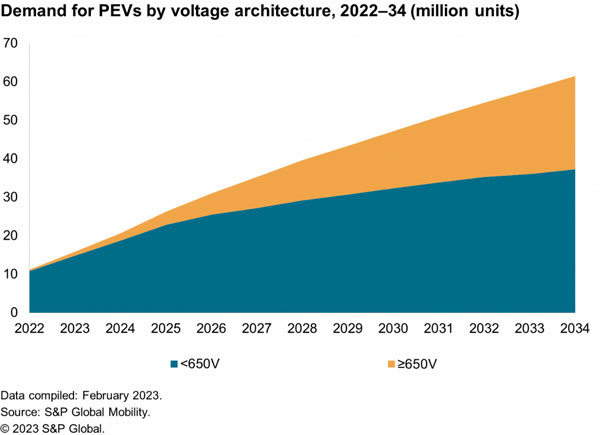

According to S&P Global Mobility, we forecast the number of vehicles equipped with high-voltage architecture of above 650V to grow at a CAGR of 16% between 2022 and 2034.

According to S&P Global Mobility, we forecast the number of vehicles equipped with high-voltage architecture of above 650V to grow at a CAGR of 16% between 2022 and 2034.

A recurring point of view of most industry watchers on the electric vehicle (EV) charging industry is that the speed of charging and easy access to charging networks will be among the most important factors that will help accelerate adoption of EVs globally. According to the S&P Global 2022 E-Mobility Consumer Survey on EV ownership and intention, nearly 43% and around 40% of the respondents, respectively, indicated the lack of charging station availability and time required for charging to be among the top reasons for not purchasing an EV again.

Besides expanding the charging network, which will include battery swapping and wireless charging solutions, OEMs and charging service providers need to heavily invest in technology and infrastructure that can charge EVs at much higher power rates and allow EV owners to reduce the pressure on the grid infrastructure and customers to sell the power back to grids.

High-power charging

One of the primary developments that needs to happen is for EVs to be able to charge at much higher power rates. To achieve this, vehicles need to be equipped with higher-voltage vehicle architectures that can withstand high-power charging. Several models—such as the Porsche Taycan, Kia EV6, Hyundai IONIQ 5, and Lucid Air—now come with an 800V or higher electric powertrain architecture. Compared with the more common 400V architecture, the 800V architecture provides significant benefits in terms of faster charging and more efficient power transfer.

As the names of the aforementioned models suggest, this technology is offered only at the premium end of the market. It is imperative for this technology to trickle down to the mass market for it to have a real impact in the industry. According to S&P Global Mobility data, the number of vehicles equipped with high-voltage architecture of above 650V is forecast to grow at a compound annual growth rate (CAGR) of 16% between 2022 and 2034 to 24.2 million units. In 2022, around 3.6% of vehicles came equipped with architectures rated 650V or above. We expect this share to jump to nearly 40% in 2034.

The DC charging standard followed by vehicles will somewhat dictate the maximum charge rate of a vehicle. Currently, there are four main DC charging standards used in EVs—the CHAdeMO, CCS, GB/T, and the Tesla standard. While the Tesla standard is mostly used for Tesla models, the adoption of the other three standards is largely dependent on the regions. CHAdeMO is mostly used by Japanese automakers, CCS is common in Europe and the North America, GB/T is used in mainland China, and Tesla standard is used exclusive for models from the US-based EV maker.

Each of these standards has different top charging rates, which have been steadily increasing. In June 2018, the CHAdeMO 2.0 protocol was released. It allowed charging at speeds of up to 400 kW, which was faster than the 350-kW limit of CCS. Even the maximum charging speeds that the CCS standard can support is set to increase in the near future to more than 500 kW.

Soon, another charging standard, called ChaoJi. is set to hit the market. The CHAdeMO Association and the China Electricity Council (CEC) have been developing the ChaoJi standard since 2018. The new standard combines CHAdeMO and GB/T connectors into a single controller area network (CAN)–based connector. The ChaoJi standard would be backward compatible with the existing CHAdeMO and GB/T fast-charging standards. In fact, we expect ChaoJi to have backward compatibility with all global standards including CCS. The CHAdeMO Association has announced that the ChaoJi standard will allow charging at speeds of up to 900 kW.

Alongside the conventional charging technologies, the charging industry is also focusing on more efficient and convenient forms of charging, such as wireless charging, battery swapping, and bidirectional charging. The development of these technologies offer value that could make owning an EV more practical.

Bidirectional charging

Another technology that will play a role in reducing the pressure on the grid infrastructure is bidirectional charging. This technology enables EVs to return a prescribed quantity of energy stored in the battery to an external load. This could be any equipment that runs on AC power, which is referred to as vehicle-to-load (V2L); to home, referred to as vehicle-to-home (V2H); or directly to the grid, referred to as vehicle-to-grid (V2G).

Bidirectional charging also provides monetary benefits for drivers. V2G technology allows customers to sell the power back to grids. This discharge from the EV battery can be programmed to be done during peak hours, when electricity rates are higher, which ensures better returns for the owner.

The use of bidirectionality is still in its infancy. One of the primary reasons is that not all charging standards are capable of V2G operations. Currently, only the CHAdeMO charging standard supports V2G technology. The other two major standards, CCS and China’s GB/T still do not support V2G. CharIn reportedly plans to add V2G capability to CCS by 2025. We expect the upcoming ChaoJi standard to feature bidirectional capability from the start.

However, V2L capability is available in some vehicles with CCS sockets including the Hyundai IONIQ5, the Kia EV6, and the Ford F-150 Lightning. The vehicles come with adapters that can be plugged into the AC port, which can then power appliances.

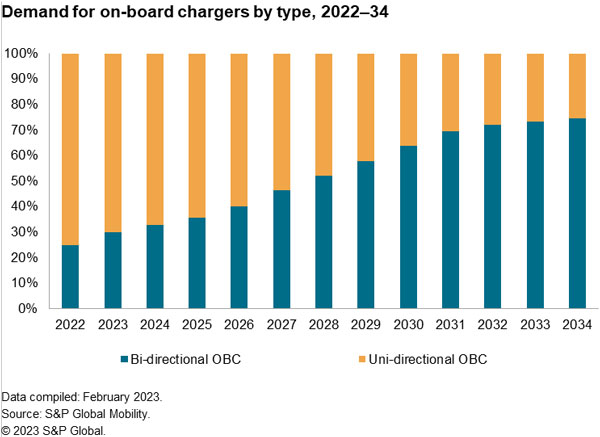

To enable bidirectionality, vehicles need to be equipped with a bidirectional on-board charger (OBC). As mentioned, several automakers are already manufacturing cars that are bidirectional charging–ready, mainly to enable V2L charging. Nearly 25% of the demand for OBCs was for bidirectional OBCs in 2022. We forecast demand to grow at an 11.3% CAGR between 2022 and 2034 to reach a share of around 70%.

For more information and analysis, read our report Charging requirement for upcoming xEVs.