by Siddiqa Batool, Research Analyst – at PTR Inc.

- PTR is observing a significant increase in the adoption of battery energy storage mainly due to the rapid integration of renewable energy with the electricity grid.

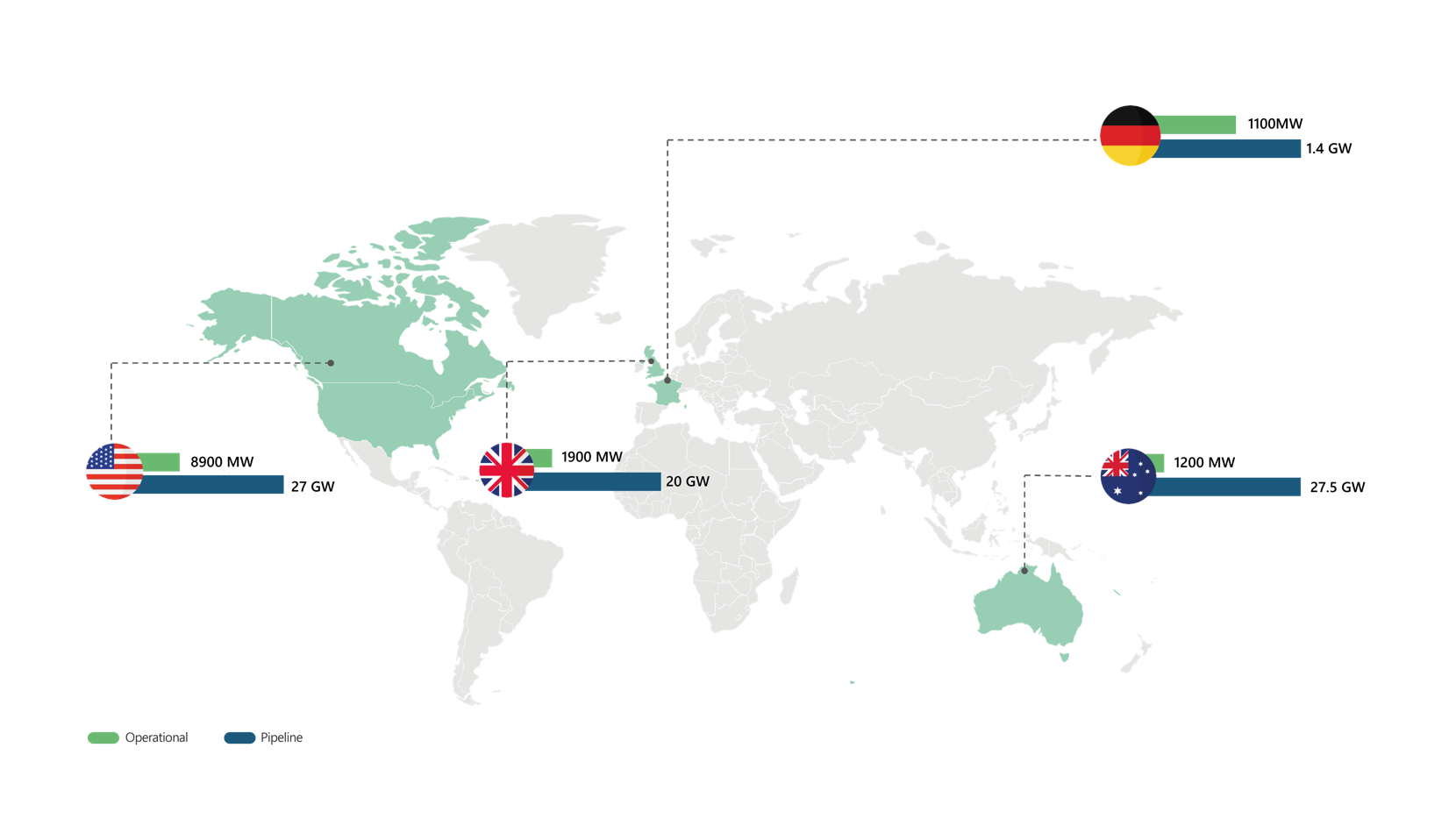

- The US, UK, Germany, and Australia are leading globally in terms of operational battery energy storage capacity.

- Battery energy storage projects rely on a range of applications, which have their own markets for the generation of revenue, including frequency services, load shifting, and energy arbitrage.

PTR is observing a significant increase in the adoption of battery energy storage mainly due to the rapid integration of renewable energy with the electricity grid. This is especially true for advanced economies across the globe that can afford to spend on clean energy resources than developing economies which are largely cash-strapped. Renewable energy is an intermittent source of electricity which in turn requires support from energy storage technologies to enable smooth electricity grid operation. Battery energy storage is a leading energy storage technology that is being deployed to support the transition from conventional sources of energy to renewable energy. BESS plays a critical role in maintaining the grid parameters (frequency and voltage) within limits specified for safe operation.

Several countries across the globe are deploying battery energy storage systems, and it is expected that battery energy storage capacity will significantly increase during the decade.

Worldwide Deployment and Growth of Battery Energy Storage Systems

The US, UK, Germany, and Australia are leading globally in terms of operational battery energy storage capacity. Recently, the US has overtaken all other countries as it installed battery energy storage projects with a capacity of 4000 MW in 2022. Within the US, California and Texas have the majority of battery energy storage capacity installed, which is why they are categorized as established markets in the Americas.

In Europe, the UK has been leading in terms of operational battery energy storage capacity. The UK has a cumulative operational battery energy storage capacity of around 1.9 GW, which is assisting the widespread deployment of low-carbon generation assets such as wind and solar energy in the country. The BESS projects in the UK have been generating significant revenue through the provision of frequency services to the electricity grid. Recently, the revenue from frequency services has started to decline because of the saturation of the frequency services market in the country.

On the other hand, in Germany, after observing a decline for three years, the utility-scale BESS project installations increased by 910% in 2022. In the same year, Germany installed BESS projects with a capacity of 470 MW which increased the total capacity to 1 GW. German projects also largely depended on the frequency control reserve market (FCR) for revenue generation. As the market for FCR has saturated, it is expected that these projects will move to tap into alternative revenue streams, for instance, peak demand and arbitrage markets.

In 2022, Australia installed BESS projects with a total capacity of 200 MW in 2022. Australia is pursuing the deployment of BESS capacity at a major scale and installing projects with a capacity of 200 MW each. These projects, which are currently either planned or under construction, are expected to increase the cumulative BESS capacity of the country drastically. Australia is also pursuing hybrid BESS projects where battery energy storage capacity is installed with a renewable generation project in order to provide capacity firming. Additionally, Australia is also installing large-scale BESS projects at retired coal power plant sites.

Figure 1: Global Market Snapshot-Battery Energy Storage System Growth in Key Countries. Source: PTR Inc

Battery Energy Storage Technology and Cost Evolution

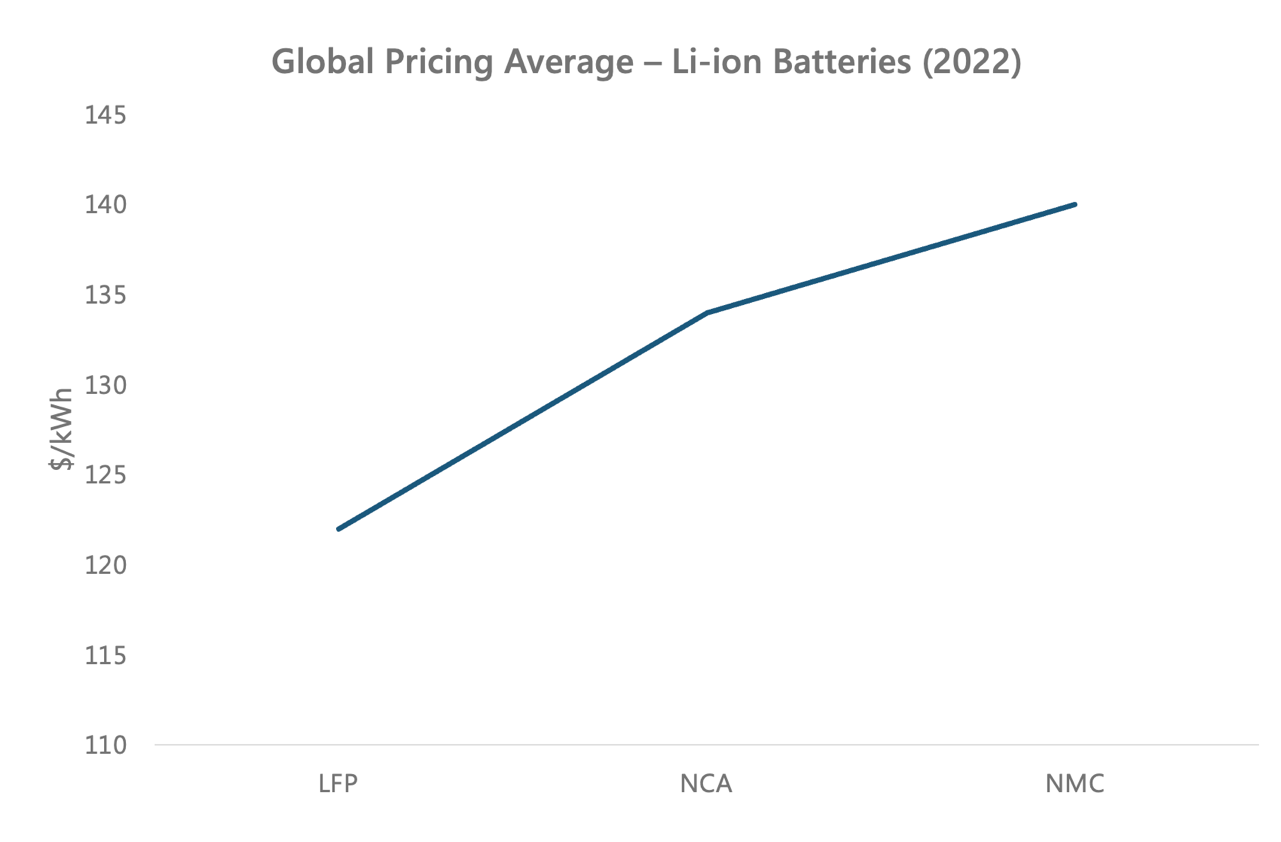

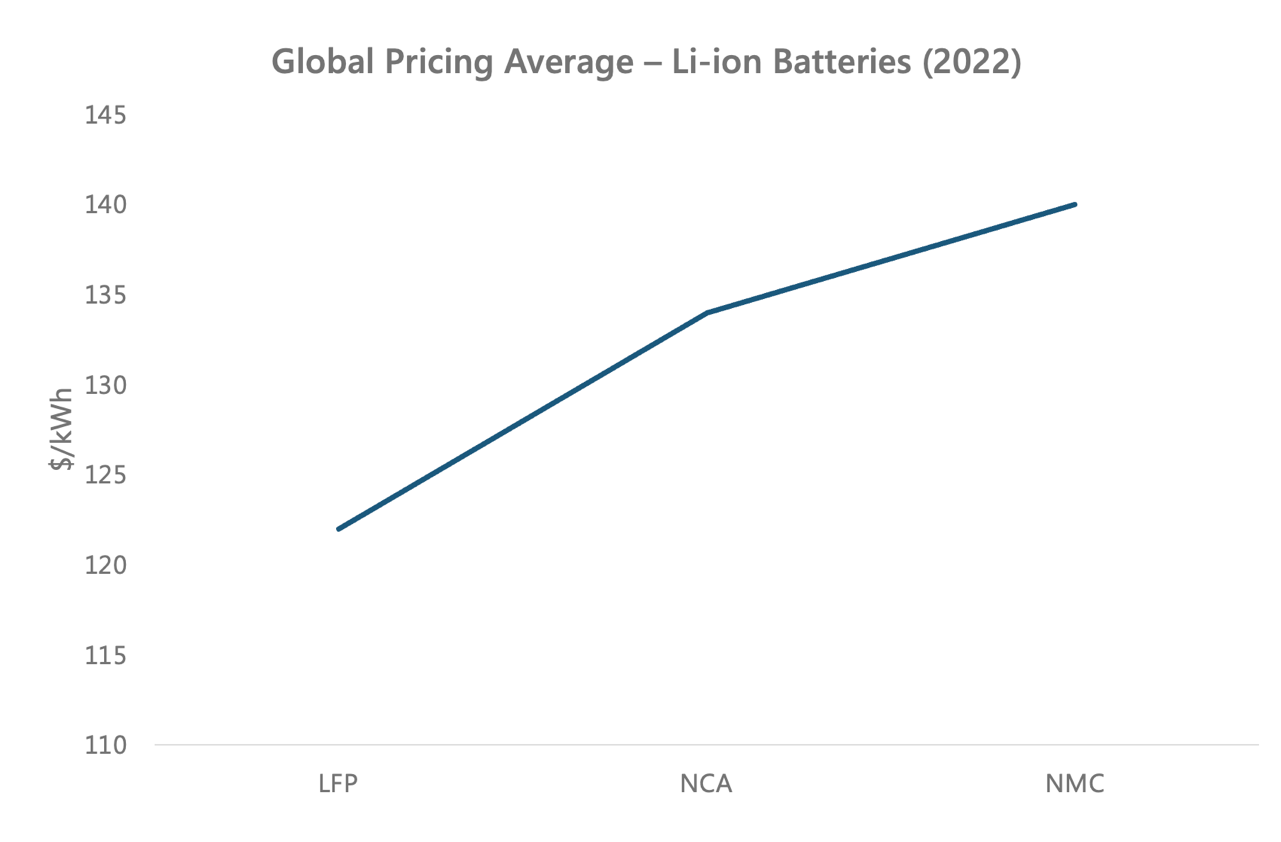

The majority of the BESS installations around the world are based on lithium-ion technology. A handful of BESS projects installed globally rely on flow battery technology and sodium ion technology. The demand for lithium-ion batteries is growing mainly because the majority of the BESS projects that are being installed are using this particular technology. However, lithium-ion technology is consistently evolving with a focus on increasing the overall energy density and safety of the BESS.

According to the estimates of the International Energy Agency, raw material prices, including lithium, cobalt, and copper, were higher in 2022 than at any point in the 2010s. This has, in turn, driven the cost of lithium-ion battery packs and cells up, which has been observing a decline for three years continuously. One of the reasons behind the increase in raw material prices is the supply chain disruptions which have pushed governments to invest in establishing local raw material supply chains. Additionally, it is observed that lithium-ion battery manufacturers are forming strategic alliances with mining companies in order to secure the supply chain. It is expected that lithium-ion battery prices will drop (as compared to 2022) in the second half of the ongoing decade.

