Cost pressures from Chinese battery cell manufacturers, EU’s bet on sustainability over affordability of battery cells, lack of an established manufacturing ecosystem for LFP cells, indistinct policy frameworks are some of the core threats that undermine EU’s capability to challenge Greater China’s hegemony on batteries

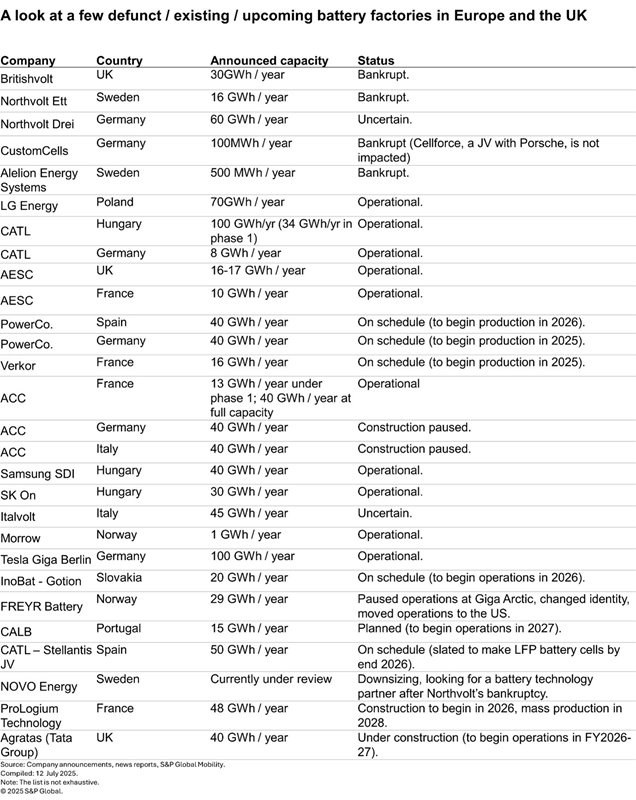

Europe and the UK region have witnessed a few high-profile battery companies abruptly filing for insolvency in the recent past, leaving behind a noteworthy setback for the region’s local battery production ambitions.

UK’s promising battery startup Britishvolt, which was once hailed by the country’s prime minister, filed for insolvency in January 2023. It was soon followed by the Swedish battery company Northvolt, which represented Europe’s hopes to compete with China’s hegemony in the global battery supply chain. It filed for Chapter 11 bankruptcy protection in the US in November 2024.

Although at that time, the Northvolt leadership expected that they would be able to get access to new funding, including $145 million in cash collateral and a $100 million commitment by Scania, to maintain continuity of operations at its main factory in Sweden, their plans failed. The company ultimately filed for bankruptcy in Sweden in March. Seeing Northvolt’s struggle to maintain liquidity and its impact on the future of Novo Energy, a joint venture between Volvo and Northvolt, the Swedish carmaker moved to take full ownership of the battery JV in January. Meanwhile, Northvolt was expected to wind down the remaining battery cell production operations at its Skellefteå plant by June end, according to a May 22 Reuters report.

German battery manufacturer CustomCells, a spinoff of the Fraunhofer Society, filed for insolvency April 30, after aerospace company Lilium, its largest customer, went bust.

Around the same time last year, Automotive Cells Company (ACC), a high-profile battery joint venture of Mercedes-Benz, Stellantis and French energy company TotalEnergies, paused the construction of its two planned gigafactories — one each in Germany and Italy — with an aim to reevaluate its battery chemistry strategy. It is known that the parent companies of ACC are evaluating more affordable options to the high-nickel NCM (nickel-cobalt-manganese) batteries, which it has already been producing at its French gigafactory for a year.

Grappling with cash flow and a slowdown in EV demand, Norwegian battery maker FREYR Battery downsized its operations, abandoned expansion and paused cell manufacturing at its gigafactory — Giga Arctic in Mo i Rana — in 2024. Earlier this year, it changed its name from FREYR to T1 Energy, moved its headquarters from Norway to Austin, Texas, to maximize eligibility for US tax benefits and pivoted its focus to solar energy applications.

Why Isn’t the EU’s Battery Manufacturing Ecosystem Taking Off?

