus will be put on those areas that do not have high power charging (HPC) points or where the existing points are insufficient to address anticipated demand.

- EXPAND-E Consortium led by IONITY and GreenWay is awarded €~ 70 M to deploy more than 2.100 recharging points (150 kW – 350 kW) for light and heavy-duty electric vehicles in more than 450 locations across 22 EU Member States

- Atlante, the company of NHOA Group has been selected for a €22.7 million grant support by the European Union under CEF Transport, the funding program supporting European transport infrastructure.

- EV Stations 2.0: The project by the EU aims to develop a set of fast and ultra-fast charging infrastructures for electric vehicles along the core and comprehensive networks in Italy. In total 45 stations will be deployed, including 180 charging points for electric vehicles, of which 90 fast charging stations (50 kW) and 90 ultra-fast charging stations (from 150 kW up to 350 kW).

- SSE's Energy Solutions business has opened its first ultra-rapid EV charging hub as part of a major new initiative to deliver 300 hubs across the UK and Ireland in the next five years.

V. Opportunities for Stakeholders

Various stakeholders are involved in the transition towards sustainable electric vehicle (EV) charging infrastructure. Electric utilities and grid operators can leverage high power DC chargers to manage peak demand and facilitate the integration of renewable energy sources. Standalone EV charging hubs with solar power are one way to achieve this goal. Public charging operators must expand their networks and business models to offer faster and more convenient charging services. To be economically viable in the medium to long term, an average network utilization of 15% is required, and in the EU, the industry is expected to converge towards even higher utilization in the next 5 to 15 years. EV manufacturers must drive innovation in high-power charging technology to meet the evolving needs of their customers. Finally, governments and policymakers can support the deployment of high-power DC chargers through funding, incentives, and regulation.

VI. Future Outlook

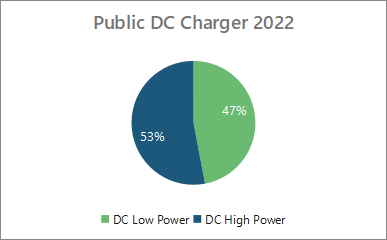

Europe is set to witness a surge in high-power DC charging infrastructure, with fast EV chargers projected to comprise 53% of DC high-power chargers in 2022 and expected to grow to 77% by 2030. This growth is expected to be bolstered by potential innovations and advancements in high-power DC charging technology, as more charging companies like ABB, Tritium, Alpitronic, and Tesla continue to launch DC fast chargers. As demand for these chargers grows, the prices of DC fast chargers are also expected to decrease in the near future through advancements in technology and mass production.

Figure 2: T&E's Recommended Total Investment of 172 Billion Euros in Public and Private EV Charging Infrastructure by 2030

Source: PTR Inc.

Conclusion

As the number of Electric Vehicles (EVs) on the road increases, it is crucial to develop EV charging infrastructure to meet the growing demand. In addition to the number of publicly available chargers, the reduced charging time is equally important. Fast DC chargers, if compatible, can reduce the charging time to as little as 15-20 minutes. As time goes on, the deployment of DC fast chargers is becoming increasingly important for public charging, in order to avoid long waiting times at charging stations. Numerous ongoing projects and plans in Europe are focused on deploying or upgrading DC fast chargers. By 2030, it is expected that 77% of the DC chargers will be DC high power, which can help address range anxiety - a major factor that discourages people from buying EVs. While slow charging is suitable for overnight and residential charging, the public charging landscape is shifting towards high-power DC charging in the coming years.

Ujyara Saleem is working as a research analyst at PTR Inc. Her research work revolves around the Electrification of the Vehicle Sector mainly focused on EVSE. Ujyara is highly skilled in primary and secondary research, data analysis, and market forecasting. She leverages her expertise in these areas to identify emerging trends and opportunities in the e-mobility market. Being the lead analyst for the EMEA region, Ujyara has worked on customized projects for major companies around the globe and off-the-shelf services as well. With a BS in Electrical Engineering from the Pakistan Institute of Engineering and Applied Sciences (PIEAS) and an MS in Engineering Management from the University of Debrecen, she possesses both technical and management skills, which she uses to provide strategic analysis in the e-mobility space.

Ujyara Saleem is working as a research analyst at PTR Inc. Her research work revolves around the Electrification of the Vehicle Sector mainly focused on EVSE. Ujyara is highly skilled in primary and secondary research, data analysis, and market forecasting. She leverages her expertise in these areas to identify emerging trends and opportunities in the e-mobility market. Being the lead analyst for the EMEA region, Ujyara has worked on customized projects for major companies around the globe and off-the-shelf services as well. With a BS in Electrical Engineering from the Pakistan Institute of Engineering and Applied Sciences (PIEAS) and an MS in Engineering Management from the University of Debrecen, she possesses both technical and management skills, which she uses to provide strategic analysis in the e-mobility space.

Contact: