By Amara Ashfaq, Business Analyst – at Power Technology Research

- Country-wide policies and targets set by OEMS to mitigate climate change are accelerating the electrification of trucks and buses.

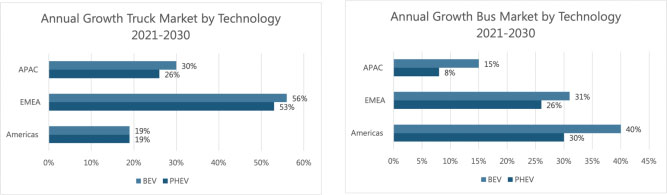

- BEVs will remain the fastest growing segment for both electric trucks and buses, for the period 2021-2030.

- Between 2021-2030, electric trucks are expected to experience the greatest year-on-year growth in the EMEA at 56%. Electric buses are predicted to experience the most year-on-year growth in the Americas, at 39%.

The climate crisis has propelled countries and companies into taking decisive action to limit global warming to well below 2°C, ideally 1.5°C, when compared to pre-industrial levels. This has led to an accelerated journey towards electrification, including electric buses and trucks. While the current landscape for buses and trucks may favor internal combustion engines (ICEs), the forecasted path for electric buses and trucks looks promising.

The Global Truck and Bus Market

BEV and PHEV Distribution

Globally, Battery Electric Vehicles (BEV) are projected to command the majority of the market share in 2030, the trend continuing on from 2021. BEV models dominate over Plug-in Hybrid Electric Vehicles (PHEV) when it comes to both buses and trucks. The regional distribution of the current and projected market shares for buses and trucks is described below.

The Electric Truck Market

- The electric truck market in the Americas is projected to remain the same in 2030 as it did in 2021, with regard to the market share of BEVs and PHEVs, with the former controlling 95% of the market.

- Similarly, EMEA’s electric truck market was dominated by BEVs in 2021, with a market share of 96%, and is projected to remain the same in 2030.

- APAC’s electric truck market also shows BEVs controlling the majority of the market share: 94% in 2021 and projected to strengthen to 95% in in 2030.

The Electric Bus Market

- The electric bus market in the Americas saw BEVs control 89% of the market share in 2021, with PHEVs having the remaining 11%. This domination of BEVs is expected to increase to 94% of the market share in 2030.

- Similarly, EMEA’s electric truck market was dominated by BEVs in 2021, with a market share of 99%, and is projected to remain the same in 2030.

- APAC’s electric truck market also shows BEVs controlling the majority of the market share: 93% in 2021 and projected to strengthen to 96% in in 2030.

Electric Annual Sales by Weight

The Electric Truck Market

Medium-Duty Trucks (MDT), trucks that weigh between 3.5 and 12T, were edged out by Heavy-Duty Trucks (HDT), trucks that weigh more than 12T, with regard to market shares in most regions of the world, with the exception of the Americas.

- The electric truck market in the Americas saw MDTs control 63% of the market share in 2021, with HDTs controlling the remaining 37%. However, HDT sales are expected to flourish and increase to 47% of the market share in 2030

- The EMEA’s electric truck market was dominated by HDTs in 2021, with a market share of 66%, and is projected to grow to 80% in 2030.

- APAC’s electric truck market also shows HDTs controlling the majority of the market share: 72% in 2021 and projected to strengthen to 82% in in 2030.

The Electric Bus Market

Heavy-Duty Buses (HDB), buses that weigh more than 12T, continue to dominate the electric bus market globally, edging out Medium-Duty Buses (MDB), buses that weigh between 3.5 and 12T.

- The electric bus market in the Americas saw HDBs control 84% of the market share in 2021, with MDBs having the remaining 16%. This domination of HDBs is expected to decrease to 79% of the market share in 2030.

- The EMEA’s electric truck market was dominated by HDBs in 2021, with a market share of 74%, and is projected to increase to 79% of the market share in 2030.

- APAC’s electric truck market also shows HDBs controlling the majority of the market share: 87% in 2021 but projected to weaken to 84% in in 2030.

The Electrification Landscape

Overall, with regards to both electric buses and trucks, annual sales are projected to increase between 2021 and 2030. However, internal combustion engines (ICE) continue to dominate in 2030, with notable exceptions in the electric bus market.

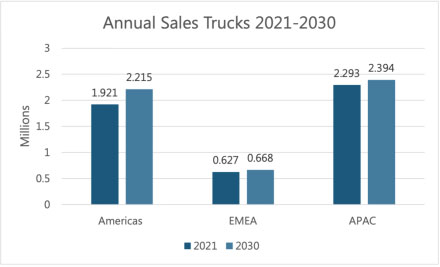

1. ICEs overwhelmingly dominate the truck market in terms of sales, in both 2021 and 2030, according to projections. This holds true for the Americas, EMEA, as well as APAC. While there is an increase in the annual sales of ICEs, there is also an encouraging increase in the annual sales of electric trucks: from 1.921m in 2021 to a projected 2.215m in 2030 in the Americas; from 0.627m in 2021 to 0.668m in 2030 in EMEA; from 2.293m in 2021 to 2.394m in 2030 in the APAC region.

Figure 1: Annual Sales of Electric Trucks, 2021 and 2030.

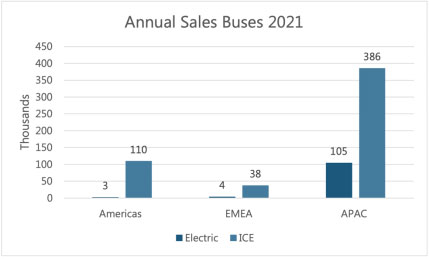

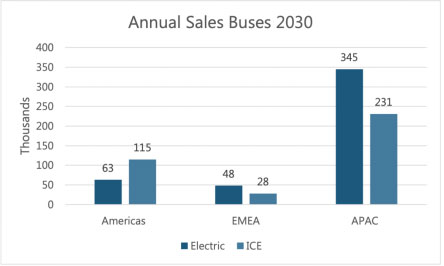

In contrast, there has been an evolution in the bus market. While ICEs dominated annual bus sales in 2021, that is forecasted to no longer be the case in 2030. Electric bus sales are projected to increase well beyond the sale of ICE buses in EMEA and APAC. In fact, annual ICE bus sales are expected to drop from 2021 levels: from 38,000 to 28,000 in EMEA, and from 386,000 in 2021 to 231,000 in 2030 in APAC. Annual sales for electric buses, on the other hand, saw a boom: from 4,000 in 2021 to 48,000 in 2030 in the EMEA and from 105,000 in 2021 to 345,000 in 2030 in the APAC region. The only region where ICE buses are projected to continue their domination is in the Americas, where annual sales were 110,000 in 2021 and will increase to 115,000 in 2030. However, the annual sales of electric buses in the Americas saw an increase as well, from a mere 3,000 to 63,000 in 2030. This showcases more growth in the electric bus market than in the ICE bus market, which is encouraging as well.

Figure 2: Annual Sales of Electric Buses, 2021.

Figure 3: Annual Sales of Electric Buses, 2030.

The projected increase in the annual sales of the electric truck market, coupled the predicted domination of the electric bus market is, no doubt, a consequence of intentional efforts on the parts of manufacturers, governments, and private entities to phase out ICEs and usher in electric vehicles, in direct response to the climate emergency.

OEM Targets

The climate crisis has urged leading OEMs in joining nations to declare their own carbon neutrality goals as well as defining targets to phase-out ICEs. Numerous OEMs have also announced electric bus and truck models in the coming years. These include the eCanter by FUSO, eActros by Mercedes-Benz, Semi by Tesla, and Urbino by Solaris, among a host of others.

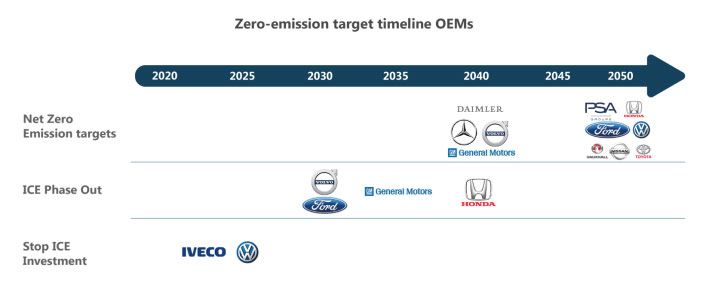

Some goals by OEMs, to accelerate the clean-energy transition, are described below:

- Vauxhall, Ford, Honda, Toyota, Nissan, Volkswagen, and the PSA Group have set 2050 as the year by which to target net-zero emissions.

- Daimler, Volvo, and General Motors have defined a stricter goal: net-zero emissions by 2040.