In his recent interview with Battery Associates, Frank Blome, CEO of PowerCo, candidly argued that in the early EV days (early 2000s), when the West did not see a business case in electric mobility, the Japanese, Koreans and Chinese were already producing batteries in significant volumes for laptops, cell phones, hybrids and electric cars.

“With that, they were finding scale and improving their processes,” he said.

In contrast, the European Commission launched European Battery Alliance (EBA) only after recognizing the need and urgency for the EU to develop a local battery value chain in 2017. That was followed by the first ever ‘EU Strategic Action Plan’ on batteries in 2018. This underlines that the EU is still in the early stages of developing its local EV battery value chain as compared to mainland China and other countries in the east.

Calling the business of producing batteries “cost intense,” Blome said that in every weekly meeting of PowerCo senior executives, 80% of the time is spent discussing costs.

In addition, he also highlighted the multilayered support system that the government in mainland China provides to the companies setting up battery manufacturing units, including the direct and indirect funding support, quick commissioning and project approvals, which lead to quicker construction of factories, incentives such as subsidized energy, tax rebates, free use of factory buildings built by specific economic development zones, among several other benefits.

“There is no system in Europe or in Germany that functions like this. But we have to do things much better here soon,” Blome said.

While Blome outlined several key points regarding Europe's ongoing challenges in establishing a competitive EV battery value chain, it is essential to delve deeper into the underlying causes of Europe's persistent difficulties in competing with mainland China in the battery sector.

a) Cost Pressures and a Tepid BEV Uptake

A combination of acute competition from the Chinese battery cell makers, which sit atop the global battery ecosystem in scale and costs, and a slower-than-anticipated uptake of battery-electric vehicles (BEVs) continue to pose the toughest challenge for any battery company of local origin to build a gigafactory in the EU region.

A sluggish uptake of BEVs will not only adversely affect new gigafactory investments, causing investors to adopt a cautious stance, but it will also place significant pressure on the operational viability of existing battery companies. A lack of decent demand for batteries inflicted serious injuries to CustomCells, FREYR Battery and ACC, which moved to pause the construction of its upcoming gigafactories in Germany and Italy on account of slower than anticipated BEV uptake and cost pressures at play.

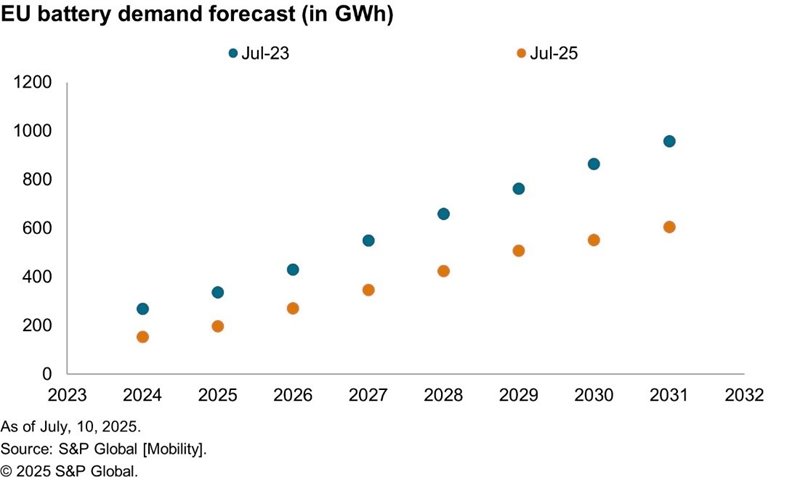

The chart below represents S&P Global Mobility’s revised forecast of the EU battery demand between 2024 to 2031. It can be seen that the demand forecast for EV batteries in the EU region has been revised downward, owing to the slower-than-anticipated uptake of BEVs. For 2025, the revised EU battery demand is down by over 40% of the volume that was anticipated earlier. Similarly, in 2030, the revised demand is down by more than 36% of the earlier forecast volumes.

Setting aside the slow BEV adoption, if we analyze what drives the cost pressure, we find several demographic and geopolitical factors that are difficult and complex for developed Western countries to handle in a business-as-usual environment. For example, the EU’s emerging battery manufacturing ecosystem is still in its early stages, with new and unoptimized processes unlike those in mainland China. It must contend with significantly higher labor and energy costs compared to mainland China, plus the expenses of transporting critical battery materials into the EU from their origins thousands of miles away.

In contrast, if we look at the top battery companies in mainland China, such as CATL and BYD, we find that they have benefited from various forms of government support, including receiving direct subsidies, in addition to tax exemptions and focused funding of research and development (R&D) activities.

Media reports suggest that BYD received about $3.7 billion in direct subsidies between 2018 and 2022. Similarly, CATL’s annual reports suggest that the battery maker’s government subsidies rose from $76.7 million in 2018 to $809.2 million in 2023. EVE Energy, another leading battery maker in mainland China, received about $208.9 million in government subsidies in 2023 alone.

To understand the government support in mainland China, especially at a provincial level, it is important to evaluate how local authorities in Gansu, a province in Northwestern China, have helped lesser-known battery manufacturer Gansu Jinhongxiang New Energy Co. in kickstarting daily production of 250,000 batteries from scratch in just about half a year.

The authorities in the Gansu province provide a “full life cycle service” to gigafactory projects, starting from rapid commissioning to monitoring the development and delivery of the project. The Jinchang Economic Development Zone, where Jinhongxiang New Energy’s plant is located, provided the company with “ready-to-move-in” standardized factory buildings for free, saving production cost and time for the enterprise. In addition, the authorities also provided a dedicated project management team, which had representatives from departments across development and reform, environmental protection and safety supervision, to complete and deliver 15 government approvals in just 30 days.

On top of these supporting factors, the local government offers a subsidy on equipment depreciation, among other incentives.

While such preferential policies from the government ensure that companies stay focused on their product development, the Gansu province also has access to significant local availability of critical raw materials, which further contributes to saving logistical costs. The article claims that these factors contribute to lowering the manufacturing cost of each battery by approximately 12% in Gansu as compared to the batteries produced in factories located in the coastal areas of Greater China.

A pertinent example of how optimized processes in battery manufacturing can yield significant improvements is reflected in a gigafactory's scrap rate. This metric indicates the quantity of material — particularly costly raw materials such as lithium, nickel and cobalt — that is wasted during the manufacturing process. Consequently, elevated scrap rates can result in increased production costs and diminished efficiency in material handling.

The incumbent players in mainland China have achieved very efficient processes with scrap rates of less than 10%. However, battery startups in the rest of the world, due to the lack of expertise, face severe quality issues during the ramp-up, resulting in scrap rates higher than 30%-40%. Northvolt notoriously struggled with high scrap rates while attempting to scale up production at its Skellefteå-based battery plant.

According to Ali Adim, manager, Battery Research, S&P Global Mobility, for a battery startup, with an already negative cash flow, fixing the scrap rate issue is a dire threat to survival.

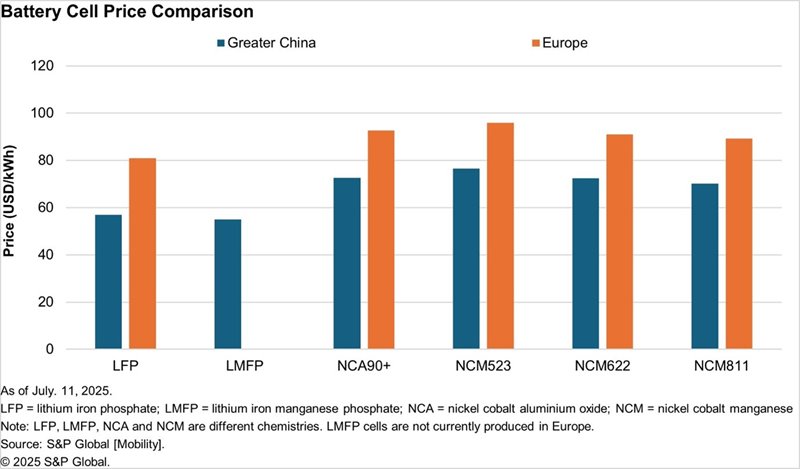

The graph below, based on the S&P Global Mobility battery cell price data, compares the price of cells with popular chemistries that are produced in Greater China and Europe. The graph not just highlights the affordability of LFP cells when compared to the NCM combinations, which are more widely used in the EU and the US, but it also underlines the upper hand that mainland China has even when the battery plants in the west are embracing the LFP chemistry. This feat is mainly achieved by the Chinese battery makers, thanks to a well-oiled supply chain, mature and optimized processes and government backing.

Moreover, it must be noted that while LFP cells cost less than $60 per kWh, LMFP cells come at an even more affordable price of ~$55 per kWh in Greater China. This not only makes LMFP cells a key chemistry to watch out for, but it is also currently produced only in Greater China and not in the EU, which provides another massive upper hand to Beijing.

Notably, LMFP cells have manganese added to the cathode to achieve a higher energy density when compared to the LFP cells. However, there are challenges for the LMFP chemistry to be integrated the system level for large-scale manufacturing.

Meanwhile, in his recent interview, acknowledging the benefits of optimized production processes in battery manufacturing, Blome accepted that PowerCo is currently learning the standard processes. After commencing production operations at Salzgitter this year, the company will build its second, more modern and optimized gigafactory in Spain, followed by a third gigafactory in Canada.

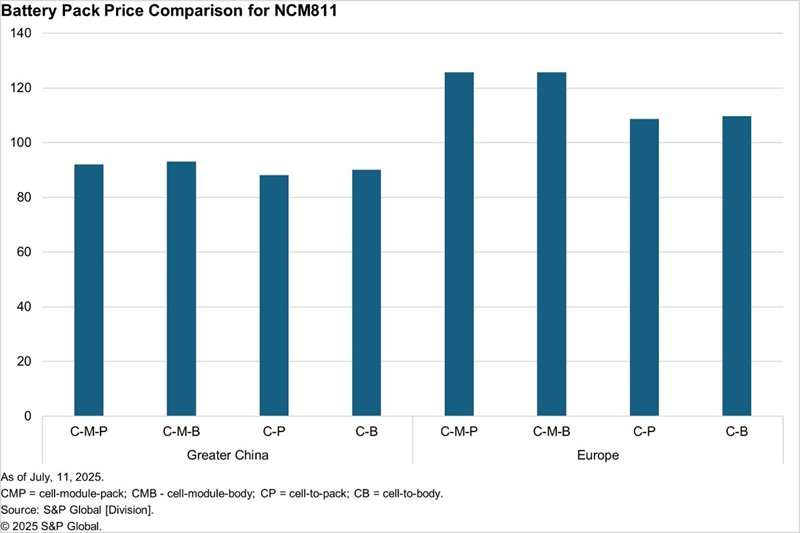

According to S&P Global Mobility battery price data, the total battery price of an NCM811 battery pack, which includes the price of cell, module, as well as the pack, in Greater China is ~$92 per kWh as compared to ~$126 per kWh in Europe. The chart below represents the difference in the NCM811 battery pack prices under multiple combinations offers by the battery makers, such as cell-module-pack (CMP), cell-module-body (CMB), cell-to-pack (CP) and cell-to-body (CB).

For LFP battery packs in cell-to-pack configuration, S&P Global Mobility data suggests that the total battery price in Greater China is ~$75 per kWh as compared to ~$102 per kWh in Europe. The prices compared here are for an LFP battery in prismatic format in a cell-to-pack configuration.

b) EU’s Bet on Sustainability Over Affordability

Northvolt, one of the best-funded battery startups in the world, running into a financial crisis early on, is a great case study to understanding Europe’s excessive focus on sustainability. Northvolt’s co-founder and Chief Executive Peter Carlsson, who was once Tesla’s head of supply chain, chose Sweden to set up the gigafactory to harness the region’s abundant and cheap clean energy, keeping carbon footprints as low as possible.

While setting up the battery cell gigafactory, Northvolt Ett, in Skellefteå, the leadership was also investing in integrating the upstream activities to establish a closed-loop circular system that could not just provide transparency on the origin of raw materials used in the batteries but also deliver up to 50% of raw materials for battery production from recycling operations by 2030. To achieve this, the well-funded company invested in building a full-fledged recycling facility, Revolt Ett, next to Northvolt Ett.

The battery startup also invested in setting up an Upstream 1 CAM production facility in Skellefteå. But the buck did not stop there. It also invested in building a recycling infrastructure for sodium sulphate — a salt that is produced as a byproduct from the production of cathode active materials (CAM). Notably, for every metric ton of CAM produced, up to two tons of sodium sulphate can be generated. In Northvolt’s own admission, the standard practice across industries is to flush down this sodium sulphate into the rivers and seas as waste materials, as permitted by law. But it went overboard to change the standard practice by investing its resources in cleaning up the salt byproduct to upcycle it as a commercial product. Huge capital spent on building such an infrastructure could have fetched returns only if Northvolt had operated at scale. But the company failed to scale its core operation to produce battery cells in a timely manner as promised to its customers.

