The US elections have concluded, with Donald Trump emerging as the winner.

The US elections have concluded, with Donald Trump emerging as the winner. President-elect Trump will assume office on Jan. 20, 2025. As the nation transitions into a new administration, the implications for various industries, including automotive, are a focal point of discussion. This article takes a closer look at the current landscape of the US automotive industry, with particular emphasis on the propulsion supply chain, and also delves into how Trump’s presidency might shape the industry’s overall trajectory.

Policies by Trump administration in 2016-20

Before examining the potential effects of Trump’s victory on the automotive sector in the US, especially regarding the supply chain for propulsion components, it is essential to review the significant automotive policies and decisions made during his first term as president.

- Safer Affordable Fuel-Efficient (SAFE) Vehicles Rule: Rolled back fuel economy standards from the previous administration, aiming for a 1.5% annual increase in fuel efficiency for passenger cars and light trucks from 2021 to 2026, compared to the 5% increase under Obama-era standards. It was projected to reduce new vehicle costs by about $1,000, making them more affordable for consumers.

- United States-Mexico-Canada Agreement (USMCA):The USMCA took effect on July 1, 2020, replacing NAFTA. Key changes include raising the requirement for North American-made parts in vehicles from 62.5% to 75%. Additionally, at least 70% of steel and aluminum used must come from North America. The agreement also introduces a labor value content requirement, mandating that 40% of a passenger car's cost and 45% of a light truck's cost must be produced in facilities where workers earn at least $16 per hour.

- S.-Korea Free Trade Agreement: Under the KORUS FTA, Korea extended the 25% U.S. truck tariff phase-out until 2041, which was originally set for 2021. US auto exports to Korea benefited from increased access, allowing 50,000 cars per manufacturer to enter the market without modifications. Testing requirements were harmonized, enabling US gasoline vehicle exports to comply with Korean emissions standards using U.S. tests. Additionally, Korea recognized US auto parts standards and reduced labeling burdens. Lastly, Korea enhanced eco-credits to meet fuel economy and greenhouse gas requirements, considering US regulations in future targets.

- Tariffs on Chinese goods:In 2018, The US imposed tariffs of up to 25% on certain Chinese auto imports, as part of a broader tariff strategy affecting around $50 billion in Chinese goods. The administration justified these tariffs as necessary for national security and to combat unfair trade practices by China, including intellectual property theft. In response, China implemented its own tariffs on American-made vehicles, escalating trade tensions and negatively impacting US auto exports, particularly for automakers with significant sales in China.

- Tariff on steel and aluminum: Trump imposed a tariff of 25% on imported steel and 10% on imported aluminum citing US national security as a reason.

Potential changes in policies by the new Trump administration (2025-29)

Trump’s impending return to the Oval Office has ignited widespread speculation regarding the potential implications of his second term, especially in the automotive sector. With a renewed emphasis on "America first" and bolstering American manufacturing, Trump is likely to prioritize policies that favor domestic production and reduce reliance on foreign imports.

Below are some of the potential actions that the Trump administration may take in context of the automotive industry.

- Reduction/slashing of various incentives/tax credits/subsidies related to EVs under the IRA: Given Trump’s stance on electric vehicles, it is highly likely that the new administration may do away with the $7,500 tax credits for EV purchases and other such incentives/subsidies related to EV manufacturing, purchasing and charging infrastructure.

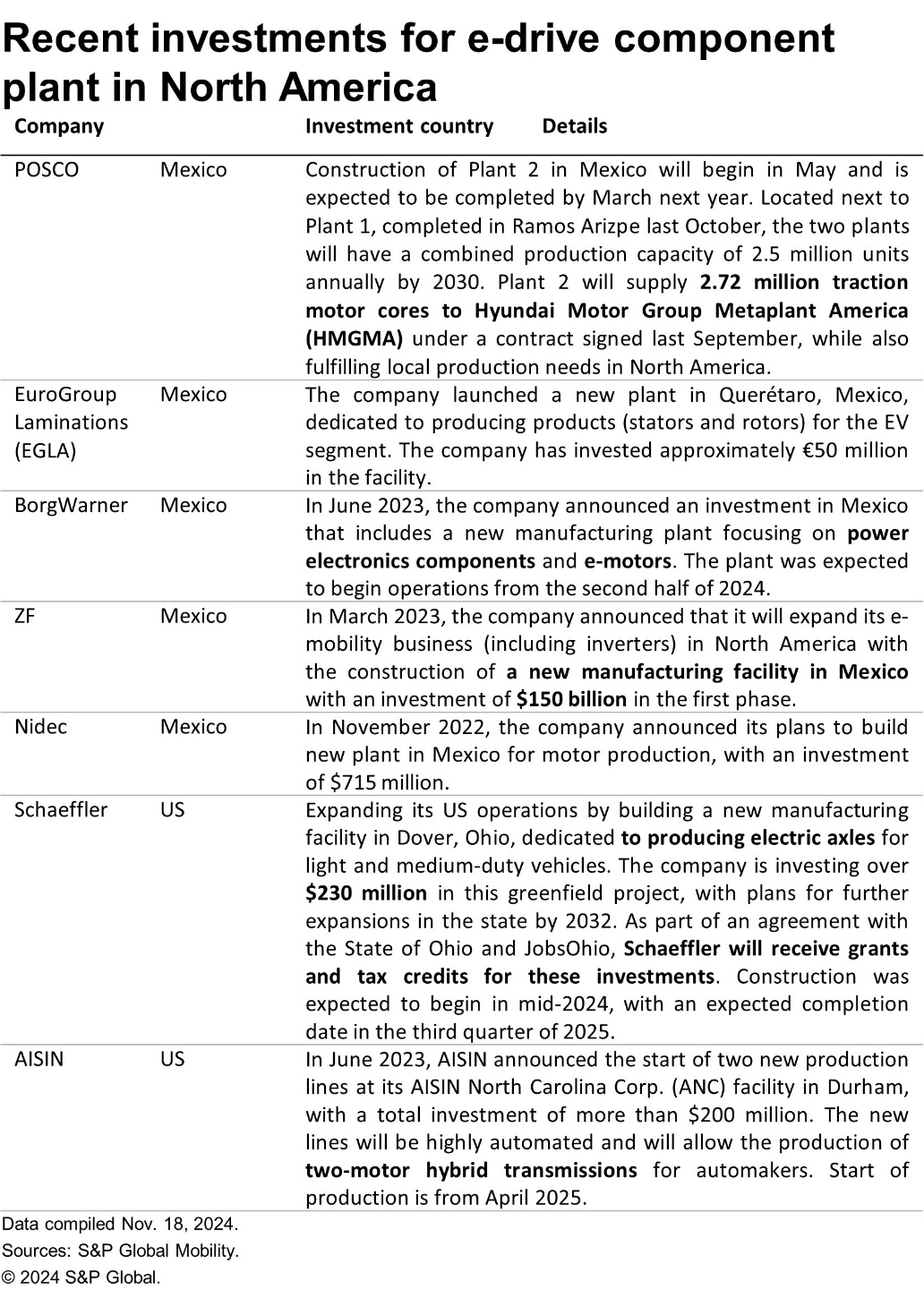

- Probability of increased tariffs on Mexican goods under USCMA:On the campaign trail, Trump raised the prospect of the USMCA being rewritten, a deal that was penned by his first administration and designed to replace the North American Free Trade Agreement (NAFTA). Additionally, while campaigning in North Carolina, Trump posited a 25% to 75% tariff on all Mexican goods — not just light vehicles. A six-year renegotiation provision is enshrined within the original USMCA, meaning that in July 2026, renegotiations are scheduled to begin. Regarding the USMCA, there are reports that the administration is preparing to immediately impose 100% tariffs on car imports from Mexico, which is a contravention of the USMCA agreement. The USMCA does allow for tariffs to be imposed on a member in certain circumstances. Such circumstances include national security concerns including defense and national infrastructure, non-compliance with labor and environmental standards, or if trade remedies are required whereby surging imports harm local industries and anti-dumping and countervailing tariffs are required.

- Increased tariffs on imports from mainland China: Given Trump's "America first" focus and emphasis on reducing reliance on imports, it is highly probable that he may impose additional tariffs on imports. The Biden administration has already announced significant tariff increases to protect American manufacturers from China's unfair trade practices. Starting Aug. 1, tariffs on EVs imported from mainland China rose from 25% to 100%, while tariffs on lithium-ion EV batteries and parts increased from 7.5% to 25%. Furthermore, tariffs on natural graphite and permanent magnets will be set at 25%, effective Jan. 1, 2026. During his first term, Trump imposed various tariffs on Chinese goods, suggesting that a new Trump administration may maintain or significantly raise these tariffs.

- Probable relaxation/weakening of EV mandates and regulations related to fuel efficiency and emissions: The new administration may likely relax regulations on emissions and fuel efficiency and weaken EV mandates, which could benefit major US automakers like Stellantis, General Motors and Ford. Although these companies have invested millions in transitioning to electric vehicles, they have recently adjusted their strategies and scaled back EV-related investments due to a global slowdown in EV demand. For example, Ford has canceled plans for an all-electric, three-row SUV and is reducing its capital expenditure for pure EVs from 40% to 30% of its annual budget. Relaxing emissions and fuel efficiency mandates would allow for a longer production run of internal combustion engine vehicles, potentially enhancing profitability for these companies and giving sufficient time to companies as well as customers to make smooth transition to EVs.

Propulsion supply chain landscape in the US

E-motor supply chain

As per the S&P Global Mobility forecast, the demand for e-motors (used in EVs, hybrid mild and hybrid full vehicles) in the US is expected to increase from 4.9 million units in 2024 to reach 14.3 million units by 2030, growing at a compound annual growth rate (CAGR) of 19%. In 2024, 37% of total e-motor demand in the US is expected to be from battery-electric vehicles (BEVs) and the remaining from hybrid vehicles. By 2030, the share of e-motor demand for BEVs is expected to increase to 66%, while the share from hybrid vehicles will decrease.

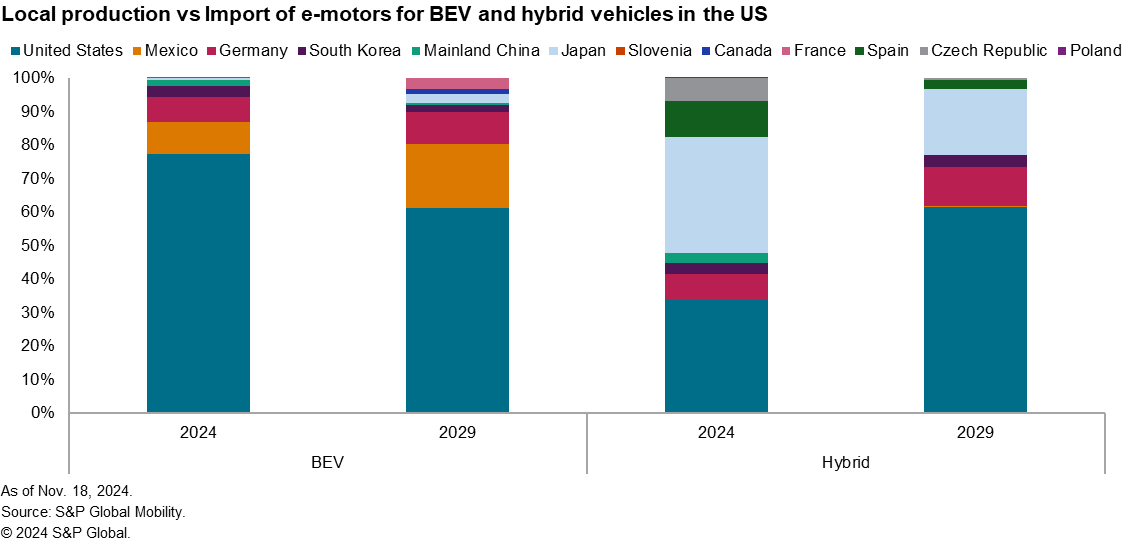

On analyzing the e-motor supply chain, as of 2024, 77% of total e-motors for BEVs are expected to be produced locally in the US while remaining volumes are expected to be imported. Imports from Mexico and Germany comprised 9% and 8% respectively, of the total e-motor demand for BEVs in the US. Notably, only 2% of the total e-motor demand for BEVs is expected to be imported from mainland China.

Among the locally produced e-motors for BEVs, the majority of them are expected to come from Tesla, Ford and Rivian.

By 2029, the share of e-motors for BEVs produced locally in the US is projected to decrease to 66%, with an increasing reliance on imports. Notably, imports from Mexico are expected to rise, accounting for 19% of the total e-motor demand for BEVs in the US. Meanwhile, imports from Germany are anticipated to represent 9% of this demand.

E-motor for hybrid vehicles

In 2024, the e-motor supply for hybrid vehicles in the US is expected to be heavily reliant on imports, with nearly 35% sourced from Japan, followed by 11% from Spain, 8% from Germany and 7% from the Czech Republic. The e-motors imported from Japan are mostly from Honda, Toyota and AISIN. Only 34% of e-motors for hybrid vehicles are projected to be produced locally in the US, with Toyota accounting for nearly 69% of this domestic production with 0.72 million units.

By 2029, however, local production is projected to rise significantly, making up 61% of the total e-motor market for hybrid vehicles. Imports from Japan and Germany are anticipated to account for 20% and 12%, respectively, of the total e-motor demand for hybrid vehicles in the US.

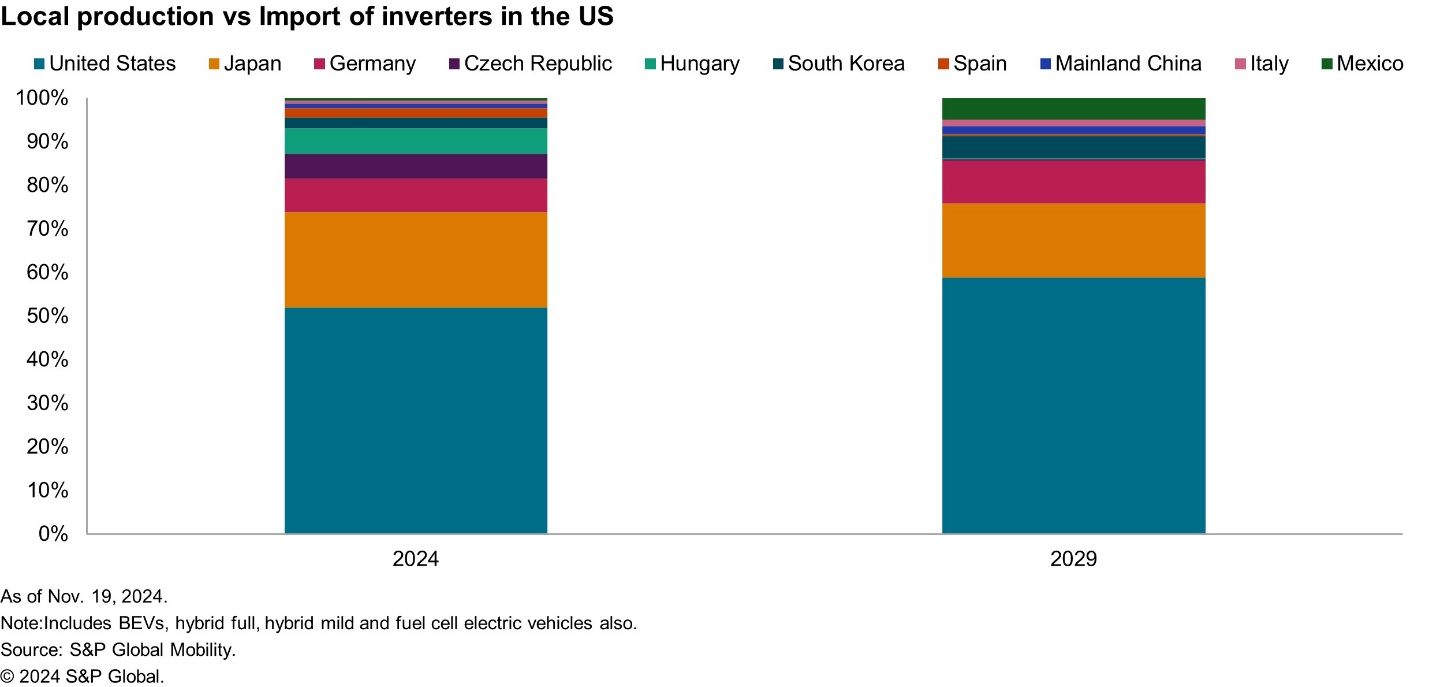

Inverter supply chain

Based on the S&P Global Mobility forecast, the demand of inverters (for all propulsion types including BEVs, hybrid full and hybrid mild) is expected to increase from 4.9 million units in 2024 to reach 13.4 million units in 2029, growing at a CAGR of 22%. In 2024, almost 52% of total US inverter demand is expected to be produced locally in the US, while 23% of it is imported from Japan, followed by Germany, Czech Republic and Hungary with 8%, 6% and 5.7%, respectively. By 2029, 59% of total US inverter demand is expected to be produced locally in the US, but the remaining 41% will still be imported. For local inverter production in the US, Denso and Tesla are the key players.

Current light vehicle scenario in the US

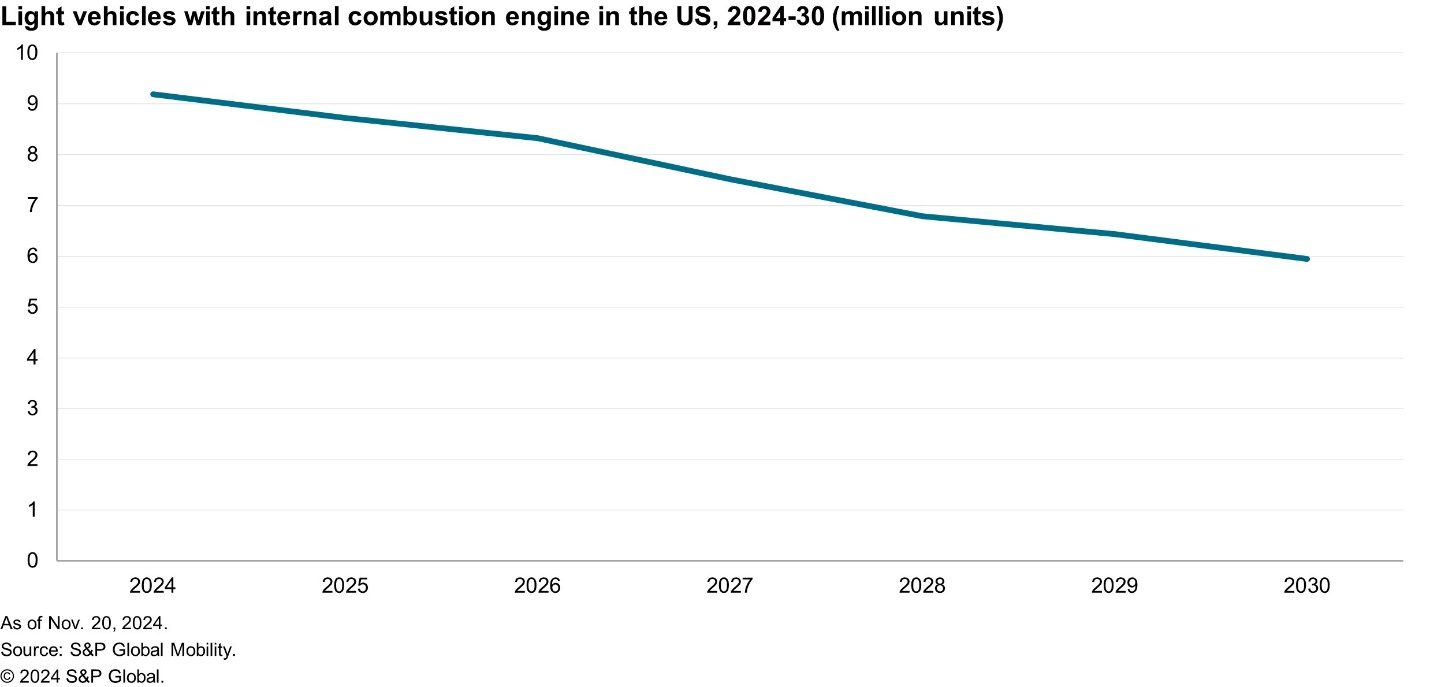

As of 2024, BEVs comprise almost 10% of the total light vehicle market in the US, and vehicles with an ICE (including hybrid, ICE and ICE stop/start) are expected to comprise 90% of the market. According to S&P Global Mobility forecasts, the number of ICE vehicles in the US is expected to reach 9.2 million in 2024, declining at a negative compound annual growth rate of 7%, to approximately 6 million units by 2030.

ICE vehicles in the US

Suppliers of ICE vehicle propulsion components

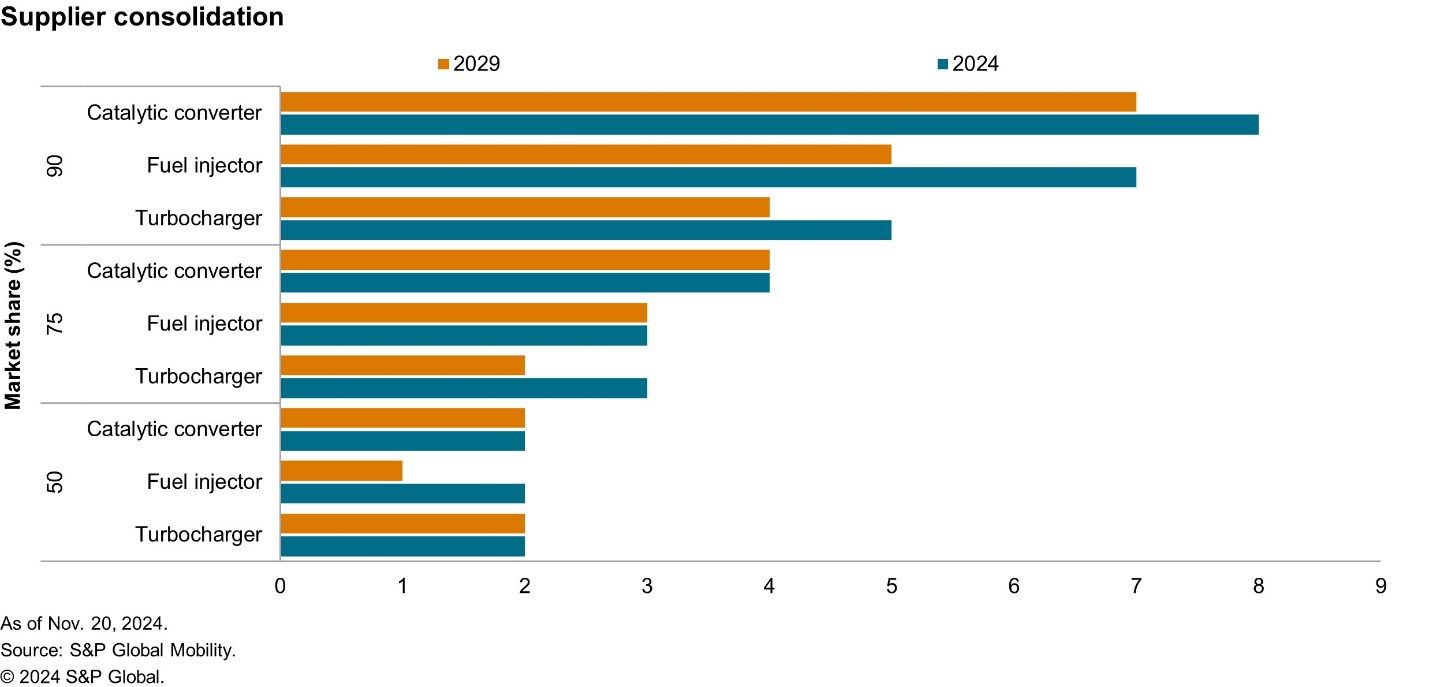

In the case of turbochargers, as of 2024, BorgWarner, Garrett Motion and IHI fulfill almost 79% of total turbocharger demand in the US. By 2029, declining demand for ICE vehicles and subsequent supplier consolidation are expected to lead to three major players dominating nearly 90% of the total turbocharger market in the US. One noteworthy point is that nearly 59% of the total expected turbocharger demand in 2024 will be imported from Mexico. For fuel injectors, Bosch, Denso and PHINIA are expected to be key suppliers for the US market. Similarly for catalytic converters, Tenneco, Faurecia, Arvin Sango are some of the key suppliers for the US market. However, going forward, with the decline in demand for vehicles with ICE, there is expected to be an increased supplier consolidation with only a few major (two-four) players comprising the majority of the component market.

The potential removal or reduction of subsidies by the Trump administration may extend the current slowdown in EV sales, which could prolong the lifespan of ICE vehicles, including hybrids. The transition to EVs is already facing challenges such as slower adoption rates and uncertainty, leading to program delays and weaker launch curves. Moreover, if the administration decides to impose more tariffs on imports from Mexico (59% of turbochargers are imported from Mexico as of 2024), the cost of components imported might increase.

If the Trump administration relaxes emissions and fuel efficiency standards while reducing subsidies for electric vehicles, the decline of ICE vehicles may not occur as projected. Instead, this decline could happen at a slower pace, resulting in a greater number of ICE vehicles remaining in the US market than previously anticipated. This scenario would likely be advantageous for major suppliers of ICE vehicle propulsion components in the US market. As per Michael Southcott, manager, technical research, S&P Global Mobility: "It certainly will be a fascinating few months and years in the United States automotive industry. Whilst the incoming administrations pledge to “drill, baby drill” bodes well for those in the internal combustion engine space, it’s unlikely OEMs are going to want to abandon all EV investments and plans. Expect, therefore, the hybrid space to come to the fore, particularly larger plug-in and potentially even range extender options”.

Author:

Priyanka Mohapatra, Senior Research Analyst, S&P Global Mobility

For more information, please click here