OEMs' focus on compelling cockpit technologies in their cars has accelerated the adoption of HUDs in the mainland Chinese market, and local suppliers are well-positioned to take advantage of the opportunity in the growing product segment.

One of the fastest advancing areas in today’s car is the cockpit equipped with contemporary features and technologies that have revolutionized the car owners’ relations with the vehicle. One such key piece of technology is the head-up display (HUD). Though the technology has been around for a long time now, first used by General Motors way back in 1988, the proliferation has been slower than expected with several impediments for the technology to gain traction. This scenario has now started to change, as over the last few years the use of HUD in cars is gaining rapidly.

There are several reasons for this technology to take off now, such as increasing implementation of human machine interaction, the proliferation of digital and connected technologies, and new electric vehicle cockpits that are far more advanced and primarily led by software. Thus, the penetration of HUD is growing across key markets and vehicle segments.

HUDs essentially project a virtual picture in front of the driver's line of vision through the optical system, enabling drivers to keep their eyes on the road ahead. Drivers can access vital information such as navigation, instrument panel and driver-assistance information through HUD, which improves driving safety and driving experience.

Several OEMs are beginning to provide HUD as part of their new vehicle offering, and growing user adoption is pushing the volume high. This is likely to help price correction moderately which then results in higher penetration

Globally, the developed markets including the United States, Europe, and Japan have been witnessing higher HUD penetration in cars. The trend is similar in the Chinese market too, as more and more OEMs are now offering HUDs, and this is more visible in the new energy vehicles (NEV) adopting HUD as one of the major cockpit technologies.

Mainland China market dynamics

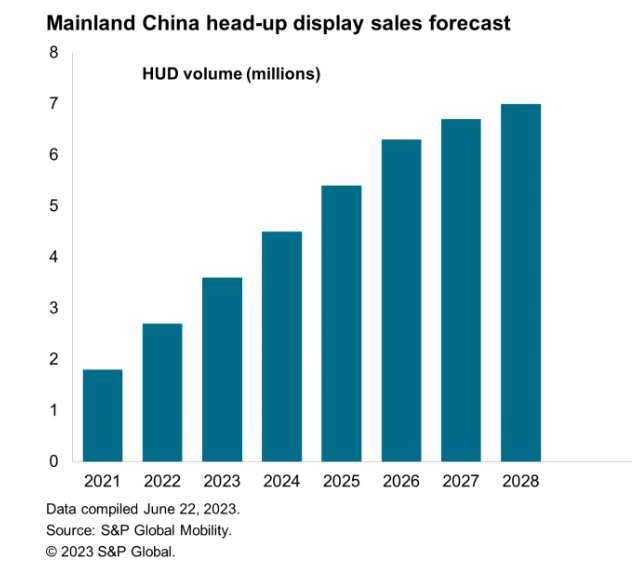

S&P Global Mobility forecasts that the demand for HUD in Mainland China is likely to grow from 2.7 million units to 7.1 million units in sales between 2022-28. While global suppliers such as Nippon Seiki, Continental, Denso, Panasonic, and Visteon are already big players in the HUD market, local suppliers and start-ups are emerging as serious players.

The rise of Chinese suppliers is likely to intensify the already fiercely competitive scenarios of the domestic HUD market. Among the number of local players that are now starting to make their presence felt in the highly competitive and technology-savvy market, the top five HUD suppliers stand out clearly. This list consists of Foryou, Jiangsu New Vision, Crystal-Optech, E-Lead, and Futurus Technology.

Are these Chinese players equipped with the necessary technology and production capacities to expand their influence in the market? What makes them worthy of taking on their formidable global competition? A closer look would answer some of the pertinent questions that would further define the Chinese HUD market in the years to come.

Foryou

One of the top HUD suppliers gaining rapid market share is Foryou MultiMedia Electronics which makes several cockpit products including digital clusters, HUD, digital rearview mirrors, cockpit domain controllers (CDC), climate controllers, driver monitor systems (DMS), high-definition cameras, other driver assistance systems, etc. The company has emerged as a top supplier of HUD within Mainland China winning key customer mandates.

Foryou earned greater customer confidence by developing the advanced HUD for several years now. The company has been instrumental in breakthroughs in key technologies such as product volume, display effect, enhanced reality integration, and HMI interaction, and providing customers with Windshield-HUD (W-HUD), and Augmented Reality-HUD (AU-HUD) series products and solutions.

