The growing trade tensions between the United States and China have led to significant economic measures.

- The growing trade tensions between the United States and China have led to significant economic measures.

- The tariffs may result in higher costs for U.S. consumers, as the increased price of Chinese EVs could be passed on to buyers, potentially slowing the adoption of EVs and undermining environmental goals.

- As the landscape continues to shift, China’s moves in Mexico could redefine the balance of power in the North American EV market.

The growing trade tensions between the United States and China have led to significant economic measures, including the imposition of tariffs on Chinese electric vehicles (EVs). As both nations vie for dominance in technology and manufacturing, the tariffs serve as a crucial point of contention, shaping the future of the global EV market.

For the U.S., the tariffs are a tool to protect domestic industries and address trade imbalances, while for China, the restrictions threaten its expansion into the world’s largest automotive market. Amidst these challenges, China's strategic interest in Mexico’s burgeoning EV sector presents new opportunities to bypass U.S. tariffs and secure access to North American consumers. This article explores the multifaceted impact of these tariffs and the role of Mexico as a critical player in the evolving EV landscape.

The Impact of Tariffs on the US and China

The U.S. tariffs on Chinese electric vehicles (EVs) could bolster the domestic EV industry by making Chinese imports less competitive, leading to increased investment in U.S. manufacturing, job creation, and innovation. Additionally, by reducing reliance on Chinese technology, the U.S. could enhance national security and protect critical industries from potential risks. The tariffs might also help reduce the trade deficit with China, as consumers and businesses may opt for domestic or non-Chinese alternatives.

On the downside, the tariffs may result in higher costs for U.S. consumers, as the increased price of Chinese EVs could be passed on to buyers, potentially slowing the adoption of EVs and undermining environmental goals. U.S. companies that rely on Chinese components for EV production may face supply chain disruptions and increased costs, affecting their competitiveness.

Additionally, the tariffs could provoke retaliation from China, leading to an escalation in trade tensions and potentially harming the U.S. economy. Finally, these tariffs could distort the global market, with Chinese manufacturers seeking alternative markets, possibly reducing the U.S. share in the global EV market and affecting the long-term competitiveness of U.S. firms.

On the other hand, exports of electric vehicles (EVs) to the U.S. are vital for China as they provide access to one of the world's largest automotive markets, enabling manufacturers to expand their global presence and achieve economies of scale. Moreover, success in the competitive U.S. market enhances China's reputation for technological innovation and drives advancements in EV technology.

Additionally, entering this market opens opportunities for strategic partnerships and helps address trade imbalances, potentially leading to more favorable trade relations. Overall, exporting to the U.S. is a strategic move for China to boost growth, innovation, and its global influence in the automotive sector.

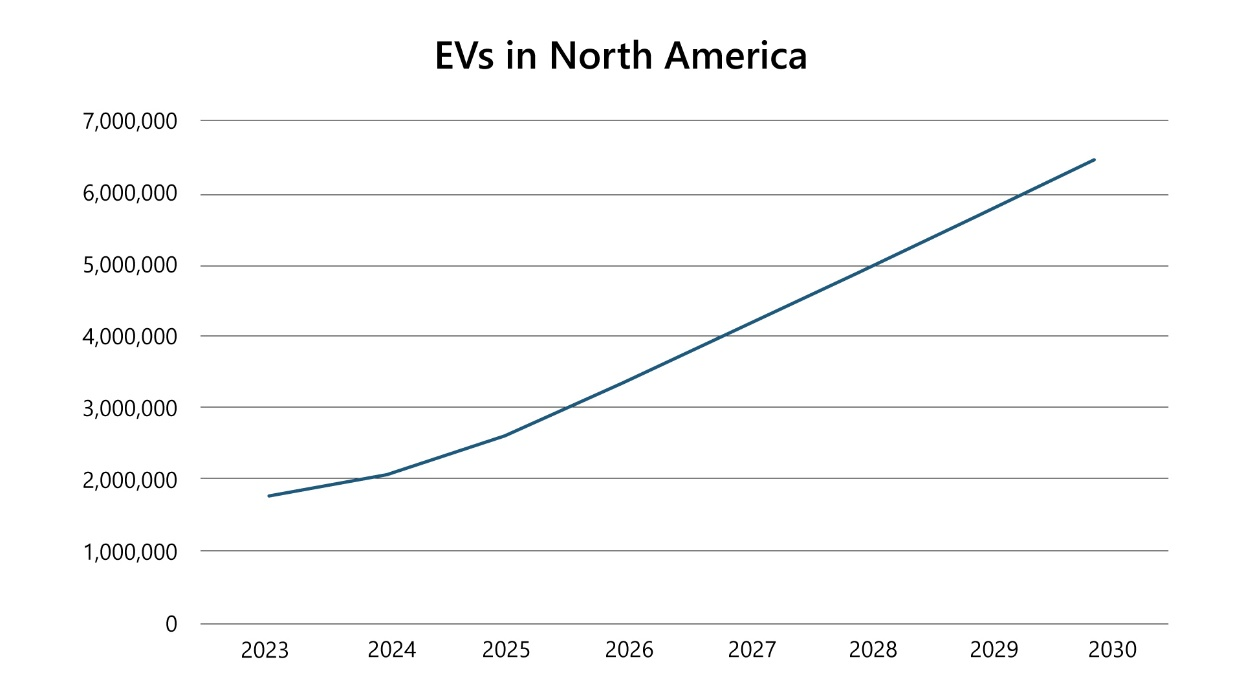

Figure 1: EVs in North America.

Source: PTR Inc.

Chinese Penetration into the Mexican EV Market

China has made significant strides in Mexico’s electric vehicle (EV) sector and manufacturing landscape in recent years. This will facilitate China in bypassing the U.S. tariffs on China’s electric vehicle sector.

- BYD’s Expansion: BYD, a prominent Chinese EV manufacturer, has made a notable entry into the Mexican market. The company launched its plug-in hybrid electric vehicle (PHEV) truck in Mexico, marking its first vehicle introduction outside China. This move highlights BYD’s commitment to expanding its international footprint and leveraging Mexico’s growing EV market.

- Affordable EV Offerings: BYD has introduced the Dolphin Mini in Mexico, priced around USD 20,000, which is significantly less expensive than the entry-level models of competitors like Tesla. This strategy positions BYD’s vehicles as a cost-effective option for Mexican consumers, catering to the price-sensitive segment of the market.

- Local Manufacturing Initiatives: Chinese manufacturers are investing in local production facilities in Mexico to capitalize on the benefits of the United States-Mexico-Canada Agreement (USMCA). This trade agreement allows for tariff-free access to the U.S. market for vehicles produced in Mexico, provided they meet certain regional content requirements. By establishing manufacturing plants in Mexico, Chinese companies can avoid import tariffs and reduce production costs while maintaining competitiveness in the U.S. market.

- Government Incentives: Several Mexican states, including Durango, Jalisco, and Nuevo Leon, are offering incentives to attract foreign investment in the automotive sector. These incentives include tax breaks, free land, and assistance with labor recruitment, which enhance the appeal of Mexico as a manufacturing base for Chinese EV companies.

- Strategic Partnerships: Chinese EV manufacturers are exploring strategic partnerships with local firms and stakeholders in Mexico to enhance their market presence and operational efficiency. These collaborations can provide access to established distribution networks, local expertise, and additional resources.

These developments reflect China's strategic approach to expanding its EV presence in Mexico. China is leveraging the country's favorable trade conditions, government incentives, and growing market potential to strengthen its position in the global automotive industry.

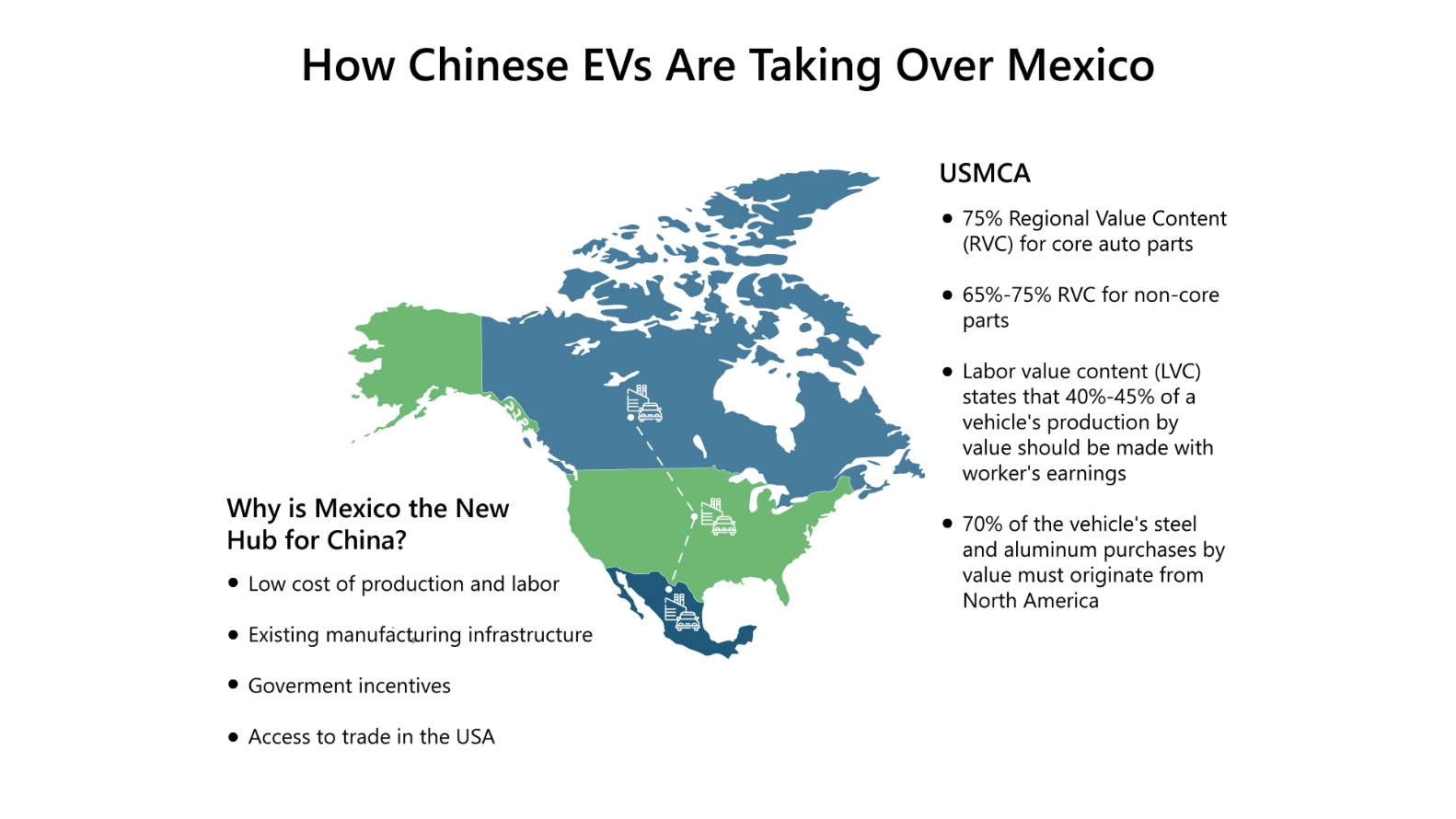

Mexico can be a game changer for China if it meets the manufacturing requirements set under the USMCA to gain access to the US and Canadian markets with zero duties. The low manufacturing infrastructure costs and low labor costs can still make Chinese EVs an economical option for buyers in the North American market. If China can start manufacturing in Mexico, it can prove to be a threat to the US auto industry.

However, the meeting regarding USMCA is going to be held in 2026, and China availing the trade-free route via Mexico through leveraging this agreement is totally dependent on the fact that Mexico remains part of this agreement, as the US will surely have concerns regarding China bypassing the tariffs through following this trade route.

Moreover, as long as Mexico is part of the agreement, China can bypass the tariffs for making moves into the US while availing this route only by qualifying through local sourcing of materials and manufacturing inside Mexico as Section 13401(a) of the IRA updates section 30D(b) of the Code to offer a credit of up to USD 7,500 per vehicle. This amount includes USD 3,750 for vehicles that meet specific criteria for critical minerals and another USD 3,750 for those that meet certain standards for battery components.

This will also let the Chinese manufacturers satisfy the clause of the IRA, i.e., 30D, to qualify for a USD 7500 discount over the EV's price if they establish the manufacturing plant in Mexico that satisfies both the USMCA and Clause 30D of the IRA as well. Summing it up, China can only bypass the tariffs if it is able to source the minerals and components within Mexico.

Figure 2: How Chinese EVs Are Taking Over Mexico.

Source: PTR Inc.

Looking Ahead

The U.S. tariffs on Chinese EVs have created a complex web of economic, political, and strategic considerations that affect both nations and the global automotive market. While the U.S. hopes to boost domestic EV production and reduce reliance on Chinese imports, China is leveraging new opportunities in Mexico to navigate these trade barriers.

The development of local manufacturing under the USMCA, coupled with Mexico’s incentives, positions China to continue its global expansion. However, the ultimate effectiveness of this strategy hinges on future trade agreements, local sourcing requirements, and geopolitical developments. As the landscape continues to shift, China’s moves in Mexico could redefine the balance of power in the North American EV market.

About the Author

Senior Analyst - PTR Inc.

Rafey Khan is a Senior Analyst II and Team Lead for Electric Vehicle Charging Infrastructure service. His research focuses on e-mobility topics, specializing in electric vehicles and it’s charging infrastructure. He has worked with major EVCI system and component manufacturers, utilities and CPOs to conduct research and provide consulting to 30+ markets around the world. He holds comprehensive knowledge of the E-Mobility market of USA particularly around EV and EVSE technologies, emerging market trends, and regional competitive landscape.

He is an electrical engineer from Lahore University of Management Sciences (LUMS) and holds a MBA from Institute of Business Administration (IBA). Before joining PTR, Rafey has gained valuable experience in Schneider Electric and K-Electric, which are a digital automation company and a utility company, respectively.

About PTR: With over a decade of experience in the Power Grid and New Energy sectors, PTR Inc. has evolved from a core market research firm into a comprehensive Strategic Growth Partner, empowering clients’ transitions and growth in the energy landscape and E-mobility, particularly within the electrical infrastructure manufacturing space.

Contact: