With an aim to catch up with its global rivals on battery-electric vehicles (BEVs), Toyota pushes the pedal on multiple battery technologies to secure a longer driving range while reducing significant costs on product development and mass production. Will the Japanese carmaker be able to deliver?

With an aim to catch up with its global rivals on battery-electric vehicles (BEVs), Toyota pushes the pedal on multiple battery technologies to secure a longer driving range while reducing significant costs on product development and mass production. Will the Japanese carmaker be able to deliver?

In its most elaborate presentation so far, on June 13 Toyota Motor Corp. shared details of its strategic technology roadmap including the developments on new battery chemistries, hydrogen fuel cells and the pathway to achieve significant cost reduction in manufacturing electric vehicles.

One of the largest carmakers in the world with a significant technology advantage on plug-in hybrid EVs and patents on EV batteries, Toyota has been visibly lagging in rolling out pure battery electric vehicles (BEVs), losing turf to Tesla and several young and upcoming EV makers, who continue to make rapid strides on BEVs, software, electrical/electronic architecture and battery technologies.

Nevertheless, Toyota’s Technical Workshop 2023 aims to provide answers to mounting skepticism around whether the company will be able to maintain its global market share amid a transition to EVs. It should be noted that the company’s detailed technology disclosures are made within a quarter of Koji Sato taking over as the president and chief executive at Toyota, succeeding his predecessor, Akio Toyoda, who is known for having a conservative approach to BEVs. Toyota’s stock surged 12-13% on the NYSE, following the announcements as shareholders voted in favor of the new leadership’s vision.

The Japanese carmaker held a technical briefing session, where it disclosed its plans to transform into a mobility company. With an aim to catch up with its potent rivals on EVs in the latter half of the ongoing decade amid the rapidly transforming global automotive landscape, the company presented its corporate direction — the Toyota mobility concept — at its technical workshop.

Elaborating on the company’s strategic focus areas under the Toyota mobility concept, Toyota Chief Technical Officer Hiroki Nakajima underlined that the carmaker plans to focus on three primary areas to ensure its future growth:

- Electrification

- Intelligence

- Diversification

Under electrification, Toyota looks to take a multipronged approach that would not only focus on the BEVs, but also on plug-in hybrid electric vehicles (PHEVs), which it calls practical BEVs, hybrid electric vehicles (HEVs) and fuel-cell electric vehicles (FCEVs).

While Toyota plans to introduce HEVs in emerging markets and countries that do not have a consistent supply of electricity, the Japanese vehicle manufacturer has recently partnered with Daimler Truck for mass production of fuel cell-powered commercial vehicles.

“In electrification, we look at a battery EV created by a carmaker that doubles the cruising range and halves the process,” Nakajima said, adding that, “we will continue to promote electrification suited to each region (globally) while maintaining our multipathway approach.”

Deploying its strategic focus areas over the last few years, Toyota has been shifting its resources (manpower and investments) to research and development (R&D) from mass production. According to the presentation given by Nakajima, 53% of Toyota’s R&D staff (up from just 37% in April 2016) now works in advanced development areas and the remaining 47% (down from 63%) works on mass production, as of March. Moreover, about 45% of the company’s R&D expenses are now incurred on the advanced development fields as against just 24% in 2017.

Toyota’s electrification efforts

Last month, Toyota established a dedicated organization called the Toyota BEV Factory to oversee all activities around the development of next-generation BEVs. The BEV Factory will have a single leader, who will have complete oversight of the development, production and business processes to ensure quick decision-making while establishing an agile structure. The company has appointed Takero Kato president of its BEV Factory.

Redrawing the BEV product development and production strategy at Toyota, Kato envisions new generation vehicles that can offer a driving range of over 1,000 km per charge. Presenting at the technical workshop, he said that Toyota aims to develop long-range BEVs by integrating next-generation batteries, aerodynamic design — which will be supported by deep learning and artificial intelligence — and a robust software ecosystem with over-the-air capabilities to enhance the passenger experience. To offer long driving range, the carmaker is developing a host of new battery technologies, including all-solid-state batteries.

Kato also disclosed that Toyota will develop a new modular structure for the vehicles, focusing on the frontal, central and rear parts of the body. This is where the carmaker plans to adopt giga casting, which will allow parts unification, thereby reducing the number of components in the overall structure as well as cutting down the number of steps involved in assembling the vehicle. This, according to the company, will help in bringing down the costs involved in product development and assembly operations. According to Kato’s presentation, Toyota aims to cut down the product development costs by 30% by 2026 and by 50% in the future. Similarly, by redrawing the factory operations for BEVs, it looks to bring down plant investments 50% by 2026.

“This new idea of monozukuri [manufacturing in Japanese] will use digital twin technology to reduce the production preparation lead time by half,” Kato said, adding that the next-generation BEV philosophy will be implemented globally with new models slated for launch from 2026.

“By 2030, 1.7 million units out of the 3.5 million units will be provided by BEV Factory,” he said, summing up his presentation.

Let’s take a detailed look at two key developments at Toyota – new battery technologies and unification of parts via giga casting.

Toyota’s battery strategy

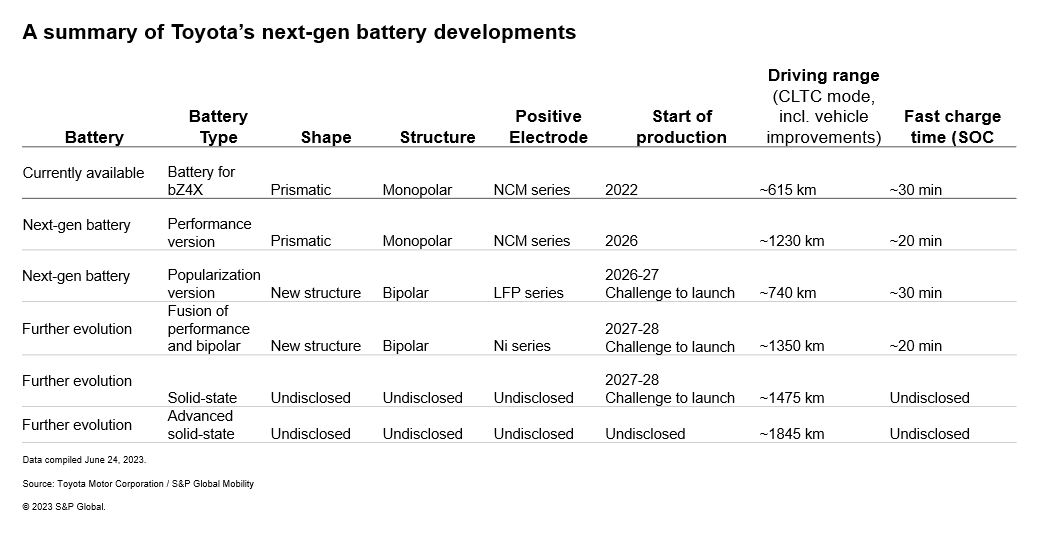

Advancing efforts to launch its next-generation BEVs from 2026, Japan’s largest carmaker disclosed that it is working on new battery technologies to upgrade its product offerings in the emerging segment. The next-generation battery technologies include:

a) Performance version –To meet the target of offering a driving range of 1,000 kms per charge, Toyota is developing a square-shaped battery, which essentially will be the liquid lithium-ion battery with improved energy density and reduced charging time. The onus of reaching the targeted driving range also lies on significantly reducing the weight and improving the aerodynamics of the vehicle. The BEVs with this battery type will be launched in 2026 and the company said it aims to reduce the costs by 20% compared to the currently sold Toyota bZ4X.

b) Popular version –As the name suggests, Toyota is also developing a low-cost battery technology aimed at affordable BEVs that can accelerate volumes for the company. These batteries will be developed using the lithium iron phosphate (LFP) chemistry and are expected to be put into use in 2026-27. These batteries will have a bipolar structure and are already being used as a form of nickel metal hydride battery in the Aqua and Crown hybrid vehicles. Notably, Toyota is looking to achieve a 20% increase in the driving range along with a 40% cost reduction compared to the currently available bZ4X models. On charging, the company is looking to achieve from a state of charge 10% up to 80% battery charging in about 30 minutes.

c) High-performance bipolar lithium-ion battery – In parallel to the ongoing development of the LFP batteries, Toyota is also working on combining the bipolar structure with a high-performance lithium-ion battery with a target of offering an even better driving range than the 1,000-km-performance-version of the liquid lithium-ion battery slated for launch in 2026. As compared to the latter, Toyota aims to achieve a 10% increase in the driving range, a 10% reduction in cost and a quicker charging time of 20 minutes (from a state of charge 10% up to 80% charge) in its bipolar lithium-ion battery. Although Toyota views mass production of this technology as a challenge, it has slated a tentative launch by 2027-28.

d) All-solid-state-batteries (ASSB) –Toyota, which holds more than 1,000 patents in solid-state battery technology, disclosed that it is working to commercially launch an ASSB-powered EV as early as 2027. The carmaker said that it has solved the longstanding challenge of solid-state batteries and is looking to introduce the technology in its conventional HEVs to start with. Although the company did not elaborate on the challenges it was earlier facing with ASSBs, it is known that batteries with a solid electrolyte have fewer recharge cycles as compared to the current generation lithium-ion batteries. Ideally, a market-ready EV battery must offer thousands of recharge cycles, but ASSBs were capable of only a few hundred recharge cycles. Toyota claims to have solved this technology barrier. The company said that it is looking to achieve a driving range of over 1,200 kms per charge with its ASSBs along with further reducing the charging time to less than 10 minutes (from a state of charge 10% up to 80% of battery charge). That said, Toyota is working on two primary challenges in this area – an effective methodology for mass production and the high cost of producing ASSBs. The carmaker hopes to solve these two challenges over the next 3–4 years.

e) Advanced ASSBs –Toyota’s R&D is also working on an advanced variant of its all-solid-state battery with which the carmaker is aiming to achieve a driving range of about 1,500 kms per charge. The company has not disclosed any further details on this variant.

Toyota’s renewed production strategy

Maintaining profitability amid the transition to mass produce EVs is one of the biggest challenges for the carmakers. While working to bring down the cost of EVs, the carmakers are also modifying the traditional production processes with an aim of removing the redundant activities from the shopfloor. Toyota plans to implement giga casting, with an aim of significantly reducing the number of parts used in its front and rear body frame. For example, the company looks to integrate 90 and 85 different parts on its front and rear body frames respectively with the help of giga casting.

What is giga casting?

Giga casting is a die-casting solution/technique that is being increasingly used by electric-car manufacturers to produce the whole body-in-white or frontal, rear or underbody sections as a single piece. The process allows carmakers to not only reduce a significant number of parts, but also the need to rivet and weld them together, simplifying the production flowchart. Usage of giga castings also save costs and reduce the time taken to produce the frames.

Toyota is not the only carmaker to look at introducing the giga casting in its manufacturing process. Giga castings or megacasting, as the original equipment manufacturers may prefer to call it depending on its size, were first deployed in a car manufacturing plant by Tesla. Using such die-castings in producing the body frames by Tesla is regarded as one of the most significant innovations at the factory level. For example, the body-in-white of the Tesla Model Y is produced by using two such castings, replacing the front and rear structures. The process eliminates several hundred individual components, stamping and welding points and associated machinery, thereby simplifying the production process and saving costs and time.

Tesla has deployed a casting press at its plant in Germany and uses megacasting to produce the Model 3. The US EV maker is reportedly deploying a 9000-ton giga press to use the megacasting technique in producing the Cybertruck.

Swedish carmaker Volvo Cars is also working to introduce the megacasting process in its Torslanda factory operations to roll out EVs. Its parent company Geely Holdings also is using the aluminum diecast to make the underbody of the Zeekr 009 minivan. Several other prominent carmakers are closely evaluating the giga casting technique in their respective facilities, including Mercedes-Benz, Nio and General Motors.

Toyota disclosed that it is developing new technology for integrated molding with aluminum die-castings. The mold assembly would typically comprise dozens of sheet metal parts. “After analyzing the casting technology that has been cultivated in the car manufacturing genba (Japanese for ‘actual place’) to a high degree of precision, we have reviewed the structural design to make it simpler and slimmer,” the company said in a document.

Moreover, Toyota plans to build a highly flexible BEV production facility that would replace conveyors with a self-propelling assembly line. As stated earlier, these efforts are part of the carmaker’s long-term plan of reducing the factory investments by 50%, cut production preparation lead time in half and achieve a significant reduction in fixed costs.

S&P Global Mobility Analysis

Battery: Toyota, which established its battery research division in 2008, is known to have developed the initial version of its solid-state battery in 2020. In June that year, Toyota developed a vehicle powered by all-solid-state batteries and conducted test runs. However, in due course of development, the carmaker found that solid-state batteries deteriorate faster due to formation of gaps within the solid electrolyte, indicating a challenge of shorter service life (compared with lithium-ion batteries). That was when the battery engineers at Toyota understood that more development of the solid electrolyte was needed.

According to S&P Global Mobility’s Director of electrification technology research, Graham Evans, Toyota’s strategy was to take a step back and perform fundamental research around the battery technologies to enable it to leapfrog the competition and solve well-known consumer pain points, such as all-electric driving range and charging time.

“If this can be delivered successfully at scale, we might expect to see Toyota emerge as a leader,” Graham said, adding that it remains to be seen whether Toyota’s technical solutions overcome well-understood solid state technology pain points.

Summarizing the key takeaways from the company’s workshop, Dr. Richard Kim, Associate Director for battery research at S&P Global Mobility, said: “With Toyota's newly announced next generation battery EV strategy, the company aims to achieve several advancements, including improved system flexibility, longer all-electric driving range and quicker charging time. One of the key aspects of this strategy is the development of a new battery that utilizes both high-nickel chemistry and nickel-free iron phosphorous chemistry. This approach allows Toyota to cater to consumers' demands for EVs with both standard and long-range versions. By offering different battery capacity variants at varying costs, Toyota can provide two distinct options to meet the needs of different consumers in different geographical locations.

“From the perspective of driving range, Toyota plans to enhance energy density at both the cell and pack levels. By changing cathode materials from mid-nickel chemistry to high-nickel chemistry, not stated but most likely, combined with the addition of silicon content in anode materials, Toyota expects to achieve roughly a 20% improvement in cell volumetric energy density by 2026 for the performance version of their EVs. Additionally, an optimized battery pack structure is anticipated approximately 30% to contribute to longer driving range. As a result of these enhancements, the next generation of Toyota's EVs is expected to have 5-60% more battery capacity compared to the current version of the bz4x, which provides a 651km CLTC range. It is worth noting that this increased battery pack weight can be offset through optimization from the body structure and other systems, making it feasible to estimate a driving range of 1,000km.”

Dr. Kim added: “The last significant improvement in Toyota's battery strategy focuses on charging performance. The company plans to achieve this through incremental steps, including the introduction of batteries with bipolar technology, not announced but most likely silicon content in anode material, and eventually, solid-state batteries into the market. These advancements aim to address consumer concerns regarding driving range and charging time, further enhancing the overall appeal and usability of Toyota's EVs.”

Dr. Kim forecasts a sharp surge in the demand for all-solid-state batteries through this decade, starting in 2024. “We forecast that the demand for ASSBs will increase from nil this year to 67MWh in 2024 and record a staggering growth to 63.548 GWh by 2030, as all major carmakers will roll out BEVs powered with solid-state batteries,” he said.

Chassis: Commenting on Toyota’s plan to introduce the giga casting technique in its BEV Factory, Edwin Pope, Principal Research Analyst at S&P Global Mobility, said: “Giga castings as embraced by Toyota specifically are about the manufacturing line impact to vehicle assembly, which is a core of Kaizen-focused manufacturing processes. I expect that crash repair processes will likely have a segmentation process as has been previously mentioned by other OEMs (not Tesla) to ensure proper repairs can take place on their vehicles.”

“Further, insurance rates for BEV customers have lately been in the news as a headwind toward long-term adoption of the technology. As Toyota customers are likely to focus on long-term costs, reliability and have an expectation the vehicle can repaired inexpensively, I expect Toyota to follow suit with some clever management of aftermarket incident response.”

Pope also expects that enlargement of panels through new tooling could be another driver of the adoption of giga castings, especially on the EVs that are produced using traditional assembly methods.

“This route may help some brownfield sites gain some cost efficiencies with minor changes to plant floorspace. For vehicles to adopt large castings, the entire production plant needs to be a ‘clean sheet of paper’ to be properly integrated into workflows and find the real measures of efficiency at the assembly plant level. So, any existing assembly lines at production plants could expect a complete shutdown and rebuild process to adopt the new procedures in an optimized environment,” he added.

To know more about S&P AutoTechInsight, please clicke here