Under the newly released guidance on foreign entity of concern (FEOC), a critical mineral extracted by an entity that is not an FEOC but processed by an entity that is an FEOC would not be eligible for tax credits under the Inflation Reduction Act (IRA) in the US

A little over 15 months after the US President Joe Biden signed the US Inflation Reduction Act (US IRA) into law, the government has released guidance on the foreign entity of concern (FEOC), further raising the eligibility criteria for electric vehicles to qualify for a total tax credit of $7,500.

On Dec. 1, 2023, the US Treasury Department and the Internal Revenue Service (IRS) published guidance on compliance with the prohibitions around FEOC in relation to the IRA’s Section 30D Clean Vehicle Tax Credit. On the same day, the US Energy Department (DOE) published a proposed guidance on the definition of “Foreign Entity of Concern (FEOC)” in the Bipartisan Infrastructure Law (BIL).

The new FEOC requirements entail that starting from 2024, an eligible EV must not contain any battery component that is manufactured or assembled by an FEOC, and, beginning in 2025, a clean vehicle must not contain any critical minerals that were extracted, processed or recycled by an FEOC.

These FEOC requirements are placed on top of the existing statutory criteria set out for the sourcing of battery components and critical minerals used in EVs to be eligible for tax credits under the IRA’s Section 30D in August 2022.

It is already known that to qualify for EV tax credits under the IRA, the EVs must be produced or assembled in North America and must not have a retail price exceeding $80,000 for electric vans, pick-up trucks and sport utility vehicles (SUVs), and $55,000 for other EVs including sedans and hatchbacks.

In addition, the US IRA mandates that at least 40% of the critical minerals used in the EV batteries must be either extracted or processed in the US or in any country that has a free trade agreement (FTA) with the US as early as the beginning of 2023. This requirement steps up to 50% for 2024 and to 70% for 2026, and to at least 80% after that.

Further, it also requires that at least 50% of the value of the battery components must be either manufactured or assembled in North America in 2023. From 2024, this must be at least 60%, further stepping up to 70% from 2026, and 100% from the beginning of 2029.

Complying with both the mandates on the sourcing requirements of EV battery components and critical minerals, each of which help in qualifying for the tax credit of $3,750, leads the eligible EV to qualify for the total tax credit of $7,500, significantly bringing down the cost for end buyers.

The Biden administration said that since the enactment of the IRA in 2022, companies have announced nearly $100 billion in new zero-emission vehicles and battery investments in the US. In parallel, government grants and funding under the BIL and IRA, including the $6 billion in awards from the US DOE’s Battery Processing and Manufacturing Grants, continue to directly build domestic battery supply chains.

Nevertheless, the new guidance adds another layer of FEOC requirements to the existing funnel, which aims to further narrow down the qualifying passage for EVs powered with batteries using materials extracted and processed in a listed FEOC. That brings us to understand how the US DOE defines the FEOC.

Foreign Entity of Concern

The US DOE’s proposed guidance on FEOC mainly covers four countries — the People's Republic of China (PRC), the Russian Federation, the Democratic People's Republic of North Korea and the Islamic Republic of Iran. According to the US DOE’s proposed document, published in the US government’s Federal Register, foreign entities qualify as FEOCs if they are being “owned by, controlled by, or subject to the jurisdiction or direction of a government of a foreign country that is a covered nation.”

The proposal asks automakers seeking EV tax credits in the US to conduct their due diligence in ensuring that battery components and critical materials are not sourced, extracted and processed in the above-listed FEOC countries.

As such, the proposed FEOC guidance suggests that while the compliance for battery components would be determined by where they are manufactured or assembled, the same for critical minerals would be determined by evaluating all the different stages involved in the mineral extraction, processing and recycling. According to the US DOE, these conditions will translate into a scenario where a mineral extracted by an entity that is not an FEOC but processed by an entity that is an FEOC would not be compliant under the new rule.

As a result, the carmakers will be required to follow industry standards for accurately tracing their EV battery materials across the upstream supply chain.

Nevertheless, the DOE acknowledges the current scenario where the global battery-material supply chain continues to remain heavily dependent on [mainland] China and that every supplier may not be able to accurately trace the extraction and processing of these materials. Therefore, it has proposed a temporary transition rule, wherein critical minerals and associated materials may be allocated to a specific set of battery cells, which would then have to be physically tracked to batteries and the EVs in which they are used with an identification system. It has proposed a temporary three-year exemption (2024–2026) to provide the automotive industry with the time necessary to develop the ability to trace certain low-value materials with precision.

The US DOE guidance has asked for general comments from experts on the need for this rule, the type of materials that should be exempted and if there can be alternative solutions to make this transition smoother.

Moreover, the DOE has proposed that starting in 2025, it would create a review system that would provide an additional layer of monitoring the FEOC compliance, in addition to providing certainty to the EV makers. Under this proposed review system, the IRS would track down the FEOC compliance by studying a compliant-battery ledger, which would contain details of the batteries used in EVs that are placed in service in 2025 or later.

Consequently, the automakers would be required to submit an estimate of the number of FEOC-compliant batteries they plan to source each year to the IRS, along with supporting documents. While the DOE would review these submissions, the proposed review system aims to offer EV makers a limited window for applying for the clean vehicle credit under section 30D.

The US DOE’s proposed FEOC terminology interpretations

For the DOE, the entity will be categorized as an FEOC under the BIL if it meets the definition of a “foreign entity” and either is “subject to the jurisdiction of a covered nation government” or “owned by,” “controlled by” or “subject to the direction of the government of a foreign country,” which is a listed nation.

a) Foreign entity: The DOE has proposed that a foreign entity would mean:

i) A government of a foreign country;

(ii) A person who is not a lawful permanent resident of the US, a citizen of the US or any other protected individual;

(iii) A partnership, association, corporation, organization or other combination of persons organized under the laws of, or having its principal place of business in a foreign country; or

(iv) An entity organized under the laws of the US that is owned by, controlled by or subject to the direction of an entity that qualifies as a foreign entity stated as above [in paragraphs (i)-(iii)].

b) Government of a foreign country:The DOE has proposed the following interpretation for this subhead:

i) A national or subnational government of a foreign country;

(ii) An agency of a national or subnational government of a foreign country;

(iii) A dominant or ruling political party of a foreign country [for example, Chinese Communist Party (CCP)];

(iv) A current or former senior foreign political figure. This would include immediate family members of the said senior official as well.

c) Subject to the jurisdiction:The DOE proposes that a foreign entity is “subject to the jurisdiction” of a covered nation government if:

(i) The foreign entity is incorporated or domiciled in a covered nation; or

(ii) If the FEOC supplying critical minerals or battery components engages in the extraction, processing or recycling of such minerals, or the manufacturing or assembly of such components in a covered nation.

d) Owned by, controlled by or subject to the direction: TheUS DOE interprets that an entity is “owned by, controlled by, or subject to the direction” of another entity, including the government of a foreign country that is a covered nation, if:

(i) 25% or more of the company’s board seats, voting rights, or equity interest are cumulatively held by that other entity, whether directly or indirectly; or

(ii) With respect to the critical minerals and battery components of a given battery, the company has entered into a licensing arrangement with another entity that entitles that other entity to exercise effective control over the extraction, processing, recycling, manufacturing or assembly of the critical minerals and battery components.

What the industry says

The Alliance for Automotive Innovation (AAI), a US auto lobbying body, said that the new FEOC guidance provides clarity to the automakers on EV tax credit eligibility from Jan. 1, 2024, onward.

In a blog post published on Dec. 1, 2023, John Bozzella, president and CEO of AAI, said, “FEOC informs not only which new light-duty EVs qualify for some or all of the $7500 30D tax credit in 2024, but how automakers can structure production facilities and battery supply chains to produce EVs that qualify for this customer incentive.”

AAI lauded the Treasury Department’s provision to exempt trace materials from the FEOC guidance, citing that it was necessary to consider the usage of inconsequential materials and parts from an FEOC for a limited time, or else the policy would be redundant.

“We argued a fastener used in an EV battery assembly, dipped in a material from an FEOC shouldn’t disqualify the battery or EV (and ultimately the consumer) from the credit. Imagine an EV that complied with all IRA eligibility requirements but is kicked out because of a negligible amount of a critical mineral or component coming from an FEOC. That wouldn’t make sense — or good policy,” Bozzella noted.

Nevertheless, even as the carmakers continue to assess the eligibility of EVs currently for sale while working on the supply chains for their upcoming models, AAI said that about 20 out of more than 103 EV models in the US will qualify for tax credits under the new rules.

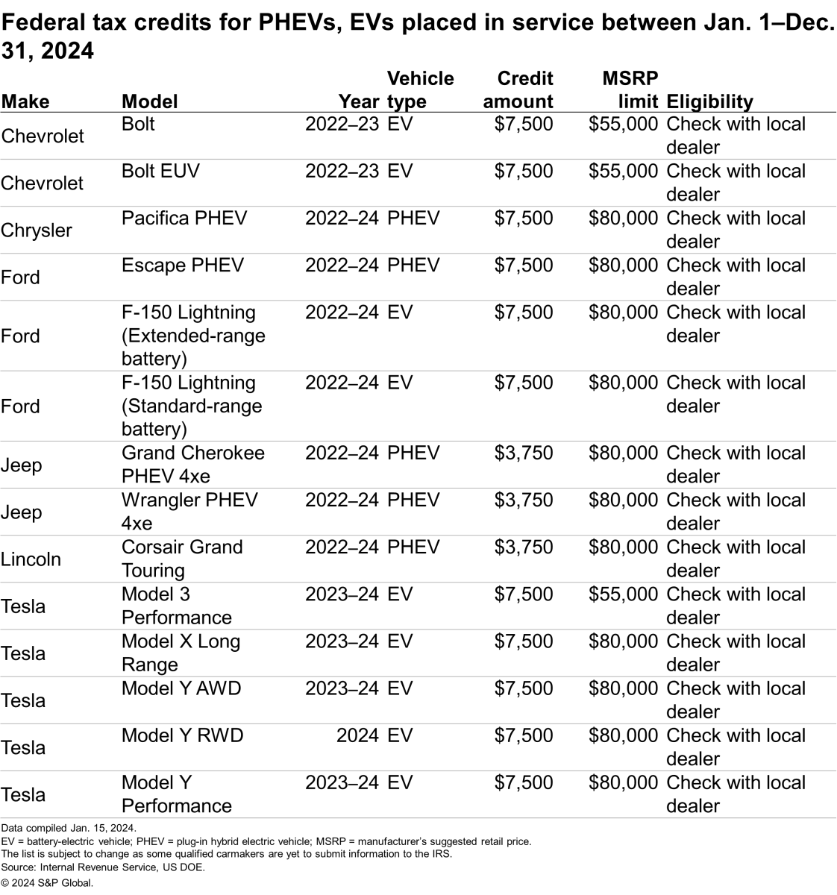

According to the official US government website (https://fueleconomy.gov), 17 models, including variants, are listed as the eligible EVs for the period of Jan. 1–Dec. 31, 2024. However, it mentioned that the vehicle eligibility for some makes and models depends on the delivery date of the vehicle. That said, it added that some qualified manufacturers have yet to submit information on eligible vehicles that meet the current requirements.

The following table lists eligible battery-electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs) as per the US government website. However, the list is subject to change over time.

Tesla loses tax credits on Model 3

In December 2023, Tesla had announced on its social media handle that some variants of Model 3 will lose the EV tax credits under the new FEOC guidelines.

“Unfortunately, the federal $7,500 EV tax credit will end entirely for Model 3 RWD and Long Range delivered after 31 December 2023,” the carmaker said on its X handle on Dec. 13, 2023.

Later during Jan. 12, 2024, Tesla announced that it had launched the upgraded Model 3 with a starting price tag of $38,990 in North America. It remains unclear if the new Model 3 variants are eligible for the EV tax credits under the new guidelines or not.

General Motors to offer $7,500 discount on models losing eligibility

Reportedly, General Motors is offering a discount of up to $7,500 for EVs that lost their eligibility for the tax credit under the new FEOC guidelines. The cash incentive was rolled out by the carmaker from the first week of January 2024. The company has already updated that the new Chevy Blazer EV and the Cadillac Lyriq would lose the eligibility for EV tax credits from Jan. 1 due to two minor components. The company said that while it has already initiated plans to source qualifying parts from other entities that are not an FEOC, it expects that the two models would soon regain their tax credit eligibility.

Currently, the Chevy Bolt is the only EV (two variants) from the stable of General Motors that qualifies for the tax credit.

S&P Global Mobility outlook

According to Eileen Wu, Senior Research Analyst at S&P Global Mobility, the new FEOC guidelines are not a shock for the companies in [mainland] China. It rather gives them a clear direction in their approach to the US market.

“Most of the [mainland] Chinese companies that have announced projects in [North America]/FTA before having either already considered some flexibility to readjust ownership structure or are looking at making it below 25%. There is more positive expectation for battery material (CAM, AAM, electrolyte) companies as the majority of them are private enterprise. And some delayed (internally considered) overseas capacity construction plan possibly will be restarted. Meanwhile, for upstream mining companies, there is concern on spodumene in Australia. For example, Greenbush and Mt Marion. Tianqi Lithium holds 26% share of Greenbush. So, it might push the mining companies to readjust the ownership structure if they want to meet IRA.”

Adding to that, Ali Adim, Senior Technical Research Analyst, battery, S&P Global Mobility, said, “While the FEOC guidelines will lead to a shakeout in the ownership structure of the [mainland] Chinese companies, it can also lead to a surge in the joint ventures between Chinese companies and non-Chinese companies. The 25% rule can be considered as toning down the earlier IRA tax that could be interpreted [as] full exclusion of Chinese influence over the supply chain. Particularly JVs in FTA countries could become an excellent route to satisfy both FEOC and minimum FTA sourcing criteria.”

Adim views FEOC conditions as a stronger criterion than the earlier minimum FTA country-sourcing mandate. “This is due to the fact that in FEOC all critical mineral for each processing step should be satisfied at the same time, whereas the threshold for FTA country sourcing provides a level of freedom to the OEMs. For example, if you can’t source graphite from [an] FTA country you can source manganese in order to meet with the threshold.”

He further added, “FEOC treats all critical minerals equally. For instance, although graphite or manganese are cheaper than nickel or lithium, they might be even more challenging to comply with FEOC criteria due to vast dominance of [mainland] China over their supply chains. As a result, the new FEOC guidelines can have [an] inflationary impact as the production costs are usually higher outside [mainland] China. The US election next year plays an important role in investment decisions. It can be expected that some of the new projects will be postponed to after the result of the election.”

Author: Amit Panday, Senior Research Analyst, Battery, S&P Global Mobility

For more information, please click here