Figure 2: Global Average Pricing-Li-ion Batteries (2022). Source: PTR Inc

Revenue Streams for BESS Projects

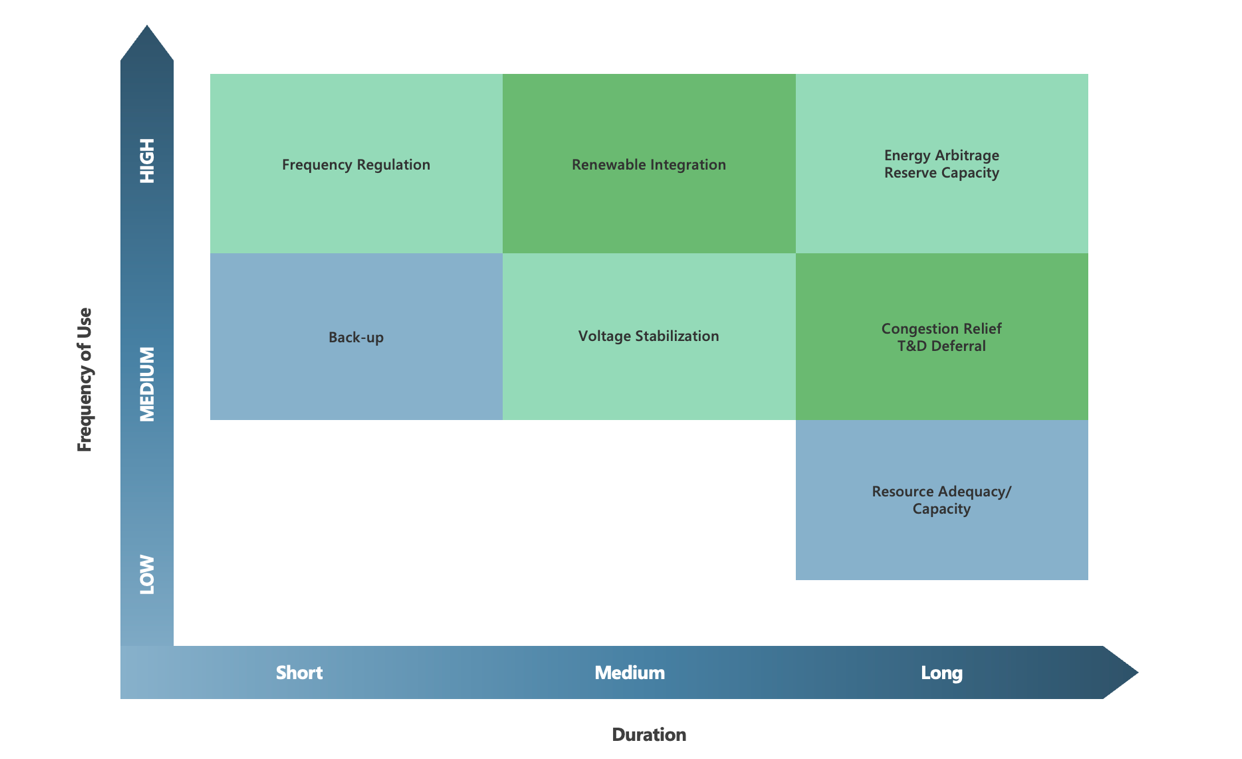

Battery energy storage projects rely on a range of applications, which have their own markets for the generation of revenue, including frequency services, load shifting, and energy arbitrage.

Frequency services

A major opportunity for BESS projects to generate revenue is through the provision of grid services like frequency regulation. As the BESS projects get integrated with the electricity grid, operators of the batteries rely on the provision of primary and secondary frequency regulation services for revenue generation. Other than being a revenue generation opportunity for the BESS projects, frequency regulation improves the stability and reliability of the electricity grid, which is highly desirable. However, it is a common observation in advanced economies like Germany, the UK, and the US that the frequency service market gets saturated, which in turn reduces the compensation for frequency regulation services.

Load shifting and energy arbitrage

It is quite common for BESS projects to generate revenue from load shifting all over the world, especially where there is widespread integration of renewable energy with the electricity grid, including solar and wind generation. In order to efficiently manage intermittent renewable energy, battery energy storage is deployed, which stores excess energy during periods of high production and transmits when the demand is on the higher side. Energy arbitrage is another revenue stream that enables renewable energy developers to not only improve their overall energy output but also allows them to generate additional revenue by committing and selling energy during peak demand hours (when the power prices are on the higher side).

New trends

Battery energy storage developers are looking to diversify their revenue streams and move towards other markets/services, including grid congestion relief and voltage stabilization, etc. BESS projects are now providing congestion relief to the grid by storing excess electricity during periods of low demand and supplying it when the demand is high. Grid congestion relief services have become an established source of revenue for BESS projects in the Netherlands. In the UK, BESS projects are providing reactive power to the electricity grid in order to stabilize grid voltages. In the US market, BESS projects are generating revenue by delaying the investment in enhancing the capacity of the transmission and distribution grid. To conclude, a range of opportunities are present in the electricity market for BESS project developers to tap into, which will not only drive growth but profitability as well in the industry.

Figure 3: Battery Energy Storage Revenue Streams vs. Energy Storage Duration. Source: PTR Inc

Looking Ahead

It is expected that the global battery energy storage capacity will increase in the coming years, mainly due to the deployment of renewable energy, especially in advanced economies. This, in turn, will create new markets for the participation of battery energy storage technology within the electricity markets of countries to provide different grid services.

However, there is a dire need for amendments in policies and regulations with a focus on removing barriers and creating an enabling environment for stakeholders in the industry. By 2030, key countries have committed to significant battery installations, aided by technological advancements, cost reductions, and advances in various chemistries. These factors will hasten the completion of planned projects, ensuring that battery energy storage plays a critical role in improving the global energy landscape's reliability, stability, and sustainability.

About the Author

Siddiqa Batool is working as an Analyst at PTR Inc., concentrating on energy storage market analysis. Her responsibilities include analyzing energy storage market trends, specifically the market size and analysis of installed and planned projects. Siddiqa also performs analysis on advancements in battery chemistries and supply chains. As a market analyst, she has also worked on projects on the topic of power grids and power electronics. She has a bachelor’s degree in electrical engineering from Mehran, UET, which brings technical background knowledge to her role as a market analyst.

For more information please contact [email protected]