Despite numerous challenges, hydrogen is emerging as a low-carbon alternate fuel option for the mobility sector, primarily because of hard-to-find alternatives for long-haul transportation

Hydrogen Mobility Market: Introduction

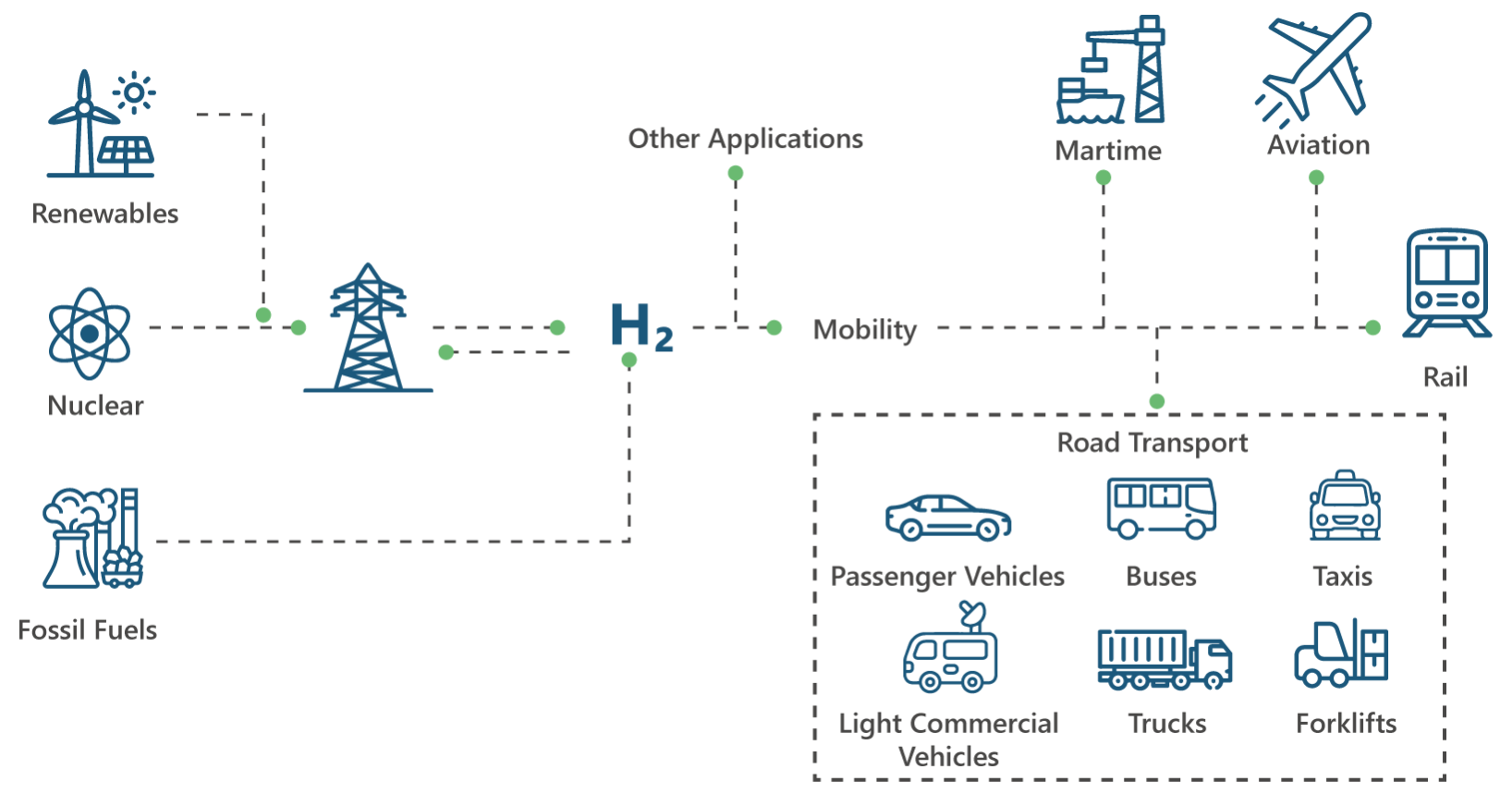

Despite numerous challenges, hydrogen is emerging as a low-carbon alternate fuel option for the mobility sector, primarily because of hard-to-find alternatives for long-haul transportation. Hydrogen usage in the mobility sector can be further segmented into four categories: road transport, maritime, aviation, and rail, as shown in Figure 1.

