The decision symbolizes Tesla's strengthened control over the component ecosystem, as they have successfully completed discussions with relevant component companies to ensure the mass production of new standard components at a reasonable cost.

Recently, Tesla announced that it will transition its electrical and electronics architecture from 12V to 48V. The purpose behind this decision is to structurally improve power efficiency and further advance vehicle lightweighting. The decision is in line with Tesla's strategy to pursue architectural and modular innovation and signifies the strengthening of its component ecosystem.

During Tesla's Investor Day in March, the company hinted at the adoption of a 48V-based electrical and electronics (E/E) architecture. Currently, the majority of the vehicles use a standard 12V voltage for their electrical components, excluding certain powertrain components. Since the 1960s, when the standard voltage for vehicle electrical components changed from 6V to 12V, most passenger and compact commercial vehicles have utilized a 12V battery (lead-acid battery), alternator and components designed accordingly. Electric vehicles (battery-electric vehicles or plug-in hybrid electric vehicles), hybrid electric vehicles (HEVs) and mild hybrid electric vehicles (MHEVs) use high-voltage components in some powertrain aspects, but even in those cases, general low-voltage electrical components operate at 12V or lower voltage through step-down mechanisms.

However, Tesla declared that they would switch to a 48V-based E/E architecture starting with their upcoming model, the Cybertruck. According to Tesla, modern vehicles equipped with various electronic devices face challenges such as complex wiring and increased wire weight due to the need to handle currents of up to 250 amperes.

