by Claudio Vittori and Srikant Jayanthan, Senior Analysts at S&P Global Mobility (formerly IHS Markit)

Whether the future of automotive industry lies in electrification is no more a debated topic. However, what is debated is how quickly the world will be able to let go its century-long dependence on fossil fuels and embrace electricity- powered vehicles. Several factors will play a role in determining this pace including the availability of enough batteries to enable this transition.

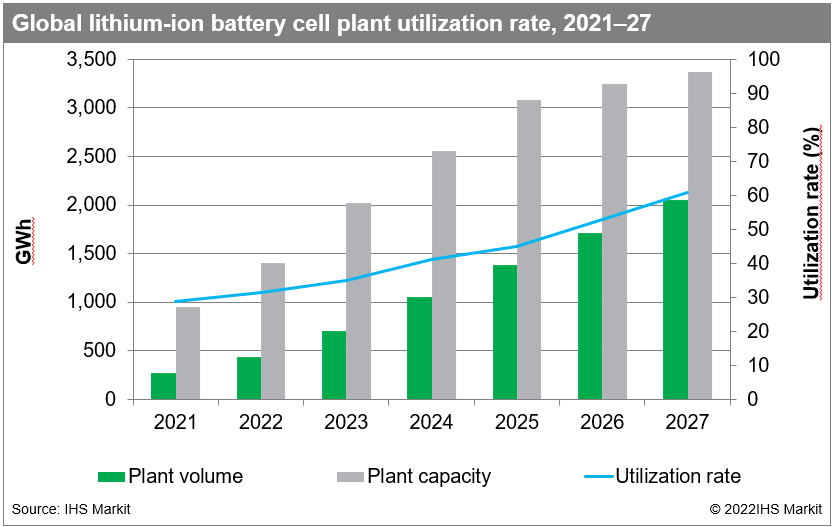

Currently there is an installed capacity of around 948 GWh for lithium-ion (Li-ion) batteries globally. Out of this, nearly 274 GWh was utilized to cater to the Li-ion battery demand from the automotive industry. If the electric vehicle (EV) sales in the last two years is anything to go by, the EV segment is set to become mainstream in the next couple of years. The addition of tens of millions of EVs every year will also require several thousand GWh of batteries.

According to S&P Global - Mobility, the demand for Li-ion batteries from light vehicle between 2021 and 2027 will increase by nearly 40% CAGR to around 2050 GWh. Installed battery capacity in the same period will grow by 23.5% CAGR to 3371 GWh in 2027.

The growth will not only be driven by established cell suppliers such as CATL, LG Energy Solution, Panasonic, but also some promising startups including SVOLT, Automotive Cells Company (ACC), Northvolt, Britishvolt and a few others.

While the automotive industry will continue to rely heavily on outsourcing, establishing partnerships with cell manufacturers to mitigate supply chain risk will be an important sourcing strategy for most OEMs in the years to come. From about 5% in 2021, cell sourcing from partnership companies will account for about 22% in 2027. There are some OEMs like Tesla and BYD that are also betting big on in-house cell manufacturing. Nevertheless, in-house production is and most likely will remain the least favored mode of battery sourcing among automakers.

Regional battery production capacity

The build-up of manufacturing capacity for Li-ion batteries is expected to vary across the different regions depending on the EV demand and prevalent regulations around localization requirements, production subsidies and ZEV-only mandates. Greater China has already taken a significant lead over all other regions in terms of installed battery capacity.

In 2021, Greater China region had a installed capacity of around 166 GWh, which was more than 72% of the global capacity. Greater China an attractive destination for manufacturing cells due to several reasons such as government support that allows faster plant setups and the low cost of manufacturing. Another notable factor for cell suppliers to set up plant in mainland China is the local availability of raw materials for battery production.

Greater China controls a huge share of the supply chain for cobalt and lithium, with mainland Chinese companies having ownership of some of the biggest mines around the world. Although a good chunk of the material is mined outside the Greater China region, it is then imported into mainland China for further processing. This has made Mainland China the biggest producer of refined, battery-grade cobalt and processed lithium.

However, in a bid to reduce dependency of Greater China for cells, most governments are looking to build their own battery manufacturing setup. Europe is the second biggest manufacturer of Li-ion batteries with 126 GWh capacity but is fast closing the gap with Greater China. By 2027, Europe’s share will grow to 22% of the global capacity, compared to just 13% currently.

LG Energy Solutions, the spun-off battery business of LG Chem, is the biggest cell manufacturer in the region, with nearly 70 GWh capacity at its Wroclaw plant in Poland. LG Energy Solutions’ plant will increase its capacity to 100 GWh in 2025, which will be similar to that of Tesla and CATL, both of which are in the process of setting up plants in Germany. Compared to 56% of the installed capacity in Greater China being used for light vehicle segment, Europe will have a much higher capacity utilization of around 74%.

North America will continue to trail Greater China and Europe till the end of the forecasting period but will see the highest CAGR growth among the three regions. One of the reasons attributed to this would be the increase in number of government initiatives to accelerate uptake of EVs. The most recent, and probably also the most influential one, is the infrastructure bill, which was signed into law by President Biden late last year. The law outlines several actions focused on setting up EV charging infrastructure.

Currently, North America has a battery production capacity of around 63 GWh, all of which is in the United States. This will increase to more than 580 GWh by 2027 at a 44.8% CAGR. While majority of the Li-ion battery manufacturing capacity in North American will be set up in the United States, Canada is also looking to have some local manufacturing of Li-ion cells. Canada will more likely play a critical role for the North American battery market in the battery material segment. Canada has rich reserves of key battery materials, such as cobalt, lithium, and nickel.

Japan/Korea region, which is home to four of the biggest cell manufacturers, was also one of the first one to get onto the electrification bandwagon. However, its preference for hybrids has meant that the demand and manufacturing capacity for Li-ion batteries has not grown at the same rate as Greater China or Europe. Although the installed capacity in the region at 72 GWh is currently higher than in North America, the growth in the coming years will be a lot lower as the demand shift towards battery electric vehicles (BEV) will be gradual. Plant capacity for Li-ion cells in Japan/Korea region will grow at around 18% CAGR between 2021 and 2027.

South Asia too will witness growth in Li-ion cell manufacturing in the next five years although it will be at much smaller scale in comparison to other regions. South Asia will have around 68 GWh of installed capacity in 2027. The growth will mainly come on the back of India which recently announced a new production linked incentive (PLI) scheme for advanced chemistry cell (ACC) manufacturing. Under the scheme, the government aims to have a cumulative 50 GWh of ACC manufacturing facilities in India.

Related data and chart

|

X-Axis |

Plant volume |

Plant capacity |

Utilization rate |

|

2021 |

273.6187 |

947.83 |

28.86791 |

|

2022 |

439.5697 |

1401.39 |

31.36669 |

|

2023 |

705.407 |

2026.09 |

34.81617 |

|

2024 |

1052.852 |

2554.58 |

41.21429 |

|

2025 |

1381.565 |

3083.58 |

44.80391 |

|

2026 |

1714.202 |

3247.58 |

52.78398 |

|

2027 |

2049.885 |

3371.58 |

60.79894 |