Figure 1: Scope of hydrogen in the mobility sector

Source: PTR Inc.

Global Hydrogen Mobility Market Landscape

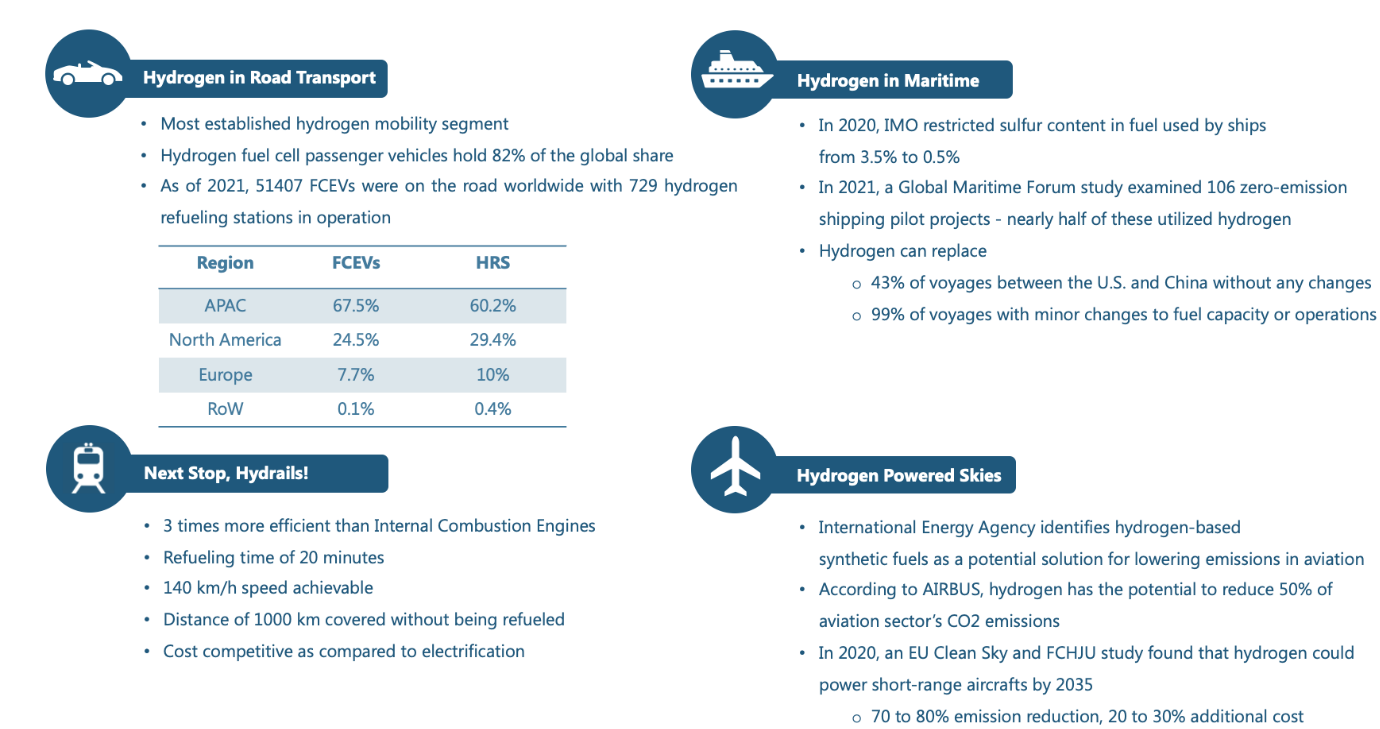

There lies huge potential in utilizing hydrogen for the decarbonization of the mobility sector, due to which the global hydrogen mobility market is rapidly growing. This can be proven with the help of some key statistics as shown in Figure 2 below.

Figure 2: Global hydrogen mobility market landscape

Source: PTR Inc.