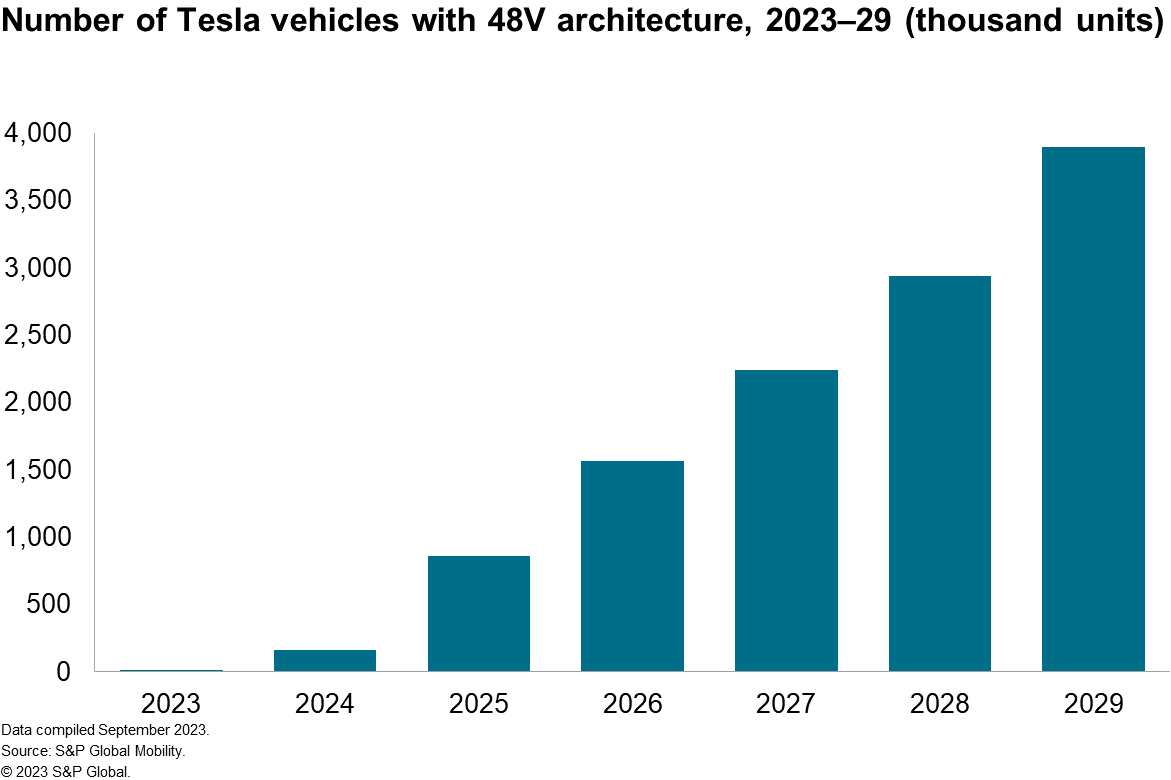

To address this, Tesla plans to apply the 48V architecture to the Cybertruck, future vehicle releases and the humanoid robot Optimus, along with designing the necessary major control units in-house. Tesla is set to implement these plans in the second half of 2023, as it aims for mass production. From 2025 onward, even Model S and Model X are forecast to fully transition to 48V architecture. By 2029, the 48V architecture will equip more than 3 million vehicles from Tesla’s assembly line.

Benefits and challenges

A 48V-based architecture can structurally enhance power efficiency and contribute to vehicle lightweighting. When transitioning from 12V to 48V under the same power requirements, the current decreases to approximately one-fourth, resulting in reduced power losses in various common electrical components, such as lighting, infotainment and steering, which consume about 3-7% of EV power. Furthermore, there is potential for improving the efficiency of heating, ventilation and air-conditioning (HVAC) systems and power-conversion systems. While theoretically higher voltages could further reduce losses, when taking occupant safety into consideration, 48V is the appropriate level of power requirement.

Simplifying wiring and reducing wire weight can contribute to vehicle lightweighting and cost savings. With reduced current, there is potential to reduce the volume, weight and associated costs of internal vehicle wiring, which can reach up to 4 km in length and 30-60 kg in weight. Moreover, it becomes easier to incorporate power-demanding computational, audio systems and customized 48V accessories. However, one aspect to note is that Tesla vehicles, which have previously pursued simplified wiring through the adoption of a centralized E/E architecture in models such as the Model S (released in 2012) and Model 3 (released in 2017), may have relatively limited additional lightweighting effects compared to other manufacturers.

Despite the expected short-term cost increases, the decision highlights Tesla's consistent innovation strategy. Due to the rarity of 48V components in the market, there is a possibility of increased delivery costs compared to the previous 12V components. Most vehicles currently in the market use 12V; thus, the development cost and production quantity shortage of 48V components may result in higher prices than 12V components. Additionally, many 12V components benefit from economies of scale as part manufacturers produce them in large quantities and supply them to various automakers, while in the short term, 48V components may face difficulty in reducing manufacturing costs with demand limited to Tesla.

However, the decision also reaffirms Tesla's strategy of pursuing architectural and modular innovation. Tesla has previously pursued cost and performance optimization through architectural innovations such as the adoption of a centralized E/E architecture and the integration of rear floor-panel casting (Giga Press) and an exoskeleton-like body structure (scheduled). Considering the plans for introducing the 48V architecture and the various module-level technological improvements showcased at Tesla Investor Day 2023, it is evident that Tesla will continue its strategy of pursuing both architectural and modular innovations in the future.

Another significant aspect to note is the increase in Tesla's dominance in the component ecosystem and the burden it places on legacy automakers trying to catch up. This decision symbolizes Tesla's increased control over its component ecosystem, as Tesla has successfully completed discussions with relevant component companies to ensure the mass production of new standard components at a reasonable cost. In the past, Tesla had limited influence over the component industry, relying on purchasing parts used in other automakers' vehicles, such as steering columns, window switches and heater-blower motors, mainly due to insufficient production volumes. However, by establishing its own component ecosystem, Tesla can maintain design autonomy and secure a stable supply of parts.

If Tesla manages to prove the practical advantages of the 48V transition, legacy automakers may feel the pressure of catching up. Some legacy automakers, due to their well-established relationships with multiple tiers of component companies, may require a longer time for a practical transition to 48V, even if they acknowledge the necessity of the transition. The transition for legacy automakers would inevitably involve changes in the supply chain, organizational restructuring in the development and procurement departments, and the allocation of resources.

Top-down development

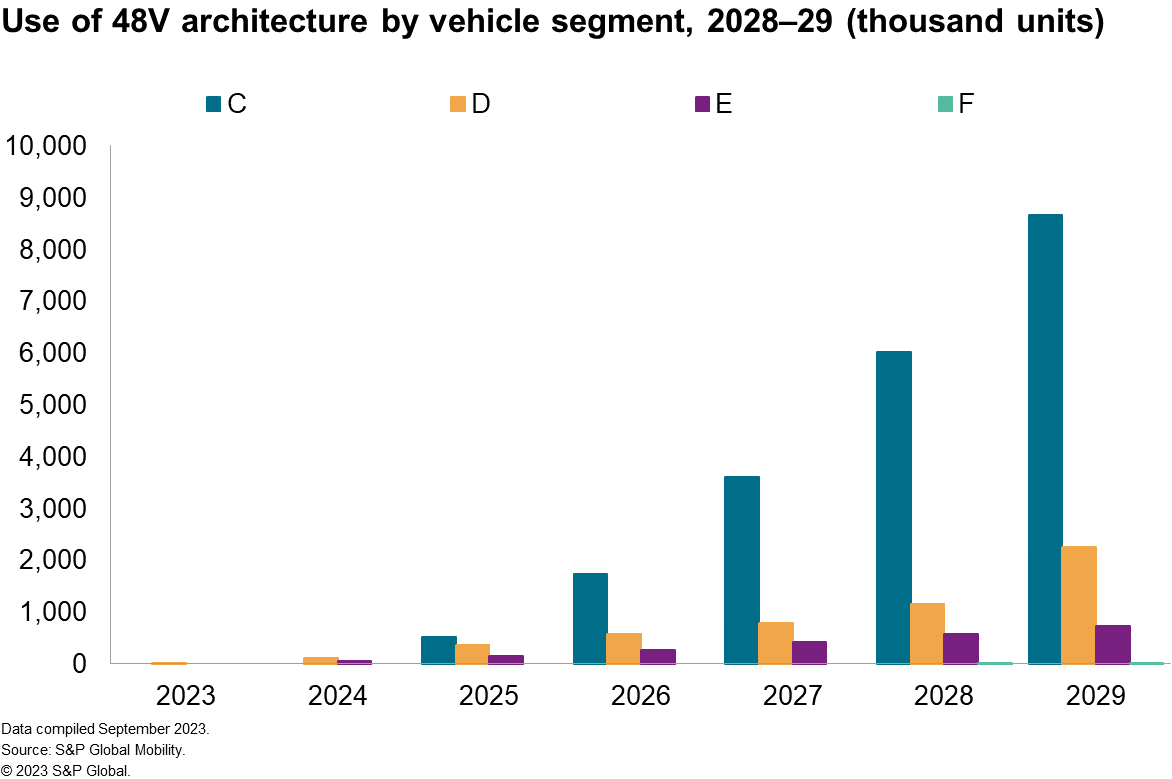

Other automakers are looking at or adopting many of the innovations implemented by Tesla. However, with 48V architecture, only a handful of ultraluxury-car makers would likely include it in their vehicles before the end of the decade. The enactment is expected to be more prominent in higher C-segment and above vehicles in the short- to mid-term period. Apart from Tesla, other brands might promote a similar approach of offering 48V architecture for auxiliary applications in cars with advanced features that require high-electric power, although the new players would likely not provide their offerings before 2028.

The slow initial adoption could be due to several reasons, including the huge investments required for revamping the assembly line, reworking the supply chain and safety concerns, to a certain extent, especially for components that may come in direct contact with passengers.

Nevertheless, with cars now featuring power-intensive additions such as active suspensions, electric turbo and numerous new gadgets onboard, the case for adopting higher voltage architecture to meet the power demand in an efficient manner will gradually gain momentum among automakers. However, it is still uncertain when this will become mainstream.

Authors:

Richard Kim,

Richard Kim,

Associate Director,

S&P Global Mobility

Srikant Jayanthan,

Srikant Jayanthan,

Senior Research Analyst,

S&P Global Mobility

For more information about S&P Global Mobility please click here