New Vision Electronics

This start-up commenced its operation in 2011 with HUD research and development testing on various technologies such as MEMS, TFT, LCOS, DMD, etc. In 2013, the company decided to go ahead with the freeform surfaces TFT solution. The first major project on its way was a collaboration with SAIC-Volkswagen on Lamando model R&D, and in 2015, the company launched its first HUD prototype and assembled it on a vehicle model.

In 2016, the production line with an annual capacity of 50,000 units started manufacturing. The first line-assembled HUD successfully rolled off with a technical service nomination from NIO Automobile. The same year, it received two production program nominations from Geely. In 2017, the production increased to an annual capacity of 200,000 units, and the first HUD for the first OEM project successfully rolled off with a technical service nomination from SAIC-Volkswagen.

In 2018, it received project nominations from Chery and BAIC-BJEV and developed an AR-HUD prototype, followed by a mandate from Lynk & Co in 2019. In the year 2020, New Vision developed the first DLP Bifocal HUD prototype in the world. However, 2021 turned out to be a year of higher mandates. The company received nominations for multiple production programs from BYD, Geely, Chery, Changan, Hongqi, etc.

The company makes windshield HUD, transparent window display, transparent A-pillar and augmented HUD.

E-lead Electronics

E-Lead is another major player in the HUD market in mainland China. The company claims to be among the pioneers of the 3D AR-HUD system functionalization in cars. Its wide range of HUD products includes AR-HUD, AR Lite HUD, AR-HUD-1 Layer, 2 Layer, 3D HUD, Passenger HUD, W-HUD, Combiner HUD, windshield reflection HUD, 3.5-inch full-color high-brightness HUD.

Zhejiang Crystal-Optech

Crystal Optech makes W-HUD and AR-HUD that are now increasingly gaining popularity among end users. The W-HUD is based on the TFT display technology that has low distortion, offers high brightness, superior uniformity, and customized product development. While the AR-HUD drivers can expand and enhance their perception of the driving environment and eliminate blind spots.

Compared with traditional HUD, AR-HUD displays a larger range, larger projection area, longer projection distance, and higher contrast/brightness. After integrating ADAS information, it can display richer and more colorful information to enhance the driving experience.

Futurus Technology

FUTURUS Technology is another major player in the Chinese markets producing W-HUDs. The company says its products offer the advantages of high display quality, lower power consumption, and smaller size. Its portfolio of products includes Standard HUD, Compact HUD, and Smart HUD.

FUTURUS’s self-developed efficient optical analysis program enables HUD to provide drivers with a clear, stable, and distortion-free display without compromising image quality even in bright light. Display brightness can be corrected actively according to the surroundings, developing the special Picture Generating Unit (PGU) design light sources well. Its HUD can achieve the same high brightness and decrease power consumption by 50%, and this design solves the problem of PGU heat management and increases product stability. By active use of volume, accurate analysis of each component, and micro modular design, FUTURUS products can save up to 50% volume against that of competition models says the company.

OEMs leverage in-house capabilities

Mainland Chinese OEMs such as BYD and Great Wall Motors (GWM) are relying on in-house sourcing of HUDs. The strategy is beneficial in term of sourcing the product at highly competitive prices and to ensure reliable supply too. Both automakers-initiated steps in this direction years ago by establishing tier 1 companies to source HUDs for captive purposes. For example, supplier Nobo Automotive is GWM’s group supplier, similarly, BYD gets its HUDs from Fudi Technology, a supplier Group of the OEM. For its software needs for AR-HUD, BYD in 2022 partnered with Raythink to work together on advanced optics and AR software development capabilities.

Conclusion

In S&P Global 2022 HMI consumer analysis, HUD globally ranked third overall for feature desirability at 68%, pointing towards greater customer willingness towards HUDs. The analysis also revealed over 87% respondents from Chinese customers desire HUDs as a feature in their cars.

Hence, we forecast that demand for HUDs will continue to soar in mainland China, and local suppliers with strong technological capabilities are likely to assert their dominance in the market. Notwithstanding the stronger competitiveness of the overseas players, what works in favour of local suppliers is the closer collaboration with domestic OEMs, a better understanding of the local market, and some pricing advantages by local manufacturing factors. What will also determine the shape of the market is the top OEMs’ strategy to source HUDs in-house, this intensifies the overall competition and consequently alters the HUD market landscape.

Kiran Bajad, Senior Research Analyst, Connected Car, Software, UI/UX at S&P Global Mobility

Kiran‘s Bajad

For more information about S&P Global ATI insight please click here