- Timelines for ICE phase-outs have also been set-up: Volvo and Ford aim to phase-out ICEs by 2030, General Motors has targeted 2035, and Honda has set 2040 as the year by which to accomplish this goal.

- Additionally, IVECO and Volkswagen have committed to putting an end to their ICE investment by 2025.

Figure 4: Zero-emission target timeline for OEMs.

Private and Public Entities’ Targets

The world is currently undergoing an energy transition, and multiple initiatives have been formed in order to accelerate the adoption of electric trucks and buses. The ZEBRA Partnership, EV100, and CALSTART Drive to Zero are some examples of these initiatives.

The Zero Emission Bus Rapid-deployment Accelerator (ZEBRA) partnership recently announced an investment of more than USD 1B in order to procure zero-emission public bus fleets in Latin America, organized by C40 Cities and the ICCT. In addition, bus manufacturers and distributers such as Volvo, Zhongtong, Busscar, IUSA, and Rennorgy have committed to making zero-emission vehicles commercially available in Latin America and locally sourced, where possible.

EV100 is an initiative that includes 123 members, spanning over 98 markets, that have committed to transitioning their fleets to EV and/or install charging infrastructure by 2030. Among a host of others, members include ABB, LG Energy Solution, Schneider Electric, and Siemens. A total of 5.5m vehicles have been committed by 2030 by various public and private authorities, including airport and transit authorities such as Heathrow Airport. To date, over 200,000 EVs have been deployed by EV100 members, with approximately 21,000 charging units installed.

The CALSTART Drive to Zero is a campaign aimed at accelerating the growth of the global zero- and near-zero-emission (ZE) commercial vehicle space. The goal is to make the ZE technology commercially competitive by 2025 and dominant by 2040 in specific vehicle segments and regions. The campaign, in collaboration with Clean Energy Ministerial, a high-level global forum to promote policies and programs that advance clean energy technology, aims at 100% Zero-Emission New Truck and Bus Sales & Manufacturing by 2040. CALSTART Drive to Zero has been endorsed by fifteen countries as well as subnational government agencies, industry players, and implementation partners.

Global Initiatives

Country-wide policies, aimed at tackling the climate crisis, have been crucial on the journey towards electrification:

- Canada has pledged USD 2.2b in funding, over the next five years, to support the decarbonization of public transit, including zero-emission public transit and school buses.

- In the U.S., sales of new medium- and heavy-duty trucks are to be 30% zero-emissions by 2030 and 100% zero-emissions by no later than 2050. Moreover, 100% of new buses purchased by transit agencies should be zero-emission by 2029. Where feasible, all medium- and heavy-duty vehicles in operation should be 100% zero-emissions by 2050.

- Europe boasts a number of initiatives such as Fit for 55, the Clean Vehicles Directive, and the Alternative Fuels Infrastructure Regulation

- In 2019, the Chinese government introduced multiple subsidies on electric trucks. These subsidies and policies called for manufacturers to produce at least 10% of their vehicles as electric. Additionally, subsidies of USD 72,500 on every fuel cell electric bus and truck that was bought were announced, automatically boosting truck sales. EVs are also exempt from purchase tax until December 2022.

- Faster Adoption and Manufacturing of Hybrid & Electric Vehicles in India (FAME), a scheme launched in India in 2015 under the National Electric Mobility Mission, is granting multiple subsidies and incentives in order to promote the adoption of Electric Vehicles. Furthermore, the Ministry of Heavy Industries has also sanctioned 2,877 EV Charging Stations, with an investment amounting to approximately USD 60m in 68 cities across 25 States under FAME II.

Looking Ahead

Growth in the electric buses and trucks categories looks very promising. Between 2021-2030, the electric truck market is expected to grow by 19%, 56%, and 29% in the Americas, EMEA, and APAC, respectively. Even more encouragingly, the ICE truck market in these regions is expected to grow by a mere 2% in the Americas and APAC, and by 1% in EMEA. Annual growth in the electric bus market, between 2021 and 2030, is predicted at 39% for the Americas, 31% for EMEA, and 14% for APAC. The ICE bus market is expected to grow at 1% in the Americas and is predicted to garner negative growth in the EMEA and APAC regions.

Figure 5: Annual Growth in the Electric Buses and Trucks Market, by Technology (2021-2030).

Contact:

Hassan Zaheer - Exec. Director Client Relations & Advisory

+49-89-12250950