Regional Analysis of the Hydrogen Mobility Market

APAC Leading the Hydrogen Mobility Market

1. National Hydrogen Strategies and Targeted Mobility SectorsIn the Asia-Pacific region, Japan, South Korea, Australia and India are the only countries that have published their National Hydrogen Strategies. If the vision and targeted sub-sectors of these countries are analyzed, a strong focus on FCEV deployment is seen, with China, Japan, and South Korea focusing on Fuel Cell (FC) passenger vehicles, buses, and taxis whereas Australia targets the FC heavy-duty transport sector. Some R&D initiatives are also seen in the rail and maritime sectors in China, Australia, and Japan. A few examples of these are as follows:

- Hydrobingo Project: It is the world’s 1sthydrogen-powered ferry that has been launched in Japan.

- Three Gorges Hydrogen Boat No. 1 Project: It is China’s 1st hydrogen fuel cell-powered boat.

- China has also launched Asia’s 1stand the world’s 2nd hydrogen-powered train.

Examining the supporting policies, regulations and incentives being offered in this region, it is evident that the APAC region faces a lack of proper regulations and legislations to support the hydrogen mobility market. However, this region offers a great number of subsidies and incentives for the deployment of hydrogen FCEVs. These are as follows:

- South Korea provides a national subsidy for purchasing FCEVs whereas state-level subsidies also offered in Busan and Incheon.

- China provided tax reductions and direct subsidies for FCEVs up till 2022. From 2023 onwards, public financial support will be provided in the form of tax exemptions and incentives.

- Japan provides subsidies for purchasing FCEVs at the national and local levels.

- In Australia, several state level subsidies are offered. The Australian Capital Territory offers a 2-year free registration for FCEVs until June 2024. South Australia offers subsidies and a 3-year registration exemption for FCEVs. In New South Wales, rebates are being offered on the purchase of FCEVs. In the state of Victoria, subsidies are provided to the 1st20,000 FCEVs sold at a certain price. The state of Western Australia provides the largest rebate offer in Australia to the 1st 10,000 Western Australians that buy an FCEV.

North America Stepping Up its Game

1. National Hydrogen Strategies and Targeted Mobility SectorsIn the North American region, only the U.S. and Canada have published their National Hydrogen Strategies. Analyzing the vision and targeted sectors of these strategies, it is observed that again there is a strong focus on FCEV deployment. The U.S. state of California leads the hydrogen mobility sector in the region with the highest number of FC passenger vehicle deployments and hydrogen refueling stations (HRS). At the federal level, the U.S. targets all types of FCEVs. even including material-handling vehicles. The Canadian provinces of Alberta and British Colombia focus on FC trucks and buses whereas Quebec and Ontario also emphasize on the usage of hydrogen in the mobility sector. Some initiatives are also seen in the aviation, maritime, and rail sectors. A few examples of these are as follows:

- Sea Change Vessel Project: This is a 75-passenger hydrogen FC ferry launched in San Francisco.

- Lighting McClean Project, Washington: It is equipped with the largest hydrogen fuel cell ever to power an aircraft.

- Coradia iLint Project: It is North America’s 1sthydrogen-powered train that is all set to debut in Canada this year.

2. Supporting Policies, Regulations, and Incentives:

Examining the supporting policies, regulations and incentives being offered in this region, it is clear that this region has a fairly advanced regulatory framework to support the hydrogen mobility sector. Key regulations supporting hydrogen in mobility sector are as follows:

- Last year, the Inflation Reduction Act (IRA) was implemented in the S..It offers

- Up to 3 USD/kg for low-carbon hydrogen production

- Up to 100,000 USD for construction of Hydrogen Refueling Stations (HRS)

- Up to 7,500 USD credits for new clean vehicle purchases

- Up to 4,000 USD for used clean vehicle purchases

- Up to 40,000 USD for FC trucks and buses being tested and deployed in the U.S.

- The Hydrogen for Trucks Act also implemented in the U.S. offers incentives for hydrogen FC trucks and construction of the corresponding HRS.

- The Canadian ‘Zero-Emission Vehicles Act’ requires automakers to meet an escalating annual percentage of new light-duty ZEV sales and leases. The targets are as follows:

- 10% of light-duty vehicle sales by 2025

- 30% of light-duty vehicle sales by 2030

- 100% of light-duty vehicle sales by 2040

- Examining the subsidy schemes and incentives being offered in the region reveals that in the U.S., California and Connecticut offer rebates on purchase and lease of FCEVs. On the other hand, in Canada, consumers receive a federal incentive for purchasing FCEVs. Moreover, incentives are also offered in the provinces of Quebec, British Colombia, and Yukon.

Europe Advancing Towards Hydrogen Mobility

1. National Hydrogen Strategies and Targeted Mobility SectorsIn the European region, Austria, Belgium, Czech Republic, Denmark, France, Finland, Germany, Hungary, Italy, Lithuania, the Netherlands, Norway, Poland, Portugal, Spain, Slovakia, Sweden, and the United Kingdom have published their National Hydrogen Strategies. If the vision and targeted sectors of these strategies are analyzed, it is seen that Spain, Norway, and the Netherlands are targeting light- and heavy-duty FCEVs whereas Germany, Italy, and Switzerland are focusing on FC heavy-duty vehicles for example trucks and military vehicles. Poland emphasizes on FC buses only whereas France targets both FC light-duty commercial vehicles (LCVs) and heavy-duty vehicles. Hydrogen initiatives are also seen in the aviation, maritime, and rail sectors. A few examples of these are as follows:

- ZeroAvia: It is the world’s largest aircraft powered by a hydrogen-electric engine.

- Hy4 Project: It holds the world record for highest-flying altitude by a hydrogen aircraft.

- Coradia iLint Project: It is the world’s 1stpassenger train powered by hydrogen fuel cells.

- HydroFLEX Project: It is the UK’s 1sthydrogen-powered train.

- Topeka: base to base Project: It is the world’s 1sthydrogen-powered zero-emission cruise ship concept.

Despite having a huge investment plan, several published strategies, and highly ambitious targets, Europe lags behind other regions in adopting hydrogen in the mobility sector. It is due to the fact that actual implementation of hydrogen powered mobility is facing challenges due to a lack of proper infrastructure and low public acceptance.

- However, to overcome these challenges, the Alternative Fuels Infrastructure Regulation (AFIR) has been introduced, which mandates EU member states to construct:

- 1 HRS after every 100 km and have at least one 700 bar dispenser at each HRS

- 1 liquid hydrogen dispenser after every 400 km

- At least one HRS per urban node by 2027

- Hydrogen and ammonia refueling points at TEN-T core maritime ports by 2025

- Work on the rollout of infrastructure for hydrogen-powered planes at airports

- Examining the subsidy schemes and incentives being offered in the region, it is seen that Denmark exempts hydrogen cars from initial registration taxes whereas Germany provides environmental or innovation bonuses for purchasing FCEVs. Switzerland exempts FCEVs from performance‐related heavy vehicle charges and petroleum taxes whereas subsidies and incentives are also offered in Austria, Spain, Italy, France, and Sweden.

Conclusion

The heightened interest in implementing hydrogen in the mobility sector is being driven in part by the global movement towards addressing climate change. Hydrogen, as a zero-emission technology, can play a major role in the decarbonization of the mobility sector. National hydrogen strategies, regulations, and subsidy schemes and incentives being offered in several countries around the world are significantly driving the growth of the hydrogen mobility market. This supporting policy framework can help hydrogen in contributing greatly towards global efforts to reduce emissions associated with the mobility sector.

Jannat Wasif is working as Lead Analyst Hydrogen at PTR Inc. She performs in-depth research and analysis across the entire value chain of hydrogen and has represented PTR at external speaking engagements. She maintains a comprehensive database of installed and planned hydrogen projects across the world along with an all-inclusive report on the hydrogen market. Jannat has a technical background with an MS and BS degree in Electrical Power Engineering from NUST and CUI respectively and has previously worked as a Research Assistant at U.S. Pakistan Centre for Advanced Studies in Energy, NUST. She has a journal publication on Virtual Power Plants and is proud to have been awarded the Campus Silver Medal for her outstanding academic performance at CUI.

Jannat Wasif is working as Lead Analyst Hydrogen at PTR Inc. She performs in-depth research and analysis across the entire value chain of hydrogen and has represented PTR at external speaking engagements. She maintains a comprehensive database of installed and planned hydrogen projects across the world along with an all-inclusive report on the hydrogen market. Jannat has a technical background with an MS and BS degree in Electrical Power Engineering from NUST and CUI respectively and has previously worked as a Research Assistant at U.S. Pakistan Centre for Advanced Studies in Energy, NUST. She has a journal publication on Virtual Power Plants and is proud to have been awarded the Campus Silver Medal for her outstanding academic performance at CUI.