Northvolt Ett was supposed to have an annual capacity of 16GWh in the first phase, but it could install only 1GWh of capacity in 2023. That said, the capacity utilization of this 1GWh was near zero as the company barely produced any battery cells beyond the insignificant pilot volume. After two years of delayed delivery of cells, as promised by Northvolt, BMW cancelled its €2 billion order for battery cells in 2024.

No doubt the company had a strong commitment to produce “green” cells, but its focus was diluted early on, especially when it should have paid attention to meeting the deadlines of its $50 billion order book to gain scale. Avoiding investments in recycling and other peripheral activities could have saved precious cash, which could have been put to use while solving the problems that were causing the delay in producing battery cells at Skellefteå to ensure survival.

Europe's commitment to sustainability and ambitious targets outlined in the Green Deal, including achieving climate neutrality by 2050 and reducing transport emissions by 90%, is placing significant pressure on emerging clean tech businesses that rely on capital-intensive hardware. This situation creates a catch-22, as the EU's best option is to produce 'green' battery cells with a lower carbon footprint than those manufactured in mainland China.

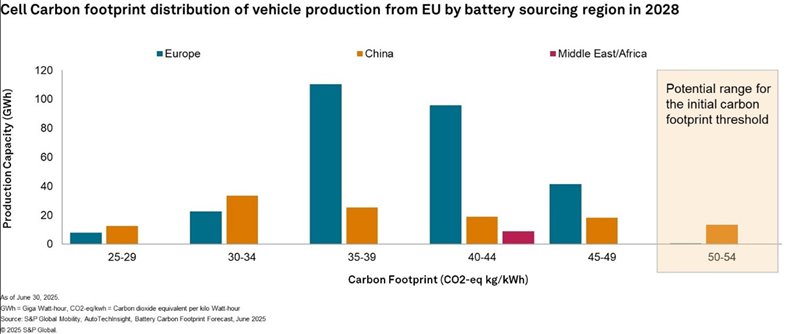

Further, the European battery startup ecosystem has been betting that original equipment manufacturers would pay a premium for their products due to their focus on sustainability. However, it is found that the Chinese battery makers are not just casually watching their counterparts in the EU region; instead they are offering even a lower carbon footprint than the Europeans through decarbonizing several layers of their battery value chain, Ali said.

The chart below depicts the carbon footprint of battery cells produced in Greater China in comparison with the same in Europe. The average carbon footprint of battery cell production is lower in Greater China than in Europe, thanks to controlled carbon emissions despite large production capacity.

c) Lack of an Established LFP Manufacturing Ecosystem in Europe

While the choice of battery chemistry significantly influences the cost structure of a BEV or a plug-in hybrid electric vehicle (PHEV), it is known that the lithium iron phosphate (LFP) batteries offer a cost advantage as compared to the more widely used lithium nickel cobalt manganese oxide (NMC) batteries. Notably, the LFP batteries are understood to be about 30% less expensive per kilowatt-hour compared to the NMC batteries, which continue to be the predominant chemistry used by the automakers in the US and Europe.

In contrast, the LFP batteries are more widely used in mainland China, the world’s largest EV market, giving the Chinese battery makers a significant advantage on the cost parameter. This also stemmed from the licensing agreements that the Chinese battery makers had with the patent holders — mainly universities in the US and Canada — over the years. This helped the Chinese companies in integrating the technology in their manufacturing processes while continuing to enhance it in their respective R&D labs.

Meanwhile, Korean and Japanese battery makers focused more on high-density, nickel-rich battery chemistries such as NCM and NCA, giving very limited attention to the applicability of affordable LFP battery cells.

That said, key patents of LFP battery technology began expiring by 2022, giving wider access to global battery companies. This shift coincided with global automakers’ ongoing pursuit to reduce the development and manufacturing cost of EVs to achieve wider adoption.

In 2020, Tesla adopted LFP batteries, moving away from NCA cells. The move was aimed at avoiding nickel, a supply chain-constrained metal, and cobalt, which came from the infamous mines of the Democratic Republic of Congo. Tesla’s battery competency and cost structures sparked interest among rivals such as Ford Motor Company, General Motors and Volkswagen, who followed suit.

Although NMC batteries continue to provide higher energy density when compared to the LFP cells, the gap has narrowed in recent years, thanks to the significant technology advancements made by Chinese battery makers.

Reports suggest that the energy density of LFP battery packs is about one-fifth lower by mass (Wh/kg) and about one-third lower by volume (Wh/L) than that of NMC packs. This performance deficit, however, is compensated by a superior thermal stability, safety and a longer life cycle as compared to the NMC battery packs.

That said, the EU has an upcoming LFP battery cell manufacturing ecosystem. According to official announcements, it is expected that CATL will likely lead the efforts to localize the production of LFP battery cells in the region. The company, which already has two plants operational in the EU region, signed two key strategic partnerships in 2024. It signed a deal with Renault to provide the French carmaker with LFP battery cells from its Hungary plant, as well as entered into an equal joint venture with Stellantis to set up LFP battery cell gigafactory in Spain.

In addition, LG Energy, which produces NCM battery cells at its Poland-based facility, plans to add LFP cells at Renault's site.

VW’s PowerCo, which has fast charging LFP cells on its test benches at Salzgitter, is on track to commence production at the site later this year.

d) Too Many, Indistinct Policy Interventions

The European Commission launched its first-ever dedicated ‘strategic action plan’ for batteries in 2018. The action plan was aimed at securing access to battery-critical raw materials, especially the materials that are not available in Europe, from resource-rich countries, supporting battery R&D, promoting sustainable battery cell manufacturing and recycling, developing a highly skilled workforce to contribute to the battery value chain, among other areas. The action plan included a funding of €360 million to promote battery R&D and €270 million to similar projects dedicated to smart grid and battery storage under Horizon 2020. That said, there was no explicitly mentioned funding available for companies putting factories to produce batteries in the EU region at that time. For context, SK On had just begun the construction of its battery plant in Hungary in early 2018, and LG Energy Solution had already established its first battery plant in Europe in Poland in 2016.

Over the years, the European Commission has rolled out several regulations aimed at promoting the local battery ecosystem, such as the Critical Raw Materials Act, Circular Economy Action Plan, Net Zero Industry Act, New Batteries Regulation 2023, which included the battery passport mandate, and the latest Industrial Action Plan for the automotive sector, which was released in March.

To boost battery manufacturing in Europe, the latest industrial action plan launched a “battery boost” package, which makes funding of €1.8 billion available over 2025-27 to support companies manufacturing batteries in the EU. This is in addition to the €3 billion that the commission has already announced earlier.

However, policymakers are still exploring the possibility of providing direct production support to companies producing batteries in the EU. The commission is also exploring if specific state aid can be provided to such companies and is working to prepare a new Clean Industrial State Aid Framework to simplify state aid rules. In addition, policymakers are also exploring the possibility of introducing specific European content requirements on battery cells and components in EVs sold in the EU region. The paper also mentioned that the commission is assessing whether interventions on standardizing battery designs could be beneficial for battery startups in the critical scale-up phase.

Although the traditional EU approach is tilted toward preparing several frameworks, rolling out new regulations and targets, making funds available via dedicated units such as the European Investment Bank (EIB), it lacks a clear pathway for companies towards achieving the EU’s ambitious goals. For example, if we compare EU’s policy approach with that of the US and focus on the latter’s execution via the roll out of the Inflation Reduction Act (IRA), it can be concluded that the US IRA addressed multiple aspects of boosting demand creation as well as advancing local manufacturing by providing tax credits for domestic production and incentives for sourcing critical materials, in addition to clearly defining the eligibility requirements for companies to qualify for those tax credits.

The result was encouraging for the US. The IRA fetched billions of dollars in fresh investments into the country to strengthen the domestic supply chain while continuing to offload foreign dependency every subsequent year.

It is also noteworthy to mention that in a few instances, European policies have been self-contradictory, often making it difficult for companies to take clear decisions. For example, EU’s move to impose countervailing duties on the import of made-in-China BEVs only encouraged Chinese carmakers to ship hybrid vehicles, which attracted no additional import duty. With demand slowdown for BEVs and an increasing uptake of hybrid vehicles, it remains questionable how EU’s policy in this regard is not self-defeating.

Similarly, while the EU aims to bolster local manufacturing of batteries, it imposes almost negligible import duty of as low as 1.3% on the import of battery cells into the region. Moreover, reports suggest there is zero tariff on the import of sodium-ion batteries into the EU region. In comparison, the US has raised the import duty on lithium-ion battery cells imported from mainland China to 25%, from the previous rate of 7.5%, under the Biden administration. This was further raised to 58% on lithium-ion batteries imported from Greater China under the Trump administration.

S&P Global Mobility outlook

Despite these structural risks, several new battery manufacturing projects were also announced in the EU and the UK over the last two years. These include Agratas’ proposed 40GWh gigafactory in Somerset, UK. While construction work at the gigafactory project, which belongs to the India-headquartered Tata Group, has already started, the facility is slated to officially commence battery production in the 2026-27 fiscal year.

On the policy front, the EU appears to be gradually recognizing the need for more active support to the emerging local battery players. In an encouraging move recently, the European Commission announced July 4 that it is awarding a total of €852 million in grants to six battery cell manufacturing projects in the region. These include ACC’s and Verkor’s gigafactory projects in France, Cellforce and Leclanche’s battery projects in Germany, Volvo-backed Novo Energy’s gigafactory in Sweden and LG Energy Solution’s battery plant in Poland.

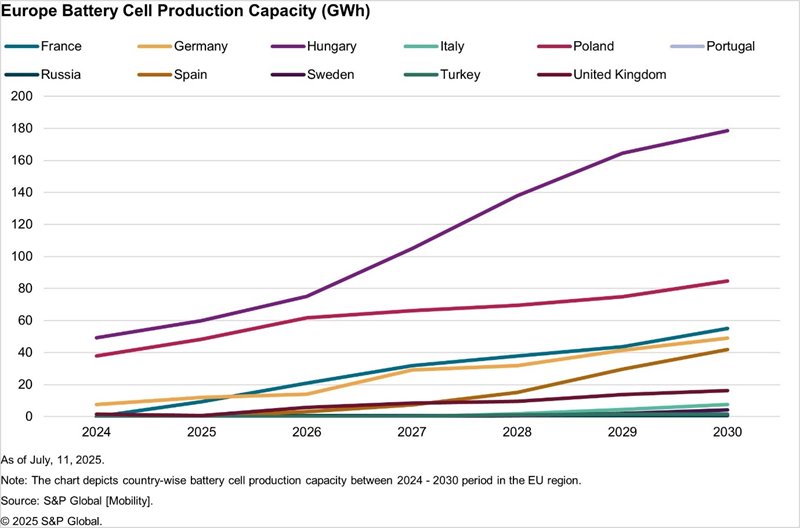

According to S&P Global Mobility data forecast, Hungary will remain the top country for battery cell production capacity in Europe, followed by Poland, France and Germany, respectively, by 2030. Hungary’s leadership in the EU’s battery cell production capacity is mainly defined by its central location, which is closer to Asia and the Middle East region. Moreover, the country offers the lowest cost of electricity in the entire EU region, in addition to the availability of a low-cost workforce when compared to western EU nations.

Sharing his perspective on the existing and upcoming gigafactories in the EU region, Adim, of Battery Research, S&P Global Mobility, said: “The onshoring of the battery production in Europe has been mostly voluntary and through the pressure from OEMs to minimize their supply chain risk. This means European OEMs are willing to pay a premium to source the European batteries, to reduce the geopolitical, transport and supply chain risks.”

“Currently, with no rule of origin and very low import tariffs, European battery makers are exposed to cheap Chinese cells. Europe may respond with protectionist measures, such as local sourcing incentives or higher tariffs on imported battery cells.”

He also said that lack of LFP battery cell production continues to be the main challenge in Europe. “ACC and PowerCo are reconsidering their nickel-based strategy in response to client demand for cheaper battery cells, but most LFP cells come from [Greater] China. While Chinese suppliers like CATL plan to start local production, dependence on Chinese companies will likely continue or may even increase.”

Amit Panday

Senior Research Analyst, S&P Global Mobility

For more information, please click here