Rising demand and supply pressures drive major growth in the global power transformer market

- Renewable energy is expected to make up nearly half of the global power mix by 2030, necessitating substantial grid upgrades and expansions.

- The escalating demand for power transformers, combined with rising commodity prices and ongoing supply chain disruptions, is driving prices upward.

- The global power transformer market is poised for significant expansion, fuelled by large-scale investments in grid modernization, renewable energy integration, and industrial growth.

The global energy landscape is rapidly evolving as nations ramp up efforts to modernize electrical grids and incorporate renewable energy sources. With an intensified commitment to reaching net-zero targets and advancing clean energy solutions, worldwide demand for power transformers is projected to rise significantly. According to IEA, renewables are expected to supply half of the global electricity demand by 2030, driving the need for significant grid upgrades and expansions. This transformation is fuelling a sharp increase in power transformer demand, given their crucial role in the efficient transmission and distribution of electricity generated from renewable sources.

Global Power Transformer Market: Rising Demand and Cost

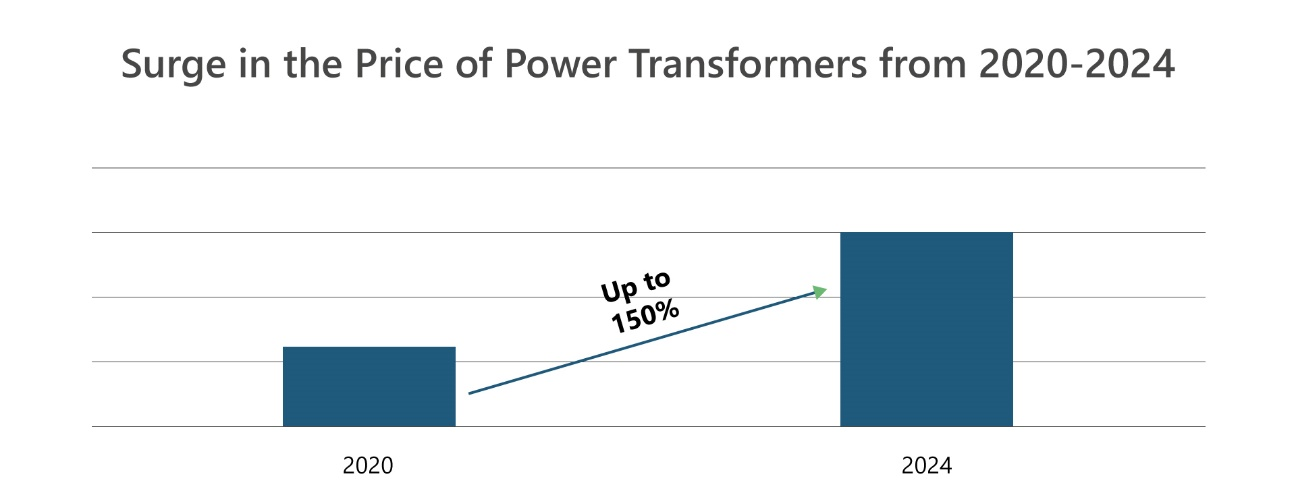

Figure 1: Surge in the Price of Power Transformers from 2020-2024.

Source: PTR Inc.

Since 2020, power transformer prices have surged by up to 150%, which can be attributed to the following major factors:

- Material Costs: The costs of essential raw materials like copper and electrical steel have significantly increased since 2020. These materials are critical components in transformer manufacturing, directly impacting overall production costs.

- Manufacturer Profit Margins: Manufacturers have widened their profit margins due to strong demand and constrained supply, further driving up prices.

- Supply Chain Constraints: Global supply chain disruptions exacerbated by war in the Middle East and Russia Ukraine crisis have also led to significant shortages of raw materials and critical manufacturing components. This disruption has not only driven up the cost of power transformers but also placed additional operational and financial pressure on manufacturers, limiting their ability to meet rising demand.

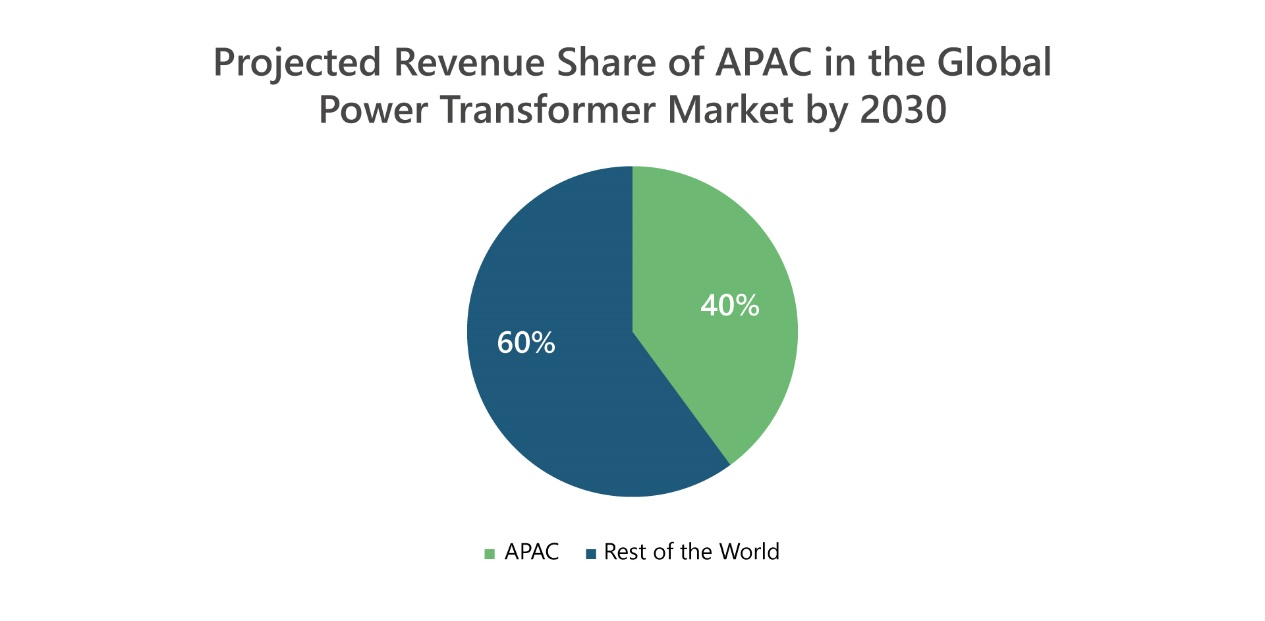

Despite these obstacles, the global power transformer market is projected to expand through 2030, with the Asia-Pacific (APAC) region anticipated to contribute more than 40% of the market’s revenue, with China as the primary contributor.

Figure 2: Projected Revenue Share of APAC in the Global Power Transformer Market by 2030.

Source: PTR Inc.

Power Transformer Market Landscape of Asia Pacific

The APAC region is emerging as a powerhouse in the global power transformer market, spurred by rapid industrialization and an increased focus on clean energy initiatives. China and India are at the forefront of this expansion due to their fast-growing industries and large populations, creating a high demand for reliable electricity to support their vast grid infrastructures. Currently, China and India account for 78% of the APAC power transformer market's revenue, making them key drivers of regional growth.

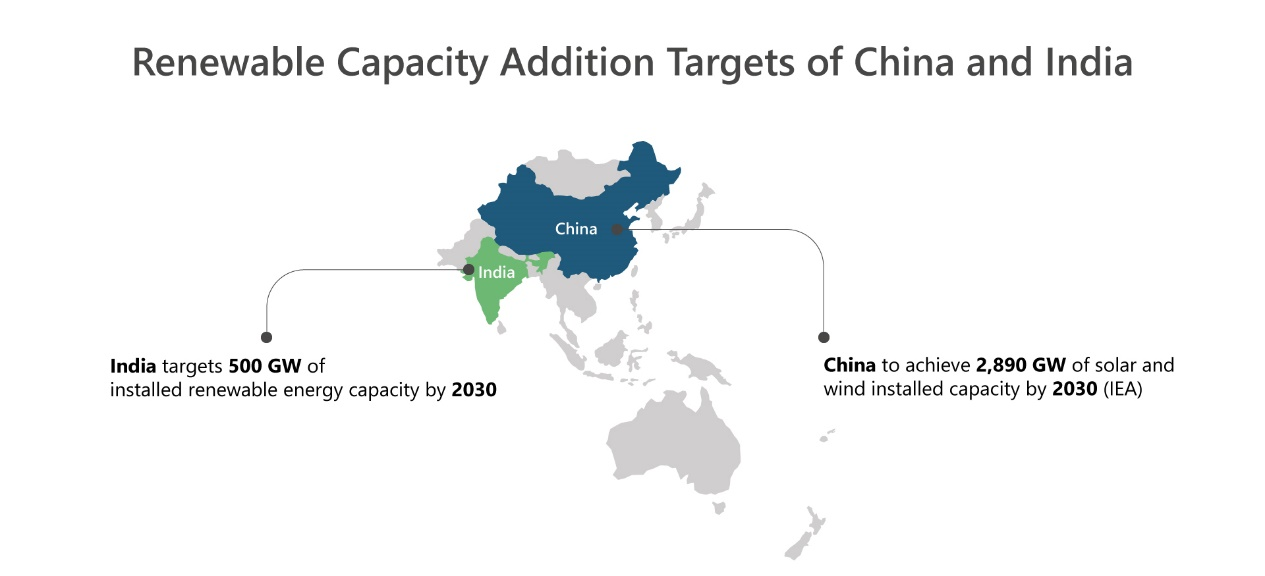

According to IEA, China aims to add approx. 2,890 GWs of solar and wind capacity by 2030, setting a regional benchmark for sustainable energy. Meanwhile, India plans to add 500 GW of renewable energy capacity by 2030, targeting the generation of 50% of its electricity from renewable sources, which underscores the region's commitment to clean energy.

Figure 3: Renewable Capacity Addition Targets of China and India.

Source: PTR Inc.

China's grid investments and renewable energy goals

China’s ambitious efforts to expand and modernize its power grid are crucial for integrating renewable energy and enhancing grid reliability, aligning with its 2030 sustainability goals. The State Grid Corporation of China has pledged USD 329 billion for grid development under the 14th Five-Year Plan (2021-2025), while China Southern Power Grid will contribute an additional USD 99 billion for the same time period. Combined with investments from regional utilities, the total national investment will reach USD 442 billion. These substantial commitments not only support China’s target of adding 2,890 GWs of renewable capacity by 2030 but also stimulate growth in the power transformer market. Notably, China initially set a goal of adding 1,200 GW of renewable energy capacity by 2030 but achieved this milestone in July 2024, six years ahead of schedule.

India and Indonesia’s clean energy ambitions

India’s power sector is experiencing rapid growth, driven by a rising demand for electricity and the need for extensive power grid infrastructure expansion. India has set ambitious renewable energy targets, aiming to add 500 GW of renewable capacity by 2030. To support this expansion, the Central Electricity Authority (CEA) plans to add over 710,940 MVA of transformation capacity (220 kV and above) between 2022 and 2027, aligning with projected electricity needs and generation capacity growth. Last month in October 2024, India’s power ministry outlined a $109 billion grid modernization plan through 2032 to facilitate the integration of 500 GW of renewable energy, contributing to the country’s goals of reducing carbon intensity by over 45% by 2030 and achieving net-zero emissions by 2070.

Indonesia's Renewable Energy Program (RUPTL), announced in 2021, aims to add 76,662 MVA of substation capacity by 2030, along with 4.68 GW of solar power. Over half of the new capacity is expected to come from renewable sources, highlighting the country’s commitment to clean energy. These initiatives are set to drive significant demand for power transformers, supporting Indonesia's transition to a more sustainable energy system.

Vietnam’s Emergence as an Industrial Hub

Vietnam is becoming a significant player in the power transformer market thanks to rapid industrialization and its growing status as a manufacturing center. The "China Plus One" strategy, which encourages companies to diversify manufacturing bases outside of China, has positioned Vietnam as a prime location for industrial growth. Favorable trade agreements, such as the EU-Vietnam Free Trade Agreement, and lower labor costs have accelerated Vietnam's infrastructure development, driving demand for power transformers to support this expansion.

As Vietnam continues to attract industrial investment and strengthen its manufacturing sector, power consumption is expected to grow, further boosting the need for reliable power grid to support infrastructure growth.

Looking Ahead

The global power transformer market is poised for significant expansion, fueled by large-scale investments in grid modernization, renewable energy integration, and industrial growth. The APAC region, with its ambitious energy goals and extensive grid development projects, is set to lead this growth. As countries like China, India, and Indonesia advance their clean energy initiatives and enhance grid infrastructure, the demand for power transformers will continue to rise. Despite challenges from rising costs and supply chain disruptions, APAC will remain a pivotal driver of global demand, supporting the ongoing expansion of the power transformer market in the years to come.

About the Authors

Chief Product Officer - PTR Inc.

Saqib is highly accomplished market research professional and a data storyteller in the international energy industry. With over a decade of experience in the field, he currently serves as the Chief Product Officer at PTR Inc. His expertise lies in the power grid and e-mobility equipment sectors. Throughout his career, Saqib has overseen numerous global market research studies and provided valuable insights to key decision-makers at various Fortune 500 companies. He is a member of the editorial board for Transformers Magazine and a member of the Advisory board of CWIEME Berlin. In addition to his market research career, Saqib has also worked in the manufacturing sector. Saqib holds a Master's degree in Electrical Power Engineering from the Technical University of Munich.

Senior Analyst - PTR Inc.

Azhar Fayyaz is a Market Analyst at PTR Inc. He is involved in projects on the power grid topics at Power Technology Research gathering data on the network structure of distribution utilities, estimating the installed base of T&D equipment, and analyzing the information to predict future market trends. As a market analyst at PTR, he performs competitive analyses of different companies operating in a region and determines their market share for a specific product. He also has more than 5 years of experience working as a senior shift engineer at Chashma Power Generation Station. Azhar comes from a technical background and has an M.Sc. in Power Engineering.

About PTR: With over a decade of experience in the Power Grid and New Energy sectors, PTR Inc. has evolved from a core market research firm into a comprehensive Strategic Growth Partner, empowering clients’ transitions and growth in the energy landscape and E-mobility, particularly within the electrical infrastructure manufacturing space